February 14, 2023 Bridge Newbury Partners Transaction Overview

2 DISCLAIMER The information contained herein is summary information that is intended to be considered in the context of Bridge Investment Group Holdings Inc.’s (“Bridge” or the “Company”) Securities and Exchange Commission filings and other public announcements that Bridge may make, by press release or otherwise. Bridge has entered into certain agreements with Newbury Partners LLC (“Newbury”) pursuant to which Bridge will acquire Newbury’s investment management business and the Newbury team will join Bridge to launch Bridge’s secondaries strategy (the “Transaction”). The Transaction is subject to customary closing conditions, including regulatory and other approvals. Nothing contained herein constitutes or forms a part of, and should not be construed as, an offer or invitation to subscribe for, underwrite or otherwise acquire, any securities of Bridge or Newbury, or any affiliate of Bridge or, Newbury or any fund or other investment vehicle managed by Bridge or Newbury or an affiliate of Bridge or Newbury. This presentation should not form the basis of, or be relied on in connection with, any contract to purchase or subscribe for any securities of Bridge or any fund or other investment vehicle managed by Bridge or an affiliate of Bridge, or in connection with any other contract or commitment whatsoever. This presentation does not constitute a “prospectus” within the meaning of the Securities Act of 1933, as amended. Any decision to purchase securities of Bridge or any of its affiliates should be made solely on the basis of the information contained in a prospectus to be issued by Bridge in relation to a specific offering. This presentation contains forward-looking statements. All statements other than statements of historical facts contained in this presentation may be forward-looking statements. Statements regarding our future results of operations and financial position, business strategy and plans and objectives of management for future operations, including, among others, statements regarding expected growth, capital raising, expectations or targets related to financial and non-financial measures, future capital expenditures, fund performance, debt service obligations, the expected timing, completion and effects of the Transaction with Newbury, the expected benefits of the Transaction, including future synergies and growth opportunities, and the future business and prospects of Bridge and Newbury, are forward-looking statements. In some cases, you can identify forward-looking statements by terms, such as “may,” “will,” “should,” “expects,” “plans,” “seek,” “anticipates,” “plan,” “forecasts,” “outlook,” “could,” “intends,” “targets,” “projects,” “contemplates,” “believes,” “estimates,” “predicts,” “potential” or “continue” or the negative of these terms or other similar expressions. Accordingly, we caution you that any such forward-looking statements are not guarantees of future performance and are subject to risks, assumptions and uncertainties that are difficult to predict and beyond our ability to control. Although we believe that the expectations reflected in these forward-looking statements are reasonable as of the date made, actual results may prove to be materially different from the results expressed or implied by the forward-looking statements. If one or more events related to these forward-looking statements or other risks or uncertainties materialize, or if our underlying assumptions prove to be incorrect, actual results may differ materially from what we anticipate. Many of the important factors that will determine these results are beyond our ability to control or predict. We believe these factors include but are not limited to the possibility of the occurrence of any event, change or other circumstances that could give rise to the termination of the definitive transaction agreement, the possibility that the Transaction could be delayed or terminated based on a failure of the parties to satisfy the closing conditions to the Transaction, the effect of the announcement of the Transaction on the ability of the parties to retain and hire key personnel and maintain their operating results and business generally, Bridge's ability to obtain its proposed financing, the possibility that regulatory and other approvals and conditions to the Transaction are not received or satisfied on a timely basis or at all, the possibility that modifications to the terms of the Transaction may be required in order to obtain or satisfy such approvals or conditions, delays in the closing of the Transaction, difficulties, delays or unanticipated costs in integrating Newbury’s operations, purchase price adjustments, unexpected costs resulting from the Transaction, delays or other disruptions associated with the Transaction or integration of personnel or operations in international jurisdictions, changes in economic conditions and regulatory conditions, and those risk factors described under the section entitled “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2021, filed with the United States Securities and Exchange Commission (the “SEC”) on March 18, 2022, or those that will be included in our Annual Report on Form 10-K for the year ended December 31, 2022, or any other filings we make, which filings will be accessible on the SEC’s website at www.sec.gov. These factors should not be construed as exhaustive and should be read in conjunction with other cautionary statements included in our SEC filings. You should not place undue reliance on any such forward-looking statements. Any forward-looking statement speaks only as of the date on which it is made, and, except as otherwise required by law, we do not undertake any obligation to publicly update or review any forward- looking statement, whether as a result of new information, future developments or otherwise. New factors emerge from time to time, and it is not possible for us to predict which will arise. We cannot assess the impact of each factor on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. Unless otherwise indicated, information contained in this presentation concerning our industry, competitive position and the markets in which we operate is based on information from independent industry and research organizations, other third-party sources and management estimates. Management estimates are derived from publicly available information released by independent industry analysts and other third-party sources, as well as data from our internal research, and are based on assumptions made by us upon reviewing such data, and our experience in, and knowledge of, such industry and markets, which we believe to be reasonable. In addition, projections, assumptions and estimates of the future performance of the industry in which we operate and our future performance are necessarily subject to uncertainty and risk due to a variety of factors, which could cause results to differ materially from those expressed in the estimates made by the independent parties and by us. Non-GAAP Financial Measures This presentation uses financial measures that are not presented in accordance with generally accepted accounted principles in the United States (“GAAP”), such as Distributable Earnings, Fee Related Earnings, Fee Related Revenues and Performance Related Earnings, to supplement financial information presented in accordance with GAAP. There are limitations to the use of the non-GAAP financial measures presented in this presentation. For example, the non-GAAP financial measures may not be comparable to similarly titled measures of other companies. Other companies may calculate non-GAAP financial measures differently than the Company, limiting the usefulness of those measures for comparative purposes. With the exception of the Newbury performance information, capitalized terms used but not defined herein with respect to certain Bridge metrics are defined in Bridge's earnings presentation. The non-GAAP financial measures are not meant to be considered as indicators of performance in isolation from or as a substitute for measures prepared in accordance with GAAP, and should be read only in conjunction with financial information presented on a GAAP basis. Reconciliations of each of Fee Related Revenues, Fee Related Earnings and Distributable Earnings to its most directly comparable GAAP financial measure are presented herein. We encourage you to review the reconciliations in conjunction with the presentation of the non-GAAP financial measures for each of the periods presented. Throughout this presentation, all current period amounts are preliminary and unaudited.

3 EXECUTING ON GROWTH OPPORTUNITIES IDENTIFIED AT IPO Expanded to serve additional fund investors who value Bridge's established operating platform, sharpshooter investment strategies, and strong performance history Drove competitive advantages and attractive investment returns through a diversified and synergistic business model spanning residential rental, real estate backed credit, development, logistics, and office Opened offices in Luxembourg and South Korea Expanded marketing efforts for real estate products in Europe in a more direct and efficient manner through the approval of AIFM license in Luxembourg in July 2022 Actively pursued organic and inorganic opportunities to accelerate growth such as the acquisition of our Single-Family Rental platform and the pending acquisition of Newbury Partners Continued to expand into high-growth sectors to complement existing investment verticals through the launch of Logistics, Net Lease Income, Renewable Energy and PropTech Scalable platform along with substantial recent investments in infrastructure position Bridge to further increase size and efficiency Pursue Accretive Acquisitions to Complement Platform Continue to Strengthen and Expand Fund Investor Network Expand Product Offerings Across the Risk-Return Spectrum Launch New Strategies Across Real Estate & Adjacent Sectors and Expand Geographically Leverage Scale to Enhance Operating Margins Expand Distribution Capabilities Domestically & Internationally

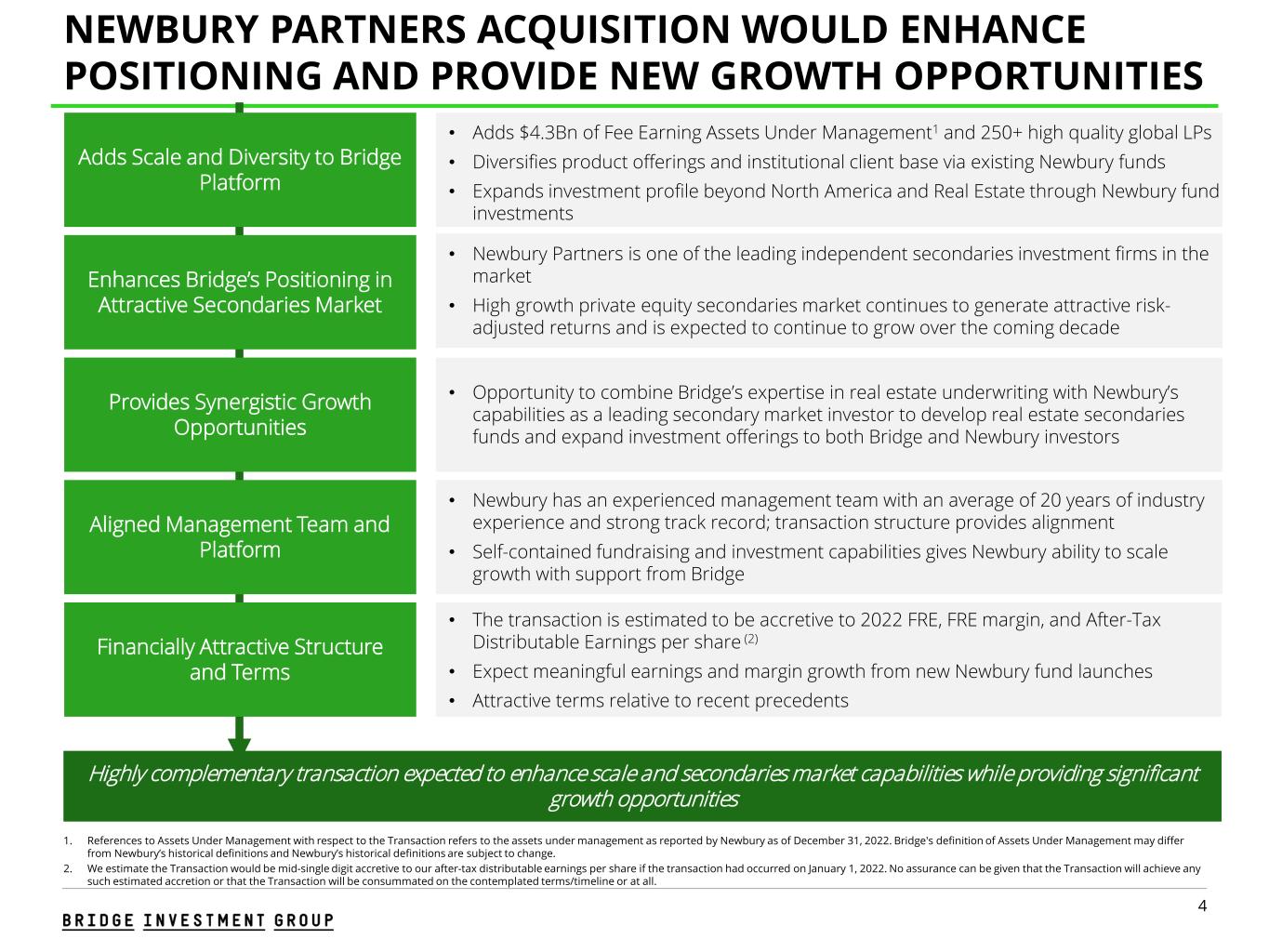

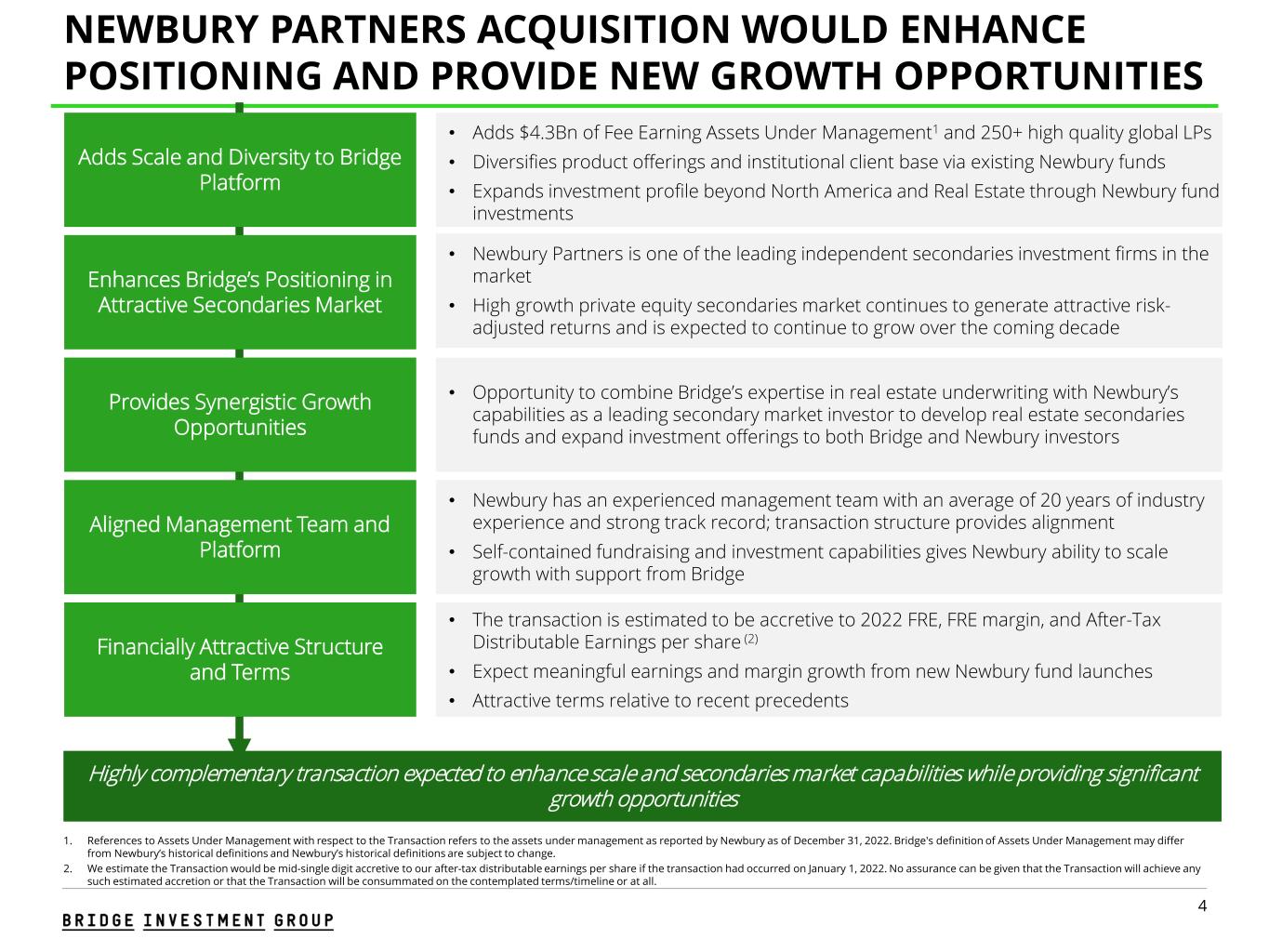

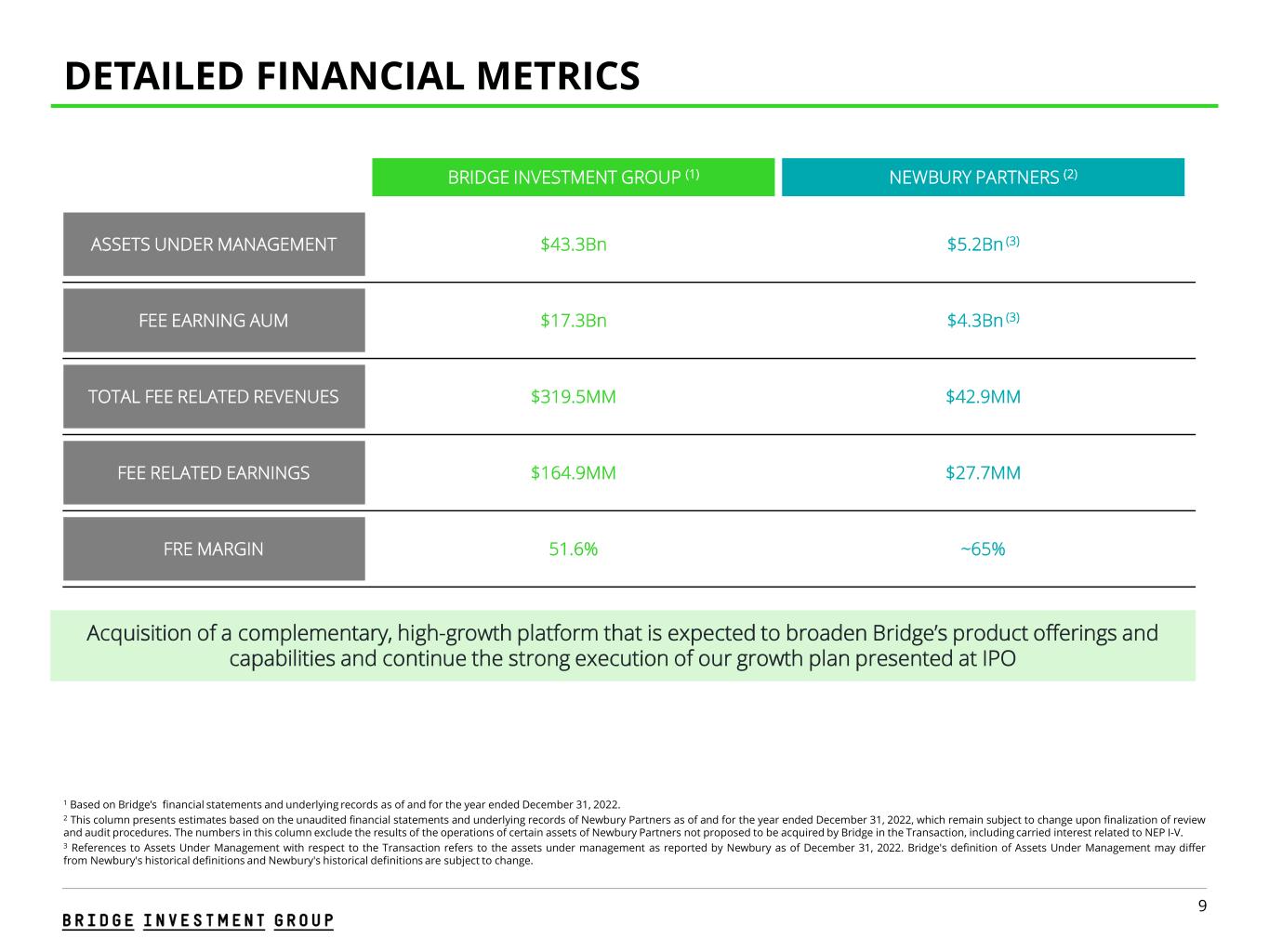

4 NEWBURY PARTNERS ACQUISITION WOULD ENHANCE POSITIONING AND PROVIDE NEW GROWTH OPPORTUNITIES • Adds $4.3Bn of Fee Earning Assets Under Management1 and 250+ high quality global LPs • Diversifies product offerings and institutional client base via existing Newbury funds • Expands investment profile beyond North America and Real Estate through Newbury fund investments Adds Scale and Diversity to Bridge Platform • Newbury Partners is one of the leading independent secondaries investment firms in the market • High growth private equity secondaries market continues to generate attractive risk- adjusted returns and is expected to continue to grow over the coming decade Enhances Bridge’s Positioning in Attractive Secondaries Market • Opportunity to combine Bridge’s expertise in real estate underwriting with Newbury’s capabilities as a leading secondary market investor to develop real estate secondaries funds and expand investment offerings to both Bridge and Newbury investors Provides Synergistic Growth Opportunities • Newbury has an experienced management team with an average of 20 years of industry experience and strong track record; transaction structure provides alignment • Self-contained fundraising and investment capabilities gives Newbury ability to scale growth with support from Bridge Aligned Management Team and Platform Highly complementary transaction expected to enhance scale and secondaries market capabilities while providing significant growth opportunities • The transaction is estimated to be accretive to 2022 FRE, FRE margin, and After-Tax Distributable Earnings per share (2) • Expect meaningful earnings and margin growth from new Newbury fund launches • Attractive terms relative to recent precedents Financially Attractive Structure and Terms 1. References to Assets Under Management with respect to the Transaction refers to the assets under management as reported by Newbury as of December 31, 2022. Bridge's definition of Assets Under Management may differ from Newbury’s historical definitions and Newbury’s historical definitions are subject to change. 2. We estimate the Transaction would be mid-single digit accretive to our after-tax distributable earnings per share if the transaction had occurred on January 1, 2022. No assurance can be given that the Transaction will achieve any such estimated accretion or that the Transaction will be consummated on the contemplated terms/timeline or at all.

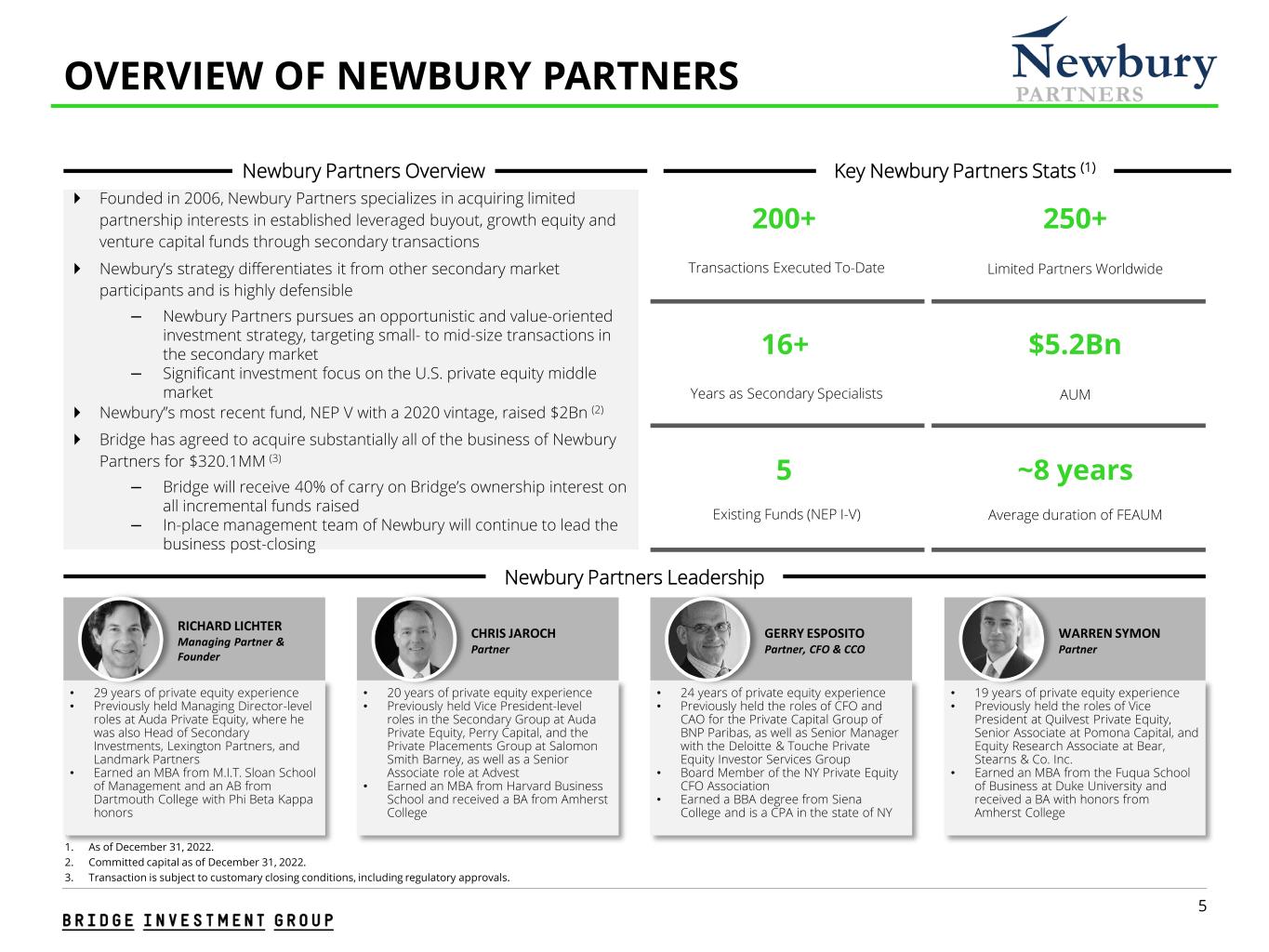

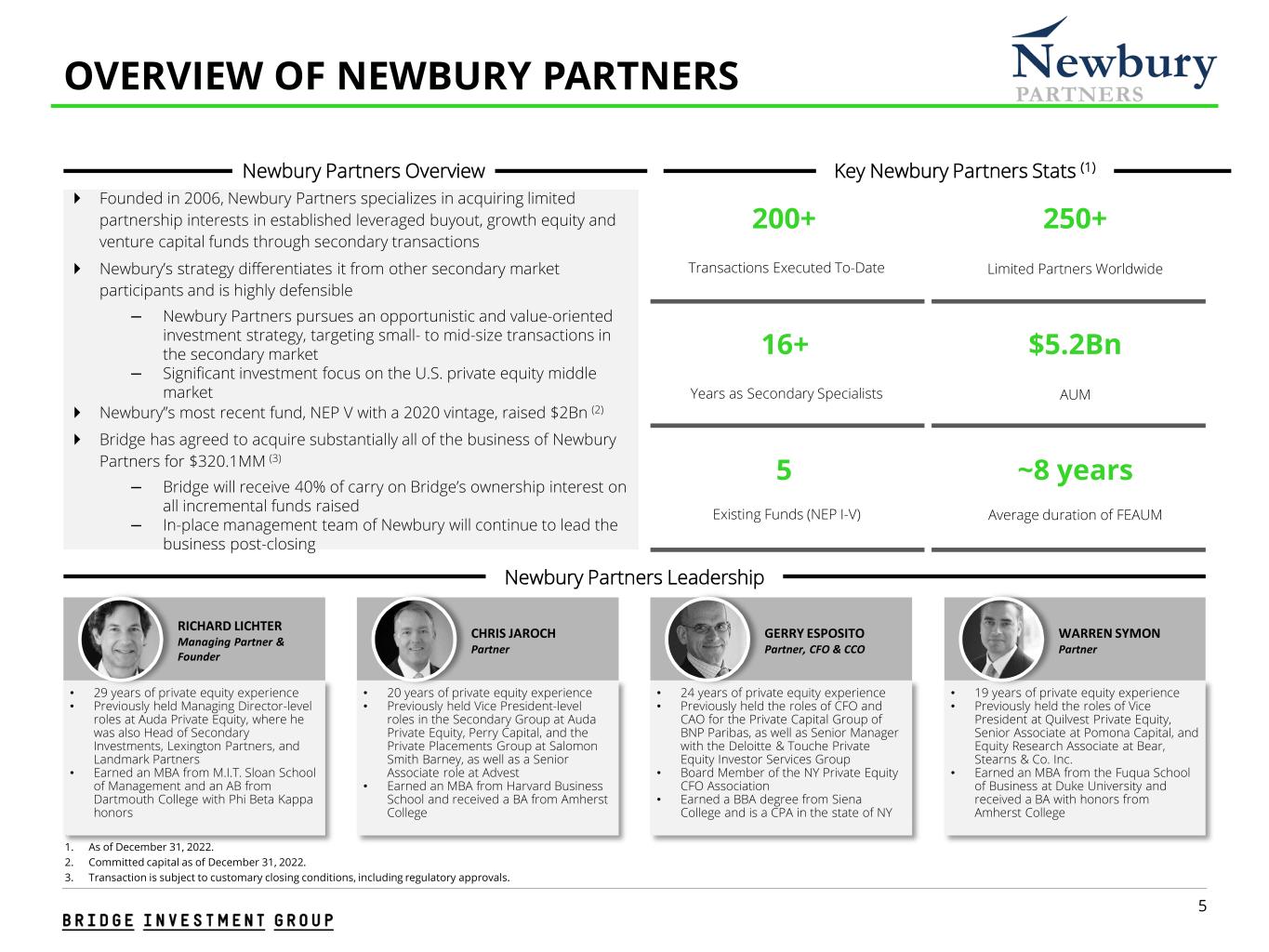

5 OVERVIEW OF NEWBURY PARTNERS : 1. As of December 31, 2022. 2. Committed capital as of December 31, 2022. 3. Transaction is subject to customary closing conditions, including regulatory approvals. Newbury Partners Overview Key Newbury Partners Stats (1) 16+ Years as Secondary Specialists $5.2Bn AUM 5 Existing Funds (NEP I-V) ~8 years Average duration of FEAUM 200+ Transactions Executed To-Date 250+ Limited Partners Worldwide Newbury Partners Leadership RICHARD LICHTER Managing Partner & Founder • 29 years of private equity experience • Previously held Managing Director-level roles at Auda Private Equity, where he was also Head of Secondary Investments, Lexington Partners, and Landmark Partners • Earned an MBA from M.I.T. Sloan School of Management and an AB from Dartmouth College with Phi Beta Kappa honors CHRIS JAROCH Partner • 20 years of private equity experience • Previously held Vice President-level roles in the Secondary Group at Auda Private Equity, Perry Capital, and the Private Placements Group at Salomon Smith Barney, as well as a Senior Associate role at Advest • Earned an MBA from Harvard Business School and received a BA from Amherst College GERRY ESPOSITO Partner, CFO & CCO • 24 years of private equity experience • Previously held the roles of CFO and CAO for the Private Capital Group of BNP Paribas, as well as Senior Manager with the Deloitte & Touche Private Equity Investor Services Group • Board Member of the NY Private Equity CFO Association • Earned a BBA degree from Siena College and is a CPA in the state of NY WARREN SYMON Partner • 19 years of private equity experience • Previously held the roles of Vice President at Quilvest Private Equity, Senior Associate at Pomona Capital, and Equity Research Associate at Bear, Stearns & Co. Inc. • Earned an MBA from the Fuqua School of Business at Duke University and received a BA with honors from Amherst College Founded in 2006, Newbury Partners specializes in acquiring limited partnership interests in established leveraged buyout, growth equity and venture capital funds through secondary transactions Newbury’s strategy differentiates it from other secondary market participants and is highly defensible ‒ Newbury Partners pursues an opportunistic and value-oriented investment strategy, targeting small- to mid-size transactions in the secondary market ‒ Significant investment focus on the U.S. private equity middle market Newbury’’s most recent fund, NEP V with a 2020 vintage, raised $2Bn (2) Bridge has agreed to acquire substantially all of the business of Newbury Partners for $320.1MM (3) ‒ Bridge will receive 40% of carry on Bridge’s ownership interest on all incremental funds raised ‒ In-place management team of Newbury will continue to lead the business post-closing

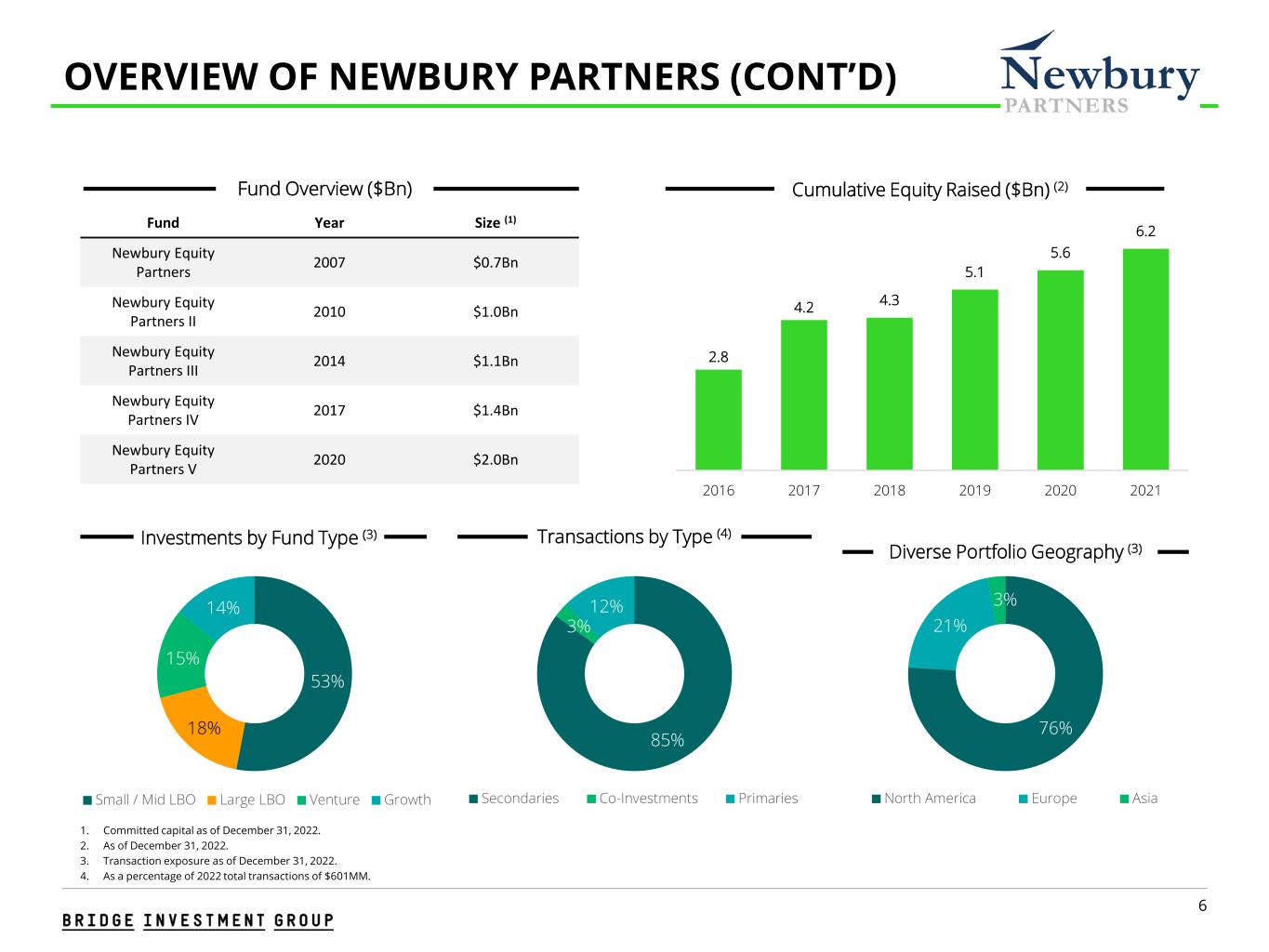

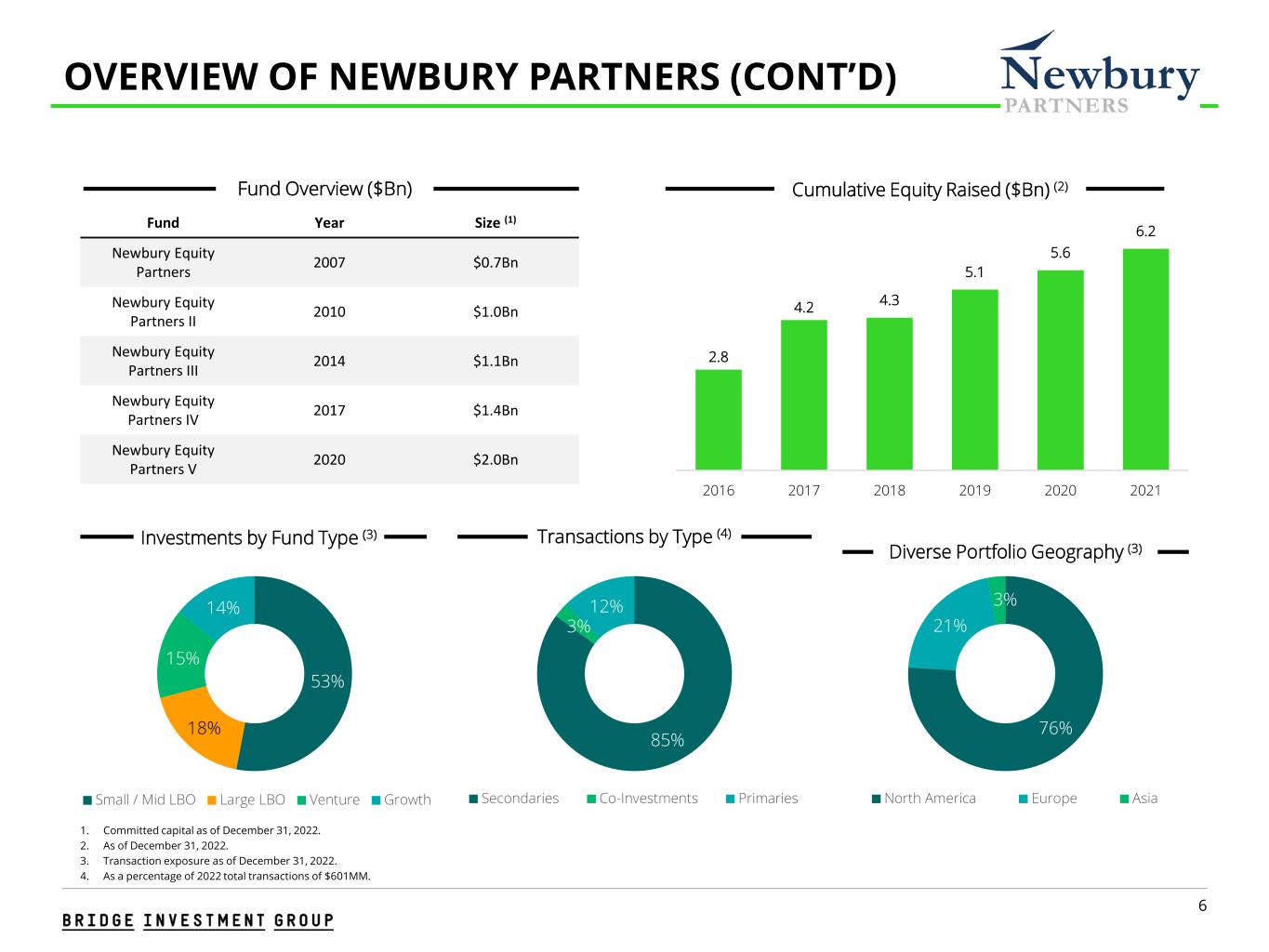

6 76% 21% 3% North America Europe Asia 85% 3% 12% Secondaries Co-Investments Primaries 53% 18% 15% 14% Small / Mid LBO Large LBO Venture Growth 2.8 4.2 4.3 5.1 5.6 6.2 2016 2017 2018 2019 2020 2021 Cumulative Equity Raised ($Bn) (2) OVERVIEW OF NEWBURY PARTNERS (CONT’D) 1. Committed capital as of December 31, 2022. 2. As of December 31, 2022. 3. Transaction exposure as of December 31, 2022. 4. As a percentage of 2022 total transactions of $601MM. Investments by Fund Type (3) Transactions by Type (4) Diverse Portfolio Geography (3) Fund Year Size (1) Newbury Equity Partners 2007 $0.7Bn Newbury Equity Partners II 2010 $1.0Bn Newbury Equity Partners III 2014 $1.1Bn Newbury Equity Partners IV 2017 $1.4Bn Newbury Equity Partners V 2020 $2.0Bn Fund Overview ($Bn)

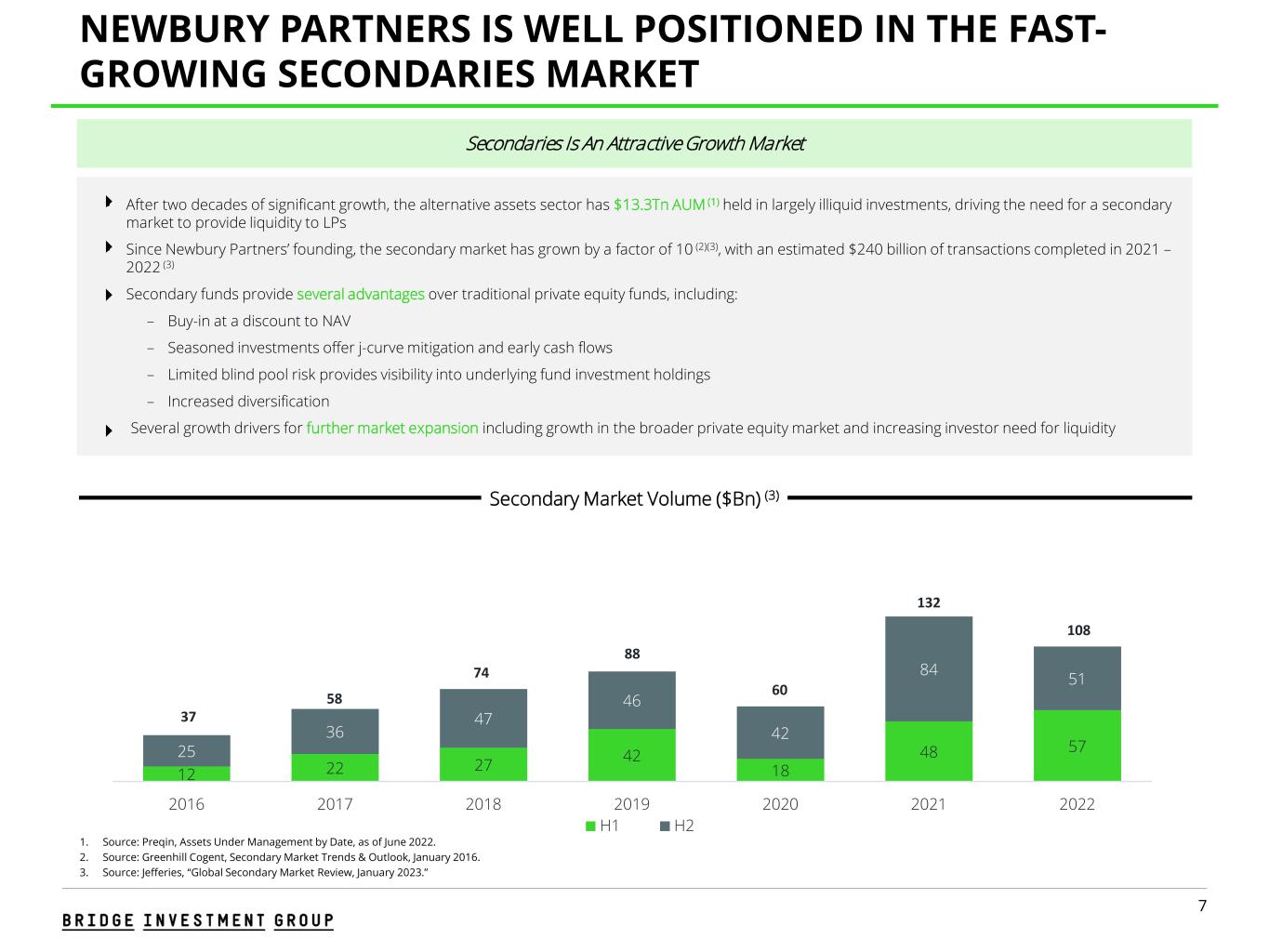

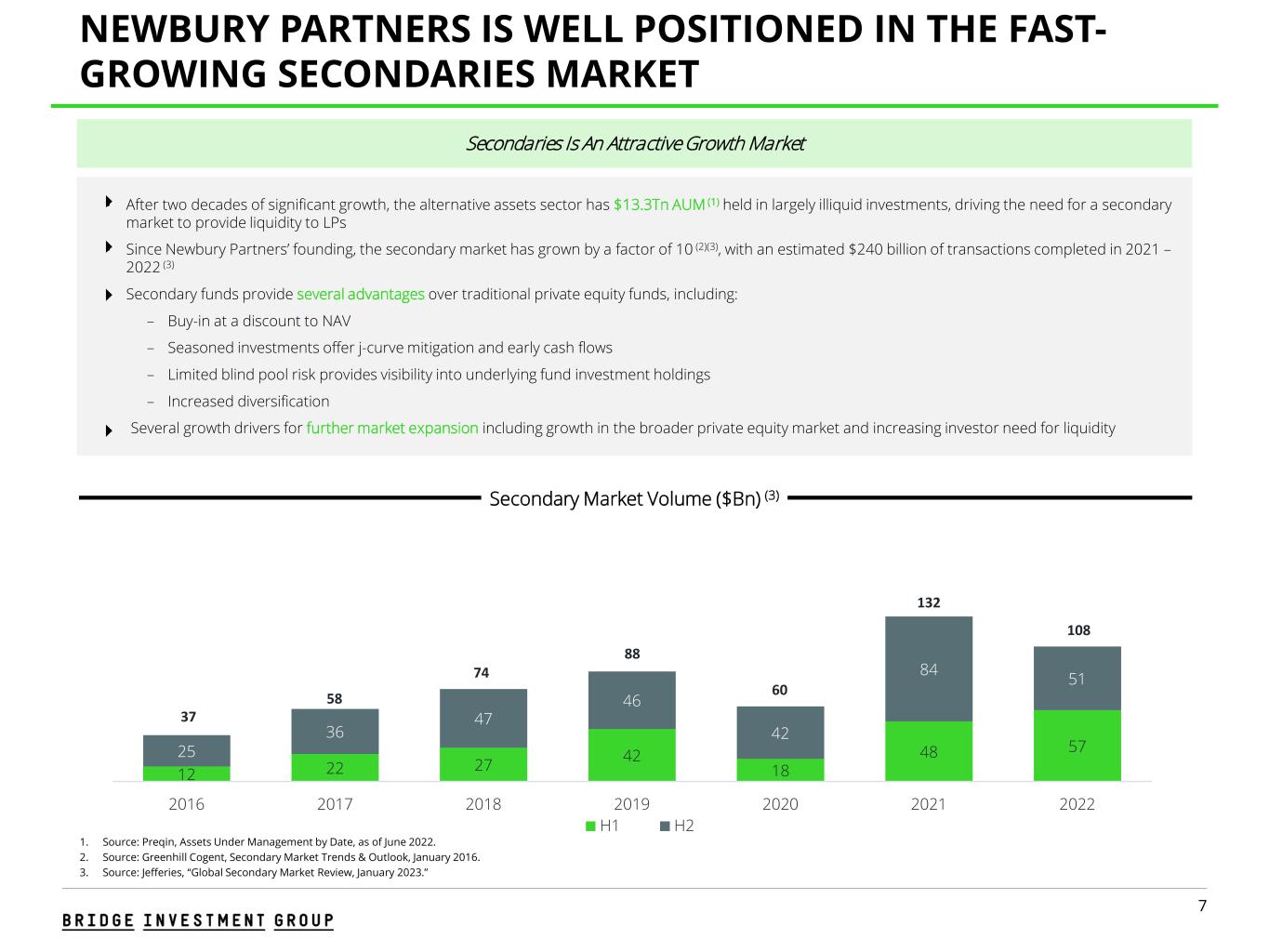

7 12 22 27 42 18 48 5725 36 47 46 42 84 51 2016 2017 2018 2019 2020 2021 2022 H1 H2 NEWBURY PARTNERS IS WELL POSITIONED IN THE FAST- GROWING SECONDARIES MARKET 1. Source: Preqin, Assets Under Management by Date, as of June 2022. 2. Source: Greenhill Cogent, Secondary Market Trends & Outlook, January 2016. 3. Source: Jefferies, “Global Secondary Market Review, January 2023.” Secondary Market Volume ($Bn) (3) 37 58 74 88 60 132 Secondaries Is An Attractive Growth Market • After two decades of significant growth, the alternative assets sector has $13.3Tn AUM (1) held in largely illiquid investments, driving the need for a secondary market to provide liquidity to LPs • Since Newbury Partners’ founding, the secondary market has grown by a factor of 10 (2)(3), with an estimated $240 billion of transactions completed in 2021 – 2022 (3) • Secondary funds provide several advantages over traditional private equity funds, including: – Buy-in at a discount to NAV – Seasoned investments offer j-curve mitigation and early cash flows – Limited blind pool risk provides visibility into underlying fund investment holdings – Increased diversification Several growth drivers for further market expansion including growth in the broader private equity market and increasing investor need for liquidity 108

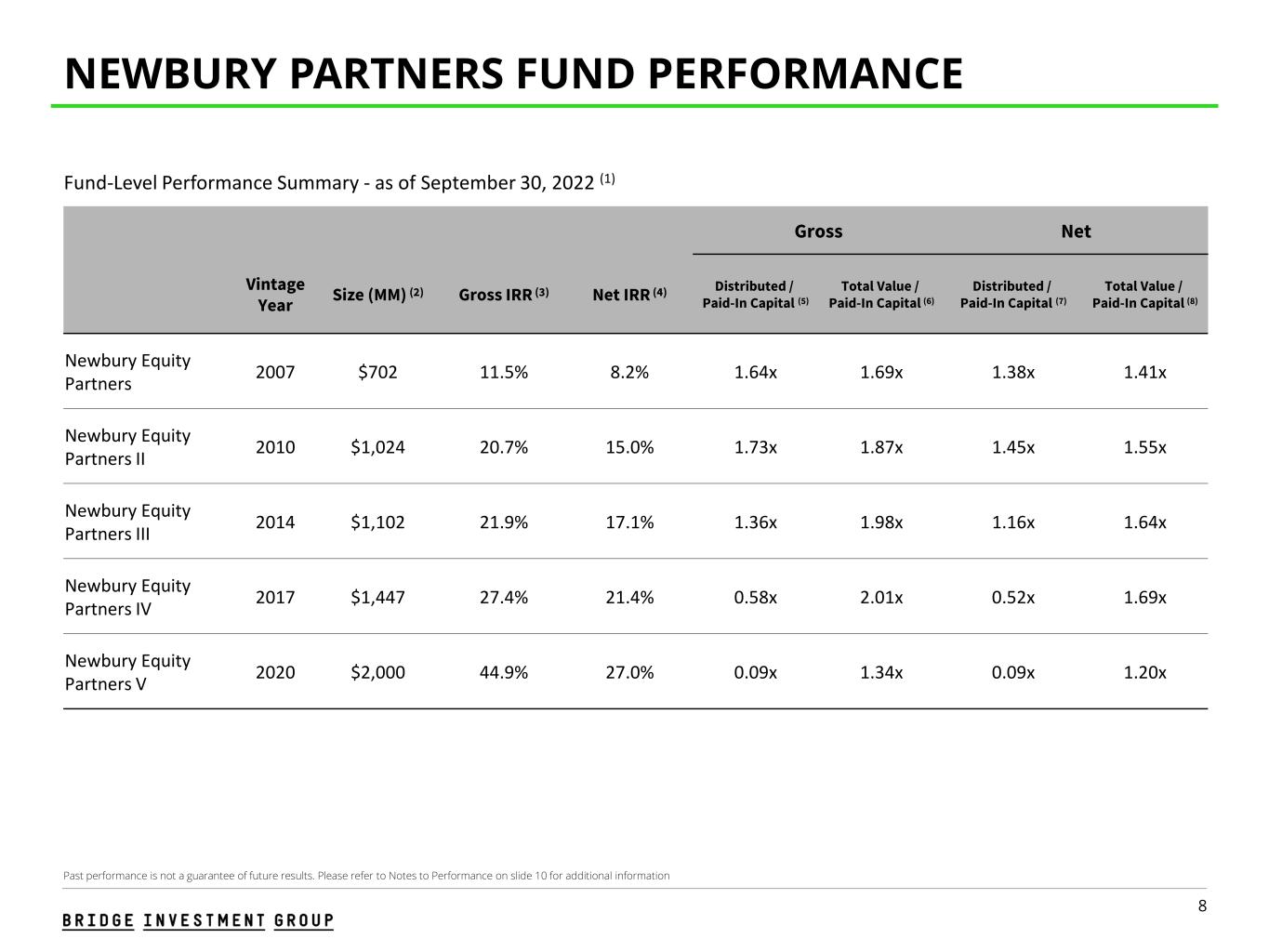

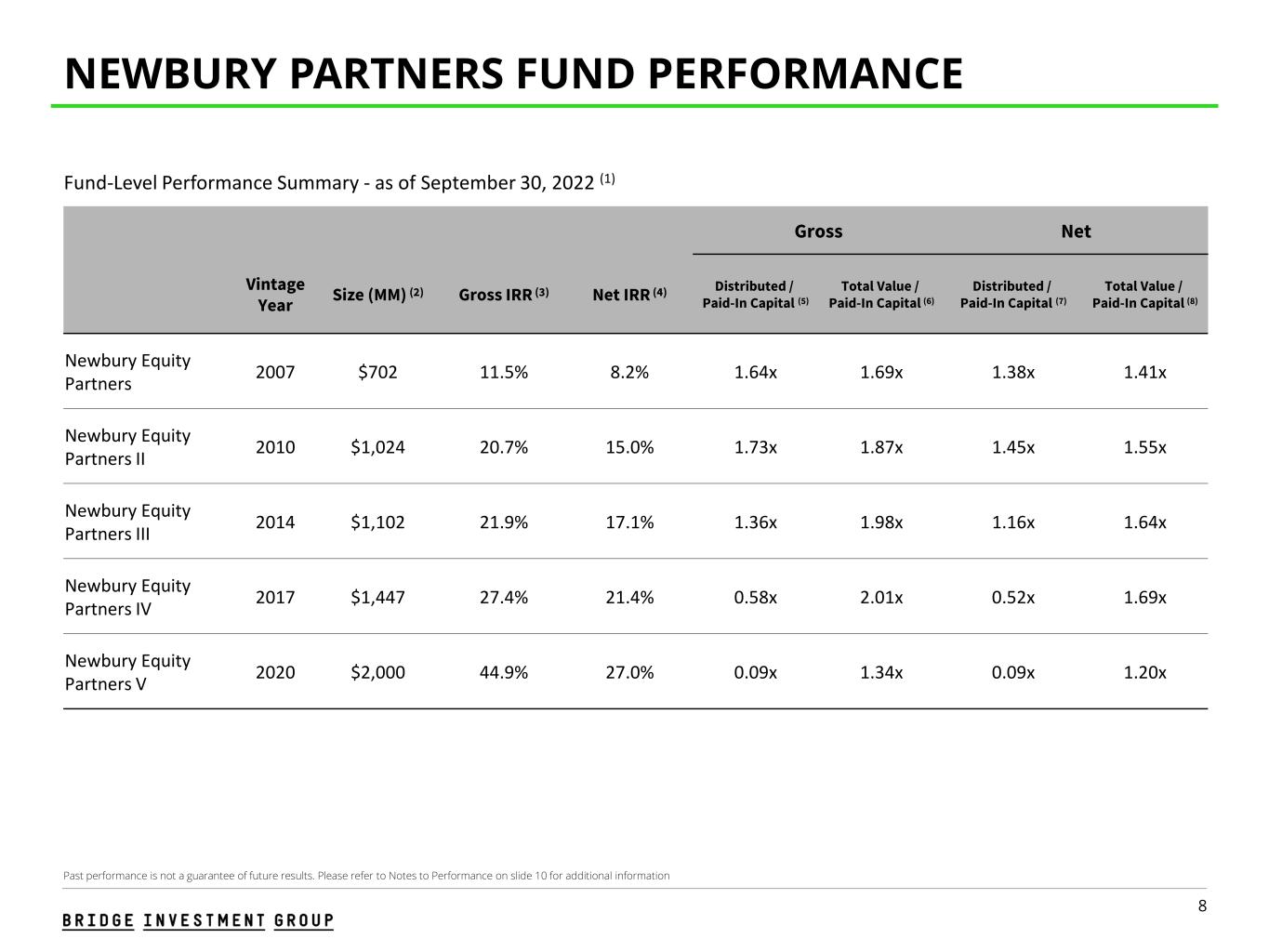

8 NEWBURY PARTNERS FUND PERFORMANCE Past performance is not a guarantee of future results. Please refer to Notes to Performance on slide 10 for additional information Gross Net Vintage Year Size (MM) (2) Gross IRR (3) Net IRR (4) Distributed / Paid-In Capital (5) Total Value / Paid-In Capital (6) Distributed / Paid-In Capital (7) Total Value / Paid-In Capital (8) Newbury Equity Partners 2007 $702 11.5% 8.2% 1.64x 1.69x 1.38x 1.41x Newbury Equity Partners II 2010 $1,024 20.7% 15.0% 1.73x 1.87x 1.45x 1.55x Newbury Equity Partners III 2014 $1,102 21.9% 17.1% 1.36x 1.98x 1.16x 1.64x Newbury Equity Partners IV 2017 $1,447 27.4% 21.4% 0.58x 2.01x 0.52x 1.69x Newbury Equity Partners V 2020 $2,000 44.9% 27.0% 0.09x 1.34x 0.09x 1.20x Fund-Level Performance Summary - as of September 30, 2022 (1)

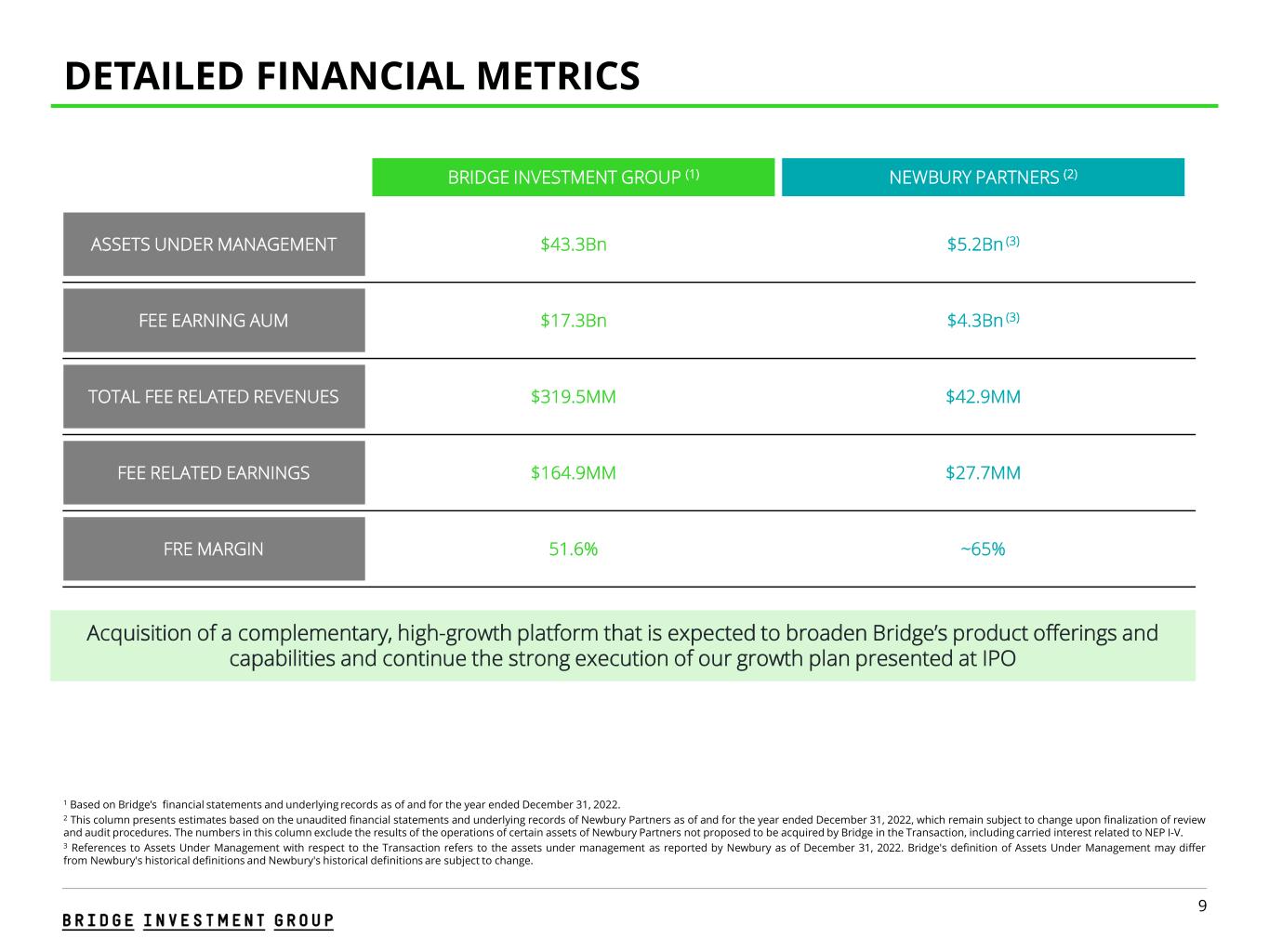

9 DETAILED FINANCIAL METRICS 1 Based on Bridge’s financial statements and underlying records as of and for the year ended December 31, 2022. 2 This column presents estimates based on the unaudited financial statements and underlying records of Newbury Partners as of and for the year ended December 31, 2022, which remain subject to change upon finalization of review and audit procedures. The numbers in this column exclude the results of the operations of certain assets of Newbury Partners not proposed to be acquired by Bridge in the Transaction, including carried interest related to NEP I-V. 3 References to Assets Under Management with respect to the Transaction refers to the assets under management as reported by Newbury as of December 31, 2022. Bridge's definition of Assets Under Management may differ from Newbury's historical definitions and Newbury's historical definitions are subject to change. BRIDGE INVESTMENT GROUP (1) NEWBURY PARTNERS (2) ASSETS UNDER MANAGEMENT $43.3Bn $5.2Bn (3) FEE EARNING AUM $17.3Bn $4.3Bn (3) TOTAL FEE RELATED REVENUES $319.5MM $42.9MM FEE RELATED EARNINGS $164.9MM $27.7MM FRE MARGIN 51.6% ~65% Acquisition of a complementary, high-growth platform that is expected to broaden Bridge’s product offerings and capabilities and continue the strong execution of our growth plan presented at IPO

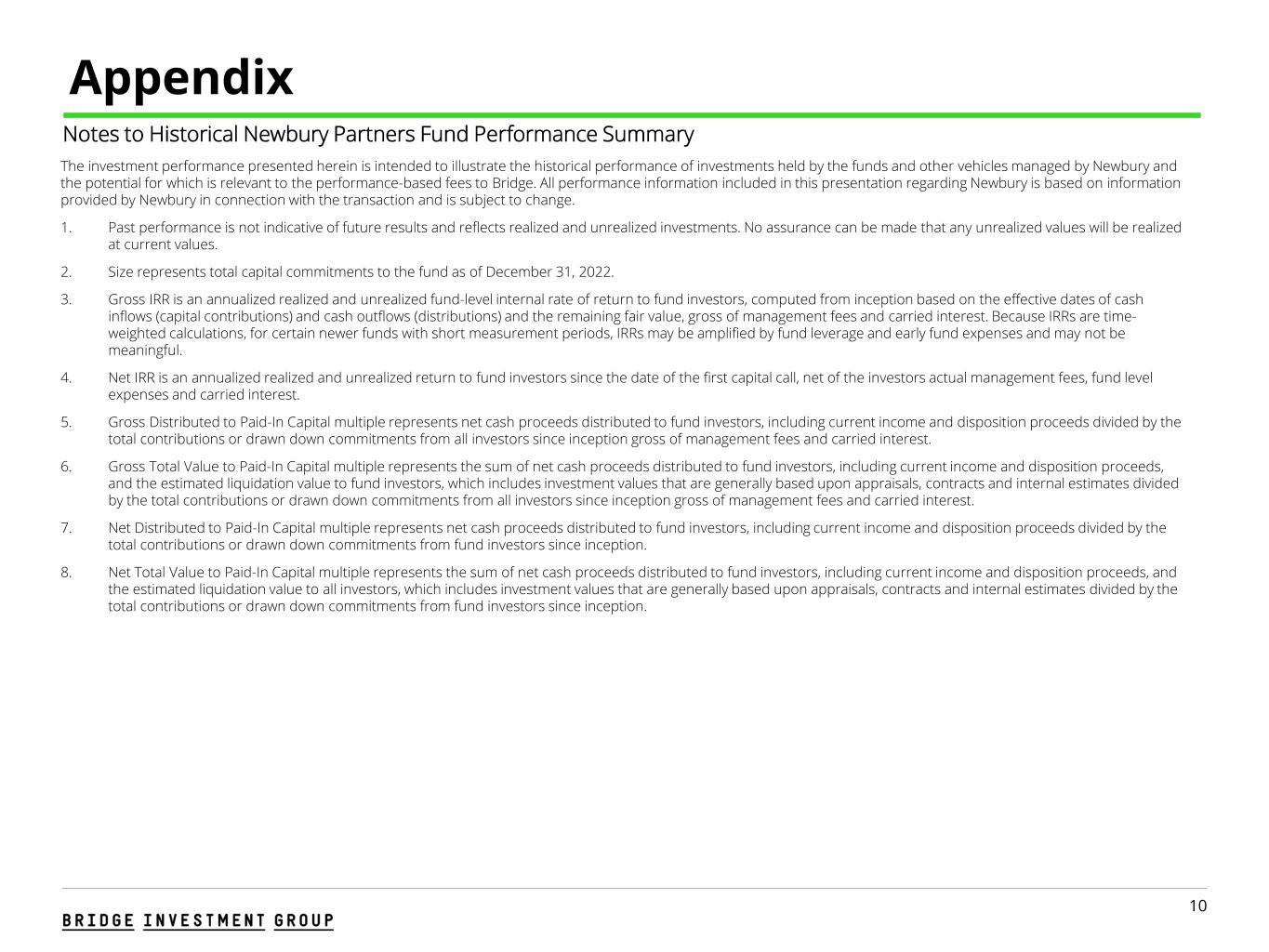

10 Notes to Historical Newbury Partners Fund Performance Summary Appendix The investment performance presented herein is intended to illustrate the historical performance of investments held by the funds and other vehicles managed by Newbury and the potential for which is relevant to the performance-based fees to Bridge. All performance information included in this presentation regarding Newbury is based on information provided by Newbury in connection with the transaction and is subject to change. 1. Past performance is not indicative of future results and reflects realized and unrealized investments. No assurance can be made that any unrealized values will be realized at current values. 2. Size represents total capital commitments to the fund as of December 31, 2022. 3. Gross IRR is an annualized realized and unrealized fund-level internal rate of return to fund investors, computed from inception based on the effective dates of cash inflows (capital contributions) and cash outflows (distributions) and the remaining fair value, gross of management fees and carried interest. Because IRRs are time- weighted calculations, for certain newer funds with short measurement periods, IRRs may be amplified by fund leverage and early fund expenses and may not be meaningful. 4. Net IRR is an annualized realized and unrealized return to fund investors since the date of the first capital call, net of the investors actual management fees, fund level expenses and carried interest. 5. Gross Distributed to Paid-In Capital multiple represents net cash proceeds distributed to fund investors, including current income and disposition proceeds divided by the total contributions or drawn down commitments from all investors since inception gross of management fees and carried interest. 6. Gross Total Value to Paid-In Capital multiple represents the sum of net cash proceeds distributed to fund investors, including current income and disposition proceeds, and the estimated liquidation value to fund investors, which includes investment values that are generally based upon appraisals, contracts and internal estimates divided by the total contributions or drawn down commitments from all investors since inception gross of management fees and carried interest. 7. Net Distributed to Paid-In Capital multiple represents net cash proceeds distributed to fund investors, including current income and disposition proceeds divided by the total contributions or drawn down commitments from fund investors since inception. 8. Net Total Value to Paid-In Capital multiple represents the sum of net cash proceeds distributed to fund investors, including current income and disposition proceeds, and the estimated liquidation value to all investors, which includes investment values that are generally based upon appraisals, contracts and internal estimates divided by the total contributions or drawn down commitments from fund investors since inception.

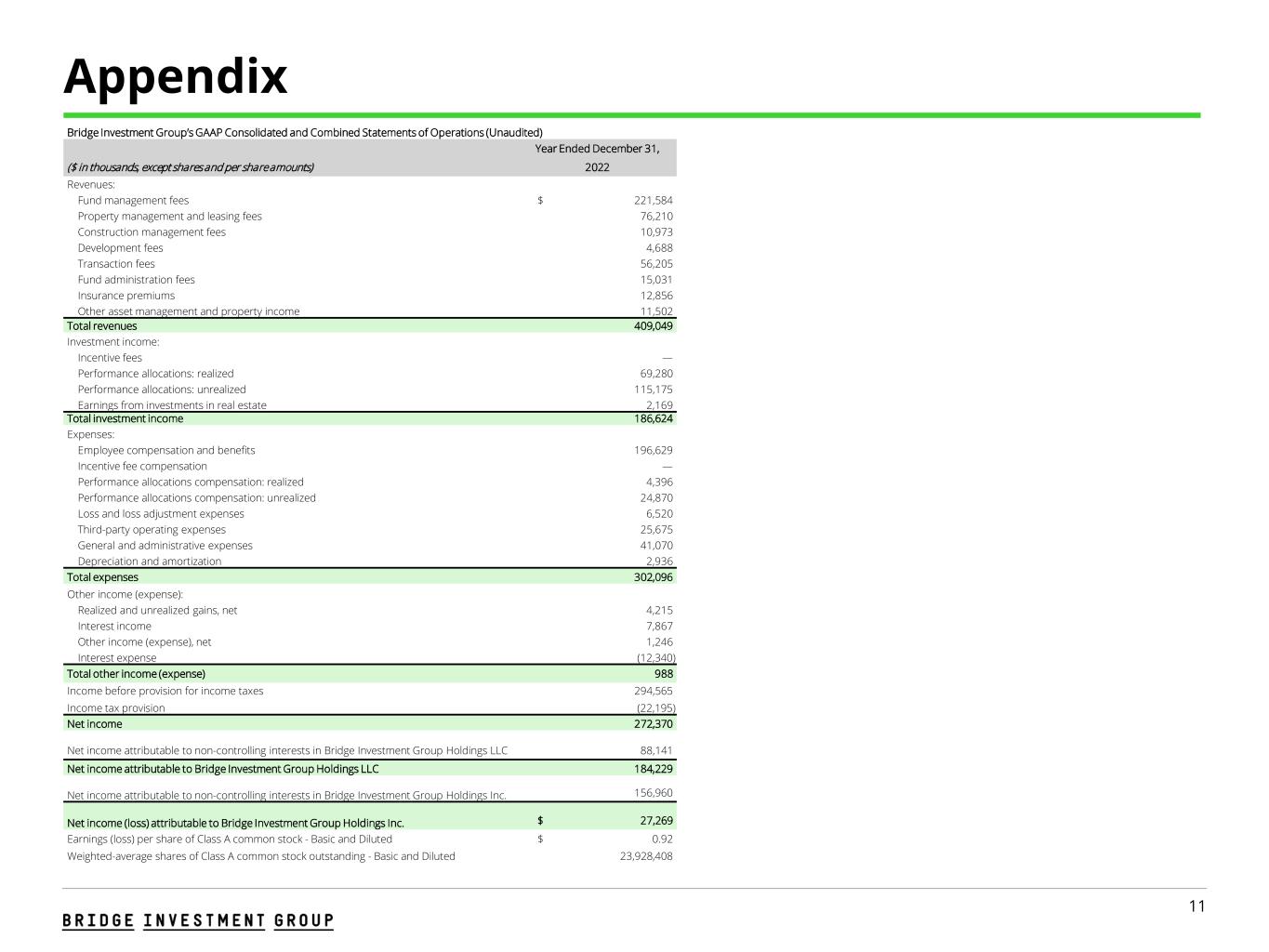

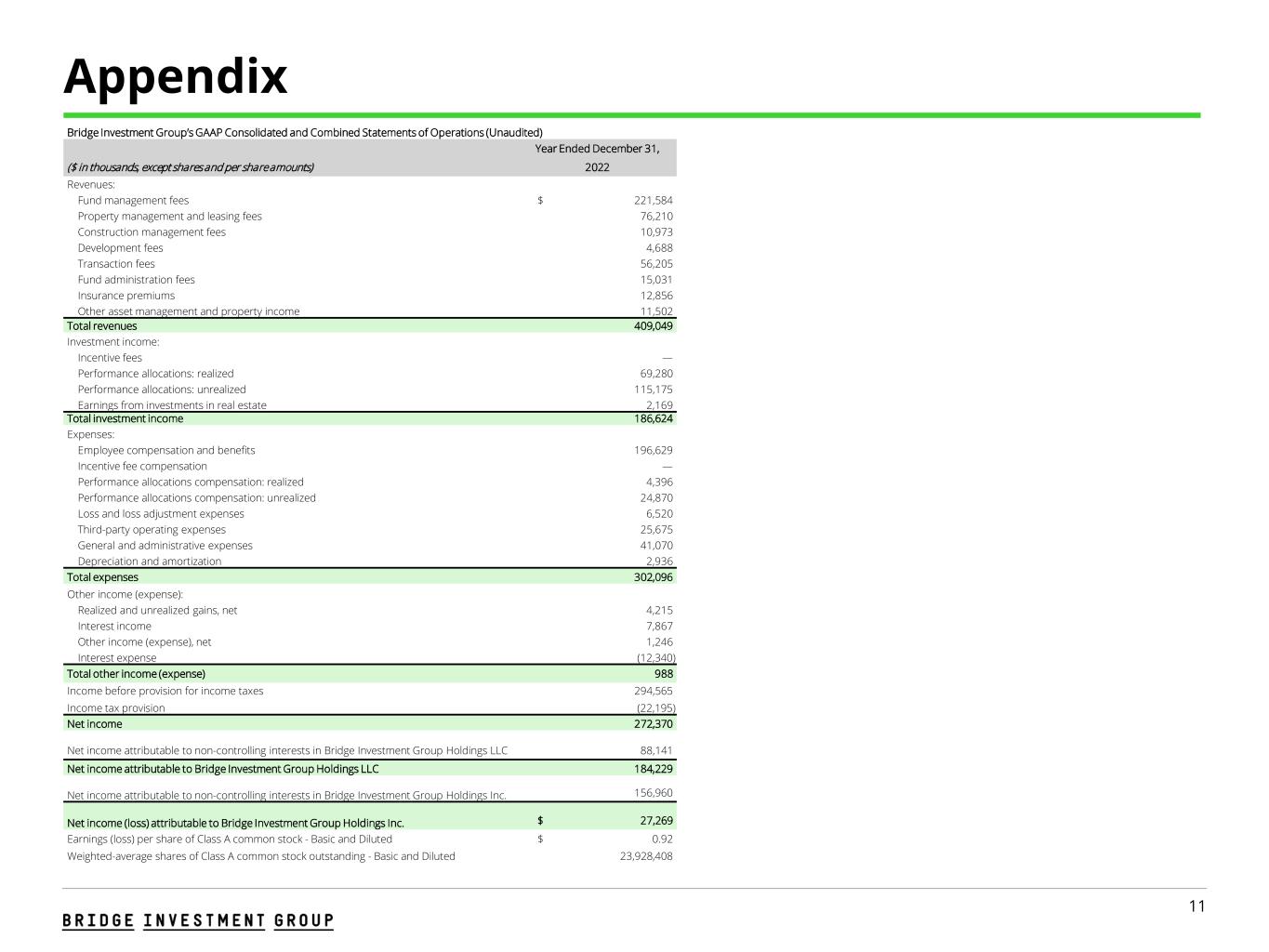

11 Appendix Bridge Investment Group’s GAAP Consolidated and Combined Statements of Operations (Unaudited) Year Ended December 31, ($ in thousands, except shares and per share amounts) 2022 Revenues: Fund management fees $ 221,584 Property management and leasing fees 76,210 Construction management fees 10,973 Development fees 4,688 Transaction fees 56,205 Fund administration fees 15,031 Insurance premiums 12,856 Other asset management and property income 11,502 Total revenues 409,049 Investment income: Incentive fees — Performance allocations: realized 69,280 Performance allocations: unrealized 115,175 Earnings from investments in real estate 2,169 Total investment income 186,624 Expenses: Employee compensation and benefits 196,629 Incentive fee compensation — Performance allocations compensation: realized 4,396 Performance allocations compensation: unrealized 24,870 Loss and loss adjustment expenses 6,520 Third-party operating expenses 25,675 General and administrative expenses 41,070 Depreciation and amortization 2,936 Total expenses 302,096 Other income (expense): Realized and unrealized gains, net 4,215 Interest income 7,867 Other income (expense), net 1,246 Interest expense (12,340) Total other income (expense) 988 Income before provision for income taxes 294,565 Income tax provision (22,195) Net income 272,370 Net income attributable to non-controlling interests in Bridge Investment Group Holdings LLC 88,141 Net income attributable to Bridge Investment Group Holdings LLC 184,229 Net income attributable to non-controlling interests in Bridge Investment Group Holdings Inc. 156,960 Net income (loss) attributable to Bridge Investment Group Holdings Inc. $ 27,269 Earnings (loss) per share of Class A common stock - Basic and Diluted $ 0.92 Weighted-average shares of Class A common stock outstanding - Basic and Diluted 23,928,408

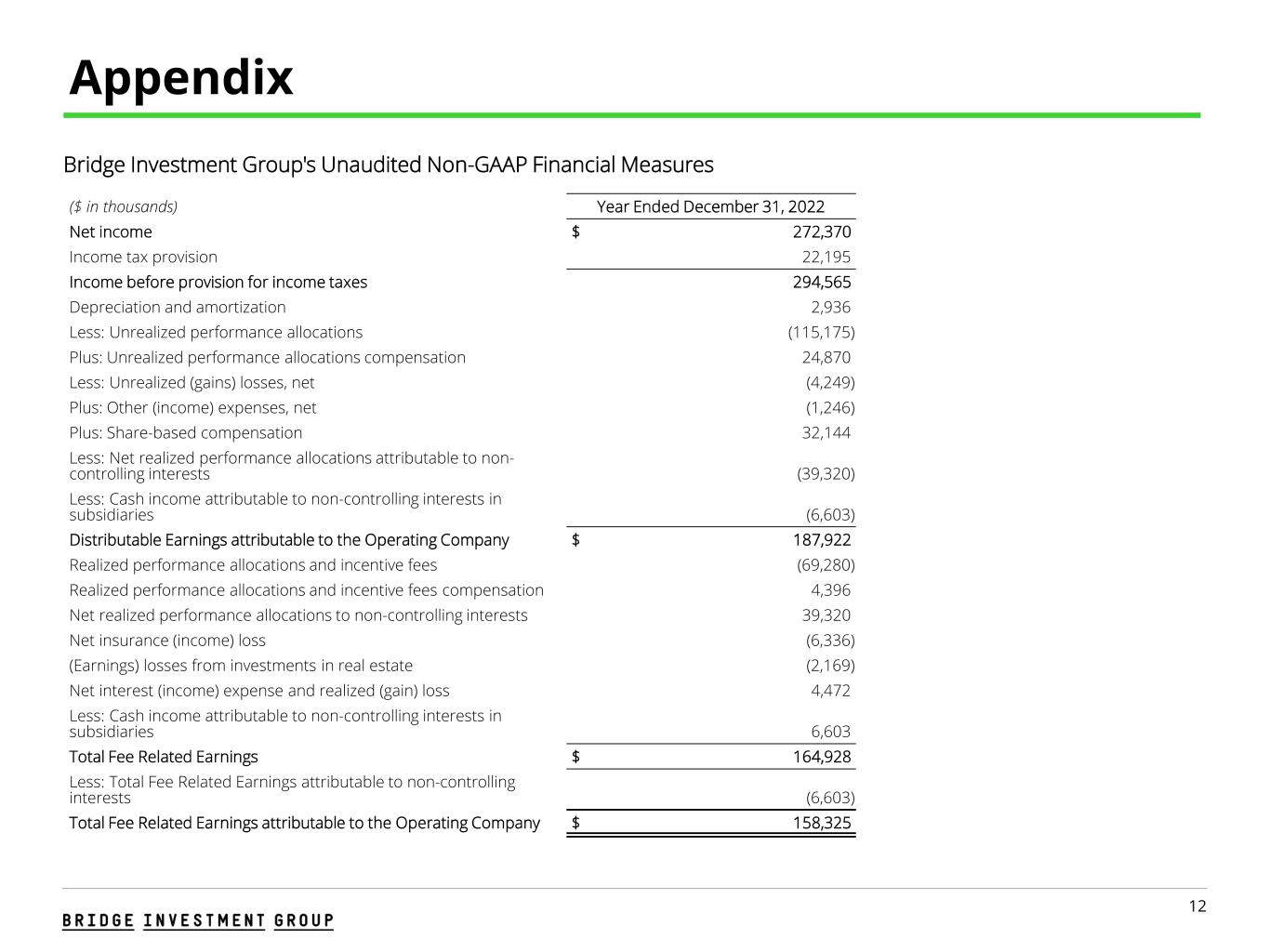

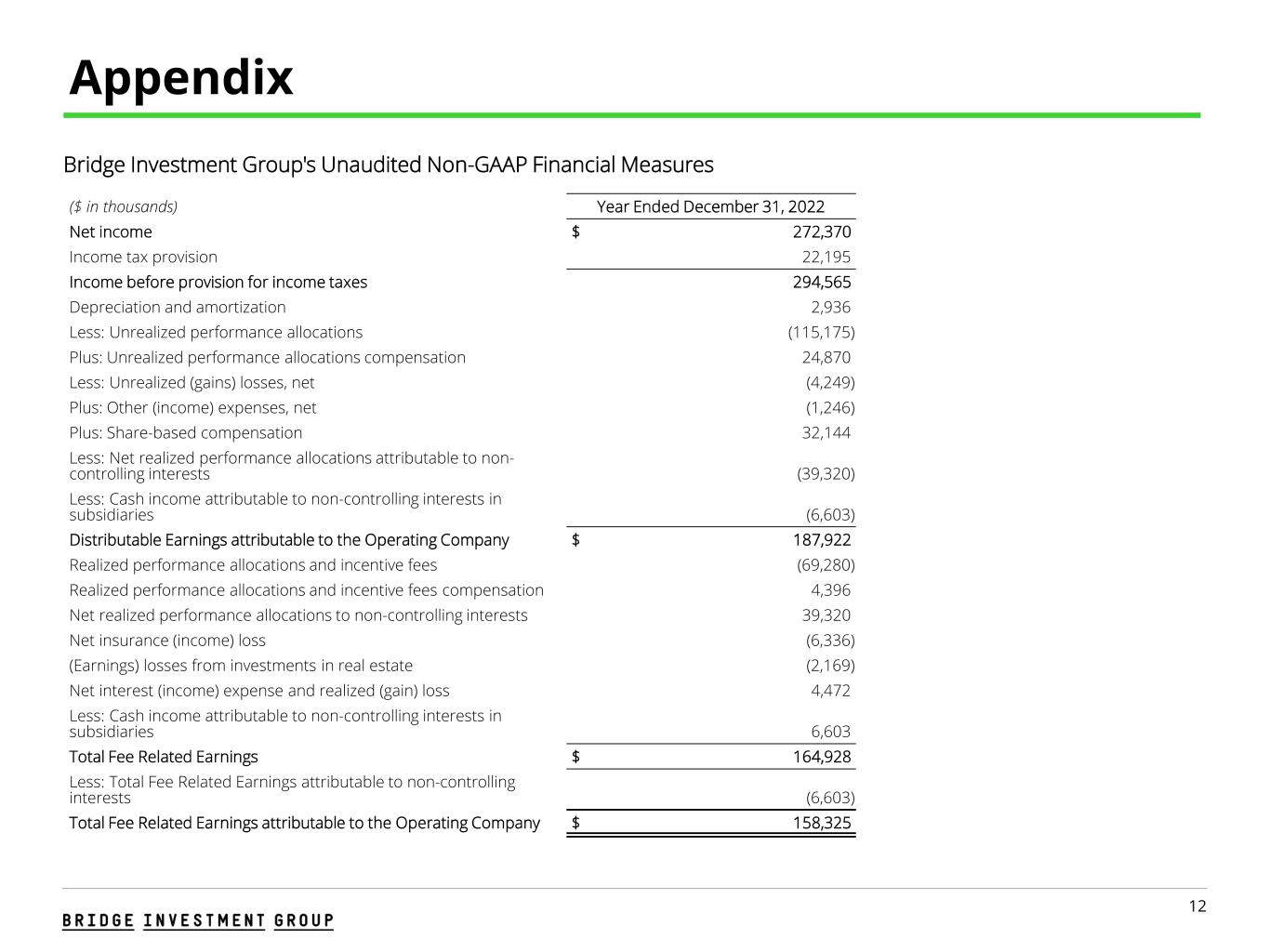

12 ($ in thousands) Year Ended December 31, 2022 Net income $ 272,370 Income tax provision 22,195 Income before provision for income taxes 294,565 Depreciation and amortization 2,936 Less: Unrealized performance allocations (115,175) Plus: Unrealized performance allocations compensation 24,870 Less: Unrealized (gains) losses, net (4,249) Plus: Other (income) expenses, net (1,246) Plus: Share-based compensation 32,144 Less: Net realized performance allocations attributable to non- controlling interests (39,320) Less: Cash income attributable to non-controlling interests in subsidiaries (6,603) Distributable Earnings attributable to the Operating Company $ 187,922 Realized performance allocations and incentive fees (69,280) Realized performance allocations and incentive fees compensation 4,396 Net realized performance allocations to non-controlling interests 39,320 Net insurance (income) loss (6,336) (Earnings) losses from investments in real estate (2,169) Net interest (income) expense and realized (gain) loss 4,472 Less: Cash income attributable to non-controlling interests in subsidiaries 6,603 Total Fee Related Earnings $ 164,928 Less: Total Fee Related Earnings attributable to non-controlling interests (6,603) Total Fee Related Earnings attributable to the Operating Company $ 158,325 Appendix Bridge Investment Group's Unaudited Non-GAAP Financial Measures

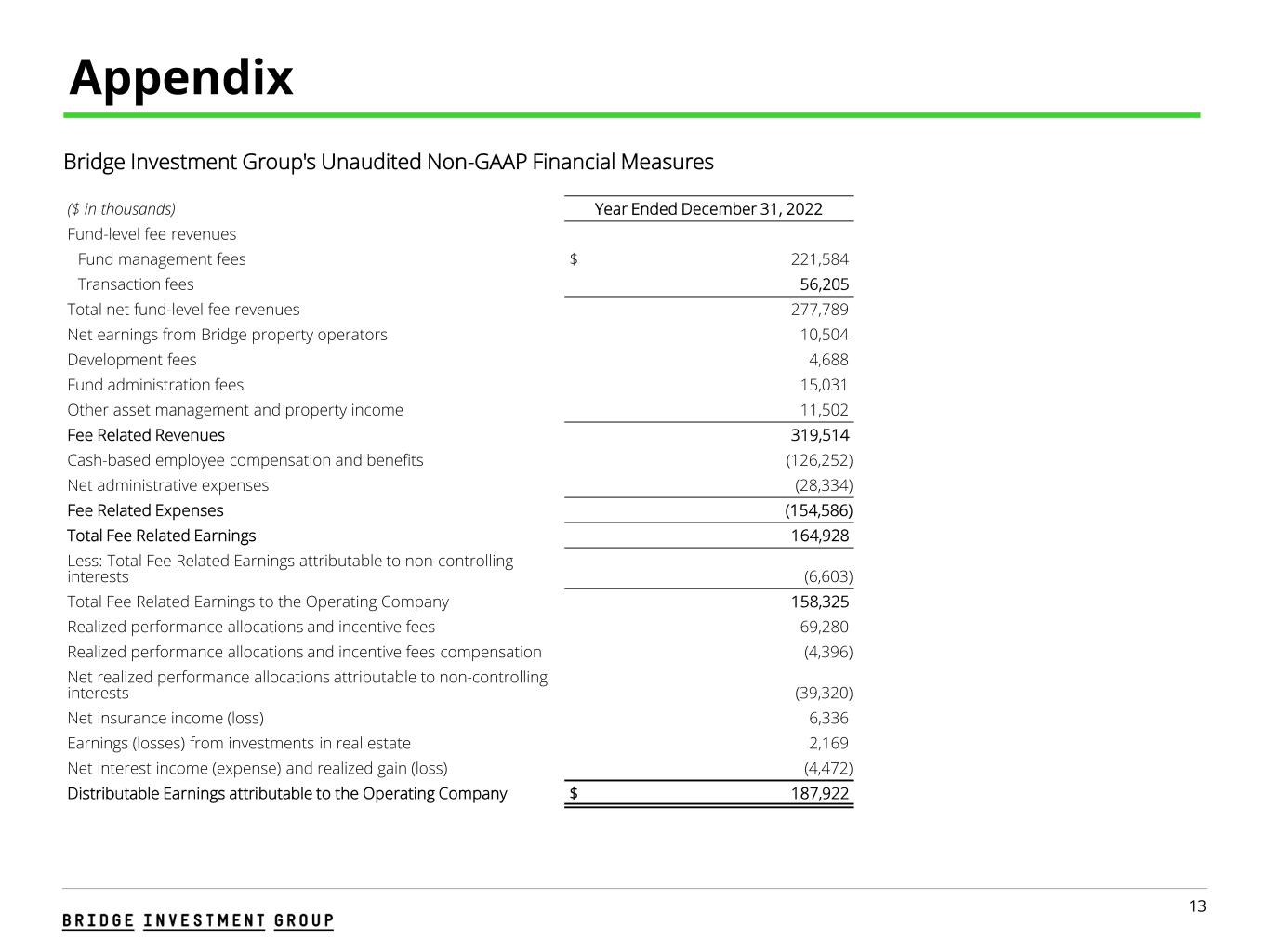

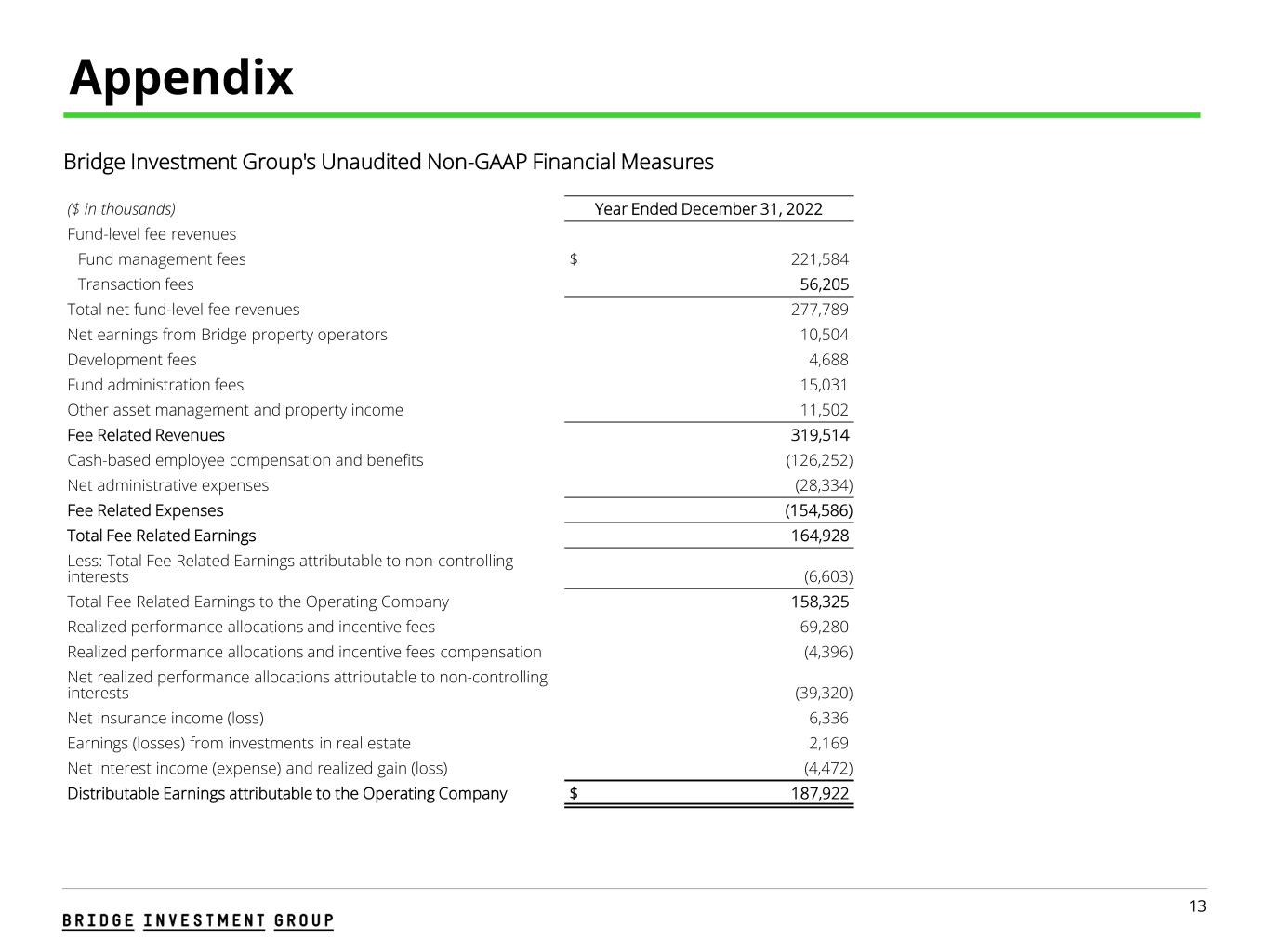

13 Appendix Bridge Investment Group's Unaudited Non-GAAP Financial Measures ($ in thousands) Year Ended December 31, 2022 Fund-level fee revenues Fund management fees $ 221,584 Transaction fees 56,205 Total net fund-level fee revenues 277,789 Net earnings from Bridge property operators 10,504 Development fees 4,688 Fund administration fees 15,031 Other asset management and property income 11,502 Fee Related Revenues 319,514 Cash-based employee compensation and benefits (126,252) Net administrative expenses (28,334) Fee Related Expenses (154,586) Total Fee Related Earnings 164,928 Less: Total Fee Related Earnings attributable to non-controlling interests (6,603) Total Fee Related Earnings to the Operating Company 158,325 Realized performance allocations and incentive fees 69,280 Realized performance allocations and incentive fees compensation (4,396) Net realized performance allocations attributable to non-controlling interests (39,320) Net insurance income (loss) 6,336 Earnings (losses) from investments in real estate 2,169 Net interest income (expense) and realized gain (loss) (4,472) Distributable Earnings attributable to the Operating Company $ 187,922

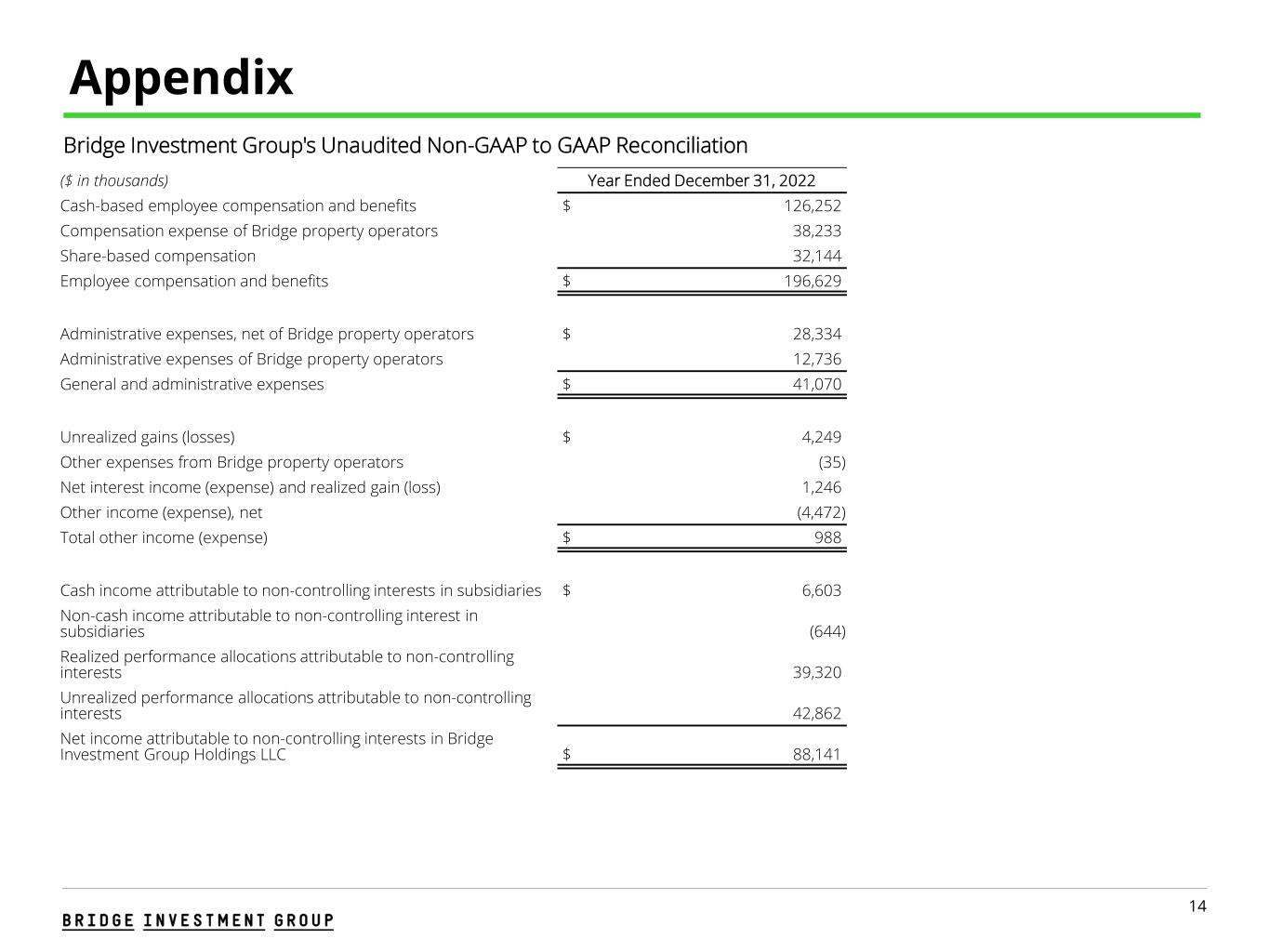

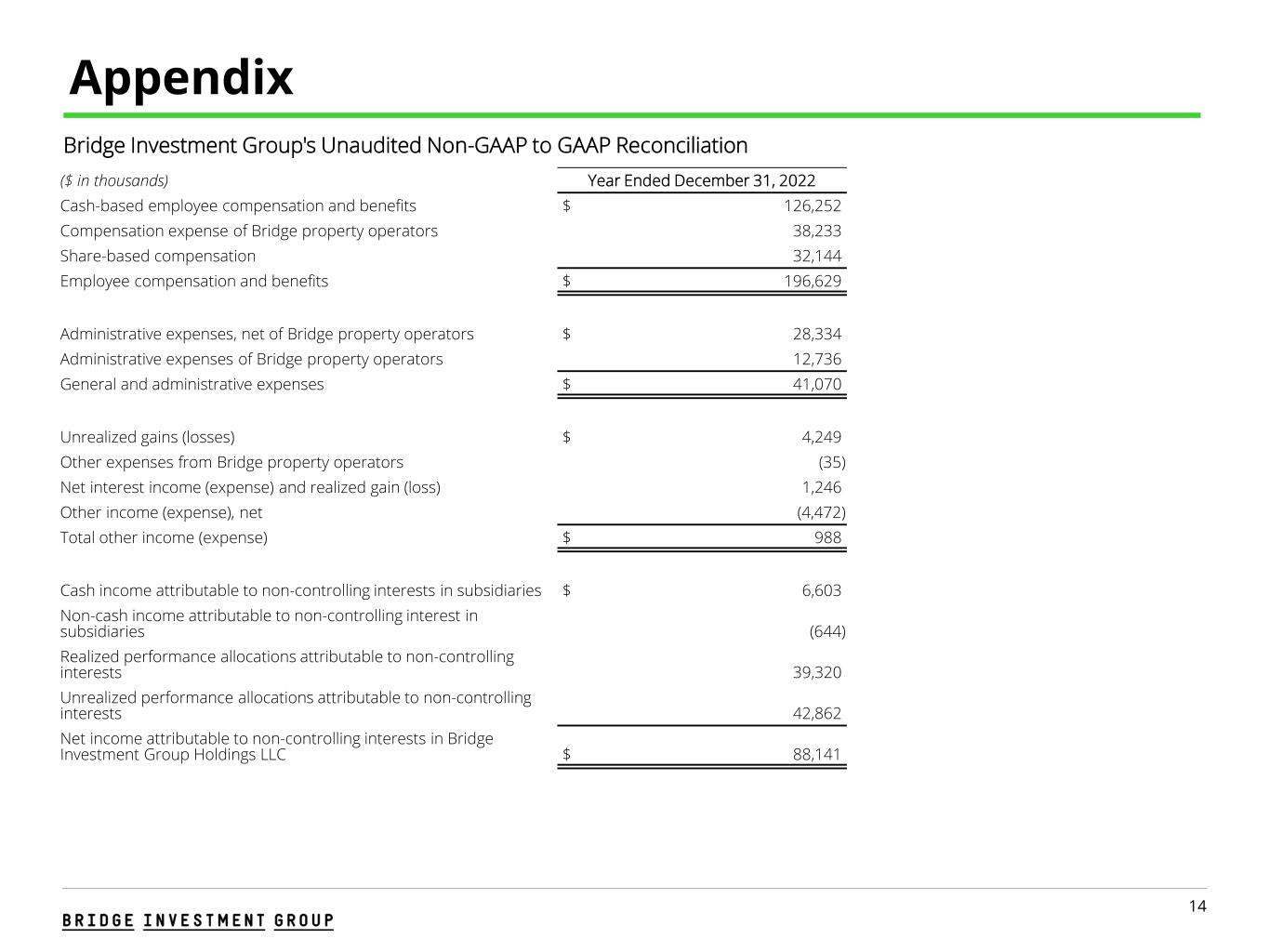

14 Appendix Bridge Investment Group's Unaudited Non-GAAP to GAAP Reconciliation ($ in thousands) Year Ended December 31, 2022 Cash-based employee compensation and benefits $ 126,252 Compensation expense of Bridge property operators 38,233 Share-based compensation 32,144 Employee compensation and benefits $ 196,629 Administrative expenses, net of Bridge property operators $ 28,334 Administrative expenses of Bridge property operators 12,736 General and administrative expenses $ 41,070 Unrealized gains (losses) $ 4,249 Other expenses from Bridge property operators (35) Net interest income (expense) and realized gain (loss) 1,246 Other income (expense), net (4,472) Total other income (expense) $ 988 Cash income attributable to non-controlling interests in subsidiaries $ 6,603 Non-cash income attributable to non-controlling interest in subsidiaries (644) Realized performance allocations attributable to non-controlling interests 39,320 Unrealized performance allocations attributable to non-controlling interests 42,862 Net income attributable to non-controlling interests in Bridge Investment Group Holdings LLC $ 88,141

15 Glossary Assets Under Management Assets under management, or AUM, represents the sum of (a) the fair value of the assets of the funds and vehicles we manage, plus (b) the contractual amount of any uncalled capital commitments to those funds and vehicles (including our commitments to the funds and vehicles and those of Bridge affiliates). Our AUM is not reduced by any outstanding indebtedness or other accrued but unpaid liabilities of the assets we manage. Our calculations of AUM and fee-earning AUM may differ from the calculations of other investment managers. As a result, these measures may not be comparable to similar measures presented by other investment managers. In addition, our calculation of AUM includes uncalled commitments to (and the fair value of the assets in) the funds and vehicles we manage from Bridge and Bridge affiliates, regardless of whether such commitments or investments are subject to fees. Our definition of AUM is not based on any definition contained in the agreements governing the funds and vehicles we manage or advise. Distributable Earnings Distributable Earnings, or DE, is a key performance measure used in our industry and is evaluated regularly by management in making resource deployment and compensation decisions, and in assessing our performance. DE differs from net income before provision for income taxes, computed in accordance with U.S. GAAP in that it does not include depreciation and amortization, unrealized performance allocations and related compensation expense, unrealized gains (losses), share-based compensation, cash income attributable to non-controlling interests, charges (credits) related to corporate actions and non- recurring items. Although we believe the inclusion or exclusion of these items provides investors with a meaningful indication of our core operating performance, the use of DE without consideration of the related U.S. GAAP measures is not adequate due to the adjustments described herein. This measure supplements and should be considered in addition to and not in lieu of the results of operations discussed further in our most recent annual report on Form 10-K and quarterly report of Form 10-Q under “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Key Components of our Results of Operations—Combined Results of Operations” prepared in accordance with U.S. GAAP. Our calculations of DE may differ from the calculations of other investment managers. As a result, these measures may not be comparable to similar measures presented by other investment managers. Fee-Earning AUM Fee-Earning AUM, or FEAUM, reflects the assets from which we earn management fee revenue. The assets we manage that are included in our FEAUM typically pay management fees based on capital commitments, invested capital or, in certain cases, NAV, depending on the fee terms. Fee Related Earnings Fee Related Earnings, or FRE, is a supplemental performance measure used to assess our ability of to generate profits from fee-based revenues that are measured and received on a recurring basis. FRE differs from income before provision for income taxes computed in accordance with U.S. GAAP in that it adjusts for the items included in the calculation of Distributable Earnings, and also adjusts Distributable Earnings to exclude realized performance allocations income and related compensation expense, net insurance income, earnings from investments in real estate, net interest (interest income less interest expense), net realized gain/(loss), and, if applicable, certain general and administrative expenses when the timing of any future payment is uncertain. FRE is not a measure of performance calculated in accordance with U.S. GAAP. The use of FRE without consideration of the related U.S. GAAP measures is not adequate due to the adjustments described herein. Our calculations of FRE may differ from the calculations of other investment managers. As a result, these measures may not be comparable to similar measures presented by other investment managers.

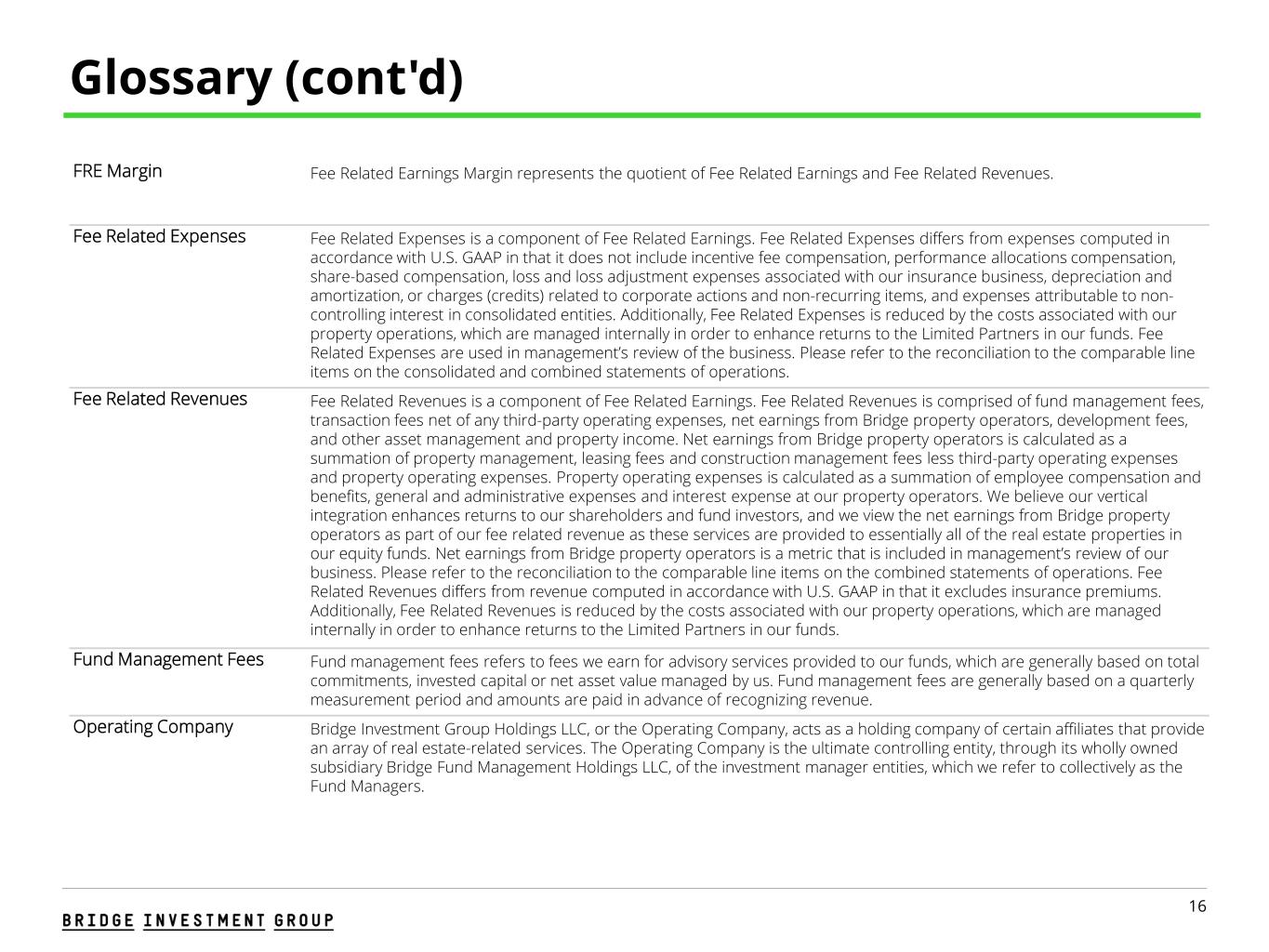

16 Glossary (cont'd) FRE Margin Fee Related Earnings Margin represents the quotient of Fee Related Earnings and Fee Related Revenues. Fee Related Expenses Fee Related Expenses is a component of Fee Related Earnings. Fee Related Expenses differs from expenses computed in accordance with U.S. GAAP in that it does not include incentive fee compensation, performance allocations compensation, share-based compensation, loss and loss adjustment expenses associated with our insurance business, depreciation and amortization, or charges (credits) related to corporate actions and non-recurring items, and expenses attributable to non- controlling interest in consolidated entities. Additionally, Fee Related Expenses is reduced by the costs associated with our property operations, which are managed internally in order to enhance returns to the Limited Partners in our funds. Fee Related Expenses are used in management’s review of the business. Please refer to the reconciliation to the comparable line items on the consolidated and combined statements of operations. Fee Related Revenues Fee Related Revenues is a component of Fee Related Earnings. Fee Related Revenues is comprised of fund management fees, transaction fees net of any third-party operating expenses, net earnings from Bridge property operators, development fees, and other asset management and property income. Net earnings from Bridge property operators is calculated as a summation of property management, leasing fees and construction management fees less third-party operating expenses and property operating expenses. Property operating expenses is calculated as a summation of employee compensation and benefits, general and administrative expenses and interest expense at our property operators. We believe our vertical integration enhances returns to our shareholders and fund investors, and we view the net earnings from Bridge property operators as part of our fee related revenue as these services are provided to essentially all of the real estate properties in our equity funds. Net earnings from Bridge property operators is a metric that is included in management’s review of our business. Please refer to the reconciliation to the comparable line items on the combined statements of operations. Fee Related Revenues differs from revenue computed in accordance with U.S. GAAP in that it excludes insurance premiums. Additionally, Fee Related Revenues is reduced by the costs associated with our property operations, which are managed internally in order to enhance returns to the Limited Partners in our funds. Fund Management Fees Fund management fees refers to fees we earn for advisory services provided to our funds, which are generally based on total commitments, invested capital or net asset value managed by us. Fund management fees are generally based on a quarterly measurement period and amounts are paid in advance of recognizing revenue. Operating Company Bridge Investment Group Holdings LLC, or the Operating Company, acts as a holding company of certain affiliates that provide an array of real estate-related services. The Operating Company is the ultimate controlling entity, through its wholly owned subsidiary Bridge Fund Management Holdings LLC, of the investment manager entities, which we refer to collectively as the Fund Managers.