000185440112/312022Q3falseP1MP3MP8Yhttp://fasb.org/us-gaap/2022#OtherAssetshttp://fasb.org/us-gaap/2022#OtherLiabilities0.3330.3330.3330.3330.3330.33300018544012022-01-012022-09-300001854401us-gaap:CommonClassAMember2022-11-01xbrli:shares0001854401us-gaap:CommonClassBMember2022-11-0100018544012022-09-30iso4217:USD00018544012021-12-31iso4217:USDxbrli:shares0001854401us-gaap:CommonClassAMember2022-09-300001854401us-gaap:CommonClassAMember2021-12-310001854401us-gaap:CommonClassBMember2022-09-300001854401us-gaap:CommonClassBMember2021-12-310001854401srt:SubsidiariesMember2022-09-300001854401srt:SubsidiariesMember2021-12-310001854401us-gaap:ParentMember2022-09-300001854401us-gaap:ParentMember2021-12-310001854401brdg:FundManagementFeesMember2022-07-012022-09-300001854401brdg:FundManagementFeesMember2021-07-012021-09-300001854401brdg:FundManagementFeesMember2022-01-012022-09-300001854401brdg:FundManagementFeesMember2021-01-012021-09-300001854401brdg:PropertyManagementAndLeasingFeesMember2022-07-012022-09-300001854401brdg:PropertyManagementAndLeasingFeesMember2021-07-012021-09-300001854401brdg:PropertyManagementAndLeasingFeesMember2022-01-012022-09-300001854401brdg:PropertyManagementAndLeasingFeesMember2021-01-012021-09-300001854401brdg:ConstructionManagementFeesMember2022-07-012022-09-300001854401brdg:ConstructionManagementFeesMember2021-07-012021-09-300001854401brdg:ConstructionManagementFeesMember2022-01-012022-09-300001854401brdg:ConstructionManagementFeesMember2021-01-012021-09-300001854401brdg:DevelopmentFeesMember2022-07-012022-09-300001854401brdg:DevelopmentFeesMember2021-07-012021-09-300001854401brdg:DevelopmentFeesMember2022-01-012022-09-300001854401brdg:DevelopmentFeesMember2021-01-012021-09-300001854401brdg:TransactionFeesMember2022-07-012022-09-300001854401brdg:TransactionFeesMember2021-07-012021-09-300001854401brdg:TransactionFeesMember2022-01-012022-09-300001854401brdg:TransactionFeesMember2021-01-012021-09-300001854401brdg:FundAdministrationFeesMember2022-07-012022-09-300001854401brdg:FundAdministrationFeesMember2021-07-012021-09-300001854401brdg:FundAdministrationFeesMember2022-01-012022-09-300001854401brdg:FundAdministrationFeesMember2021-01-012021-09-300001854401brdg:InsurancePremiumsMember2022-07-012022-09-300001854401brdg:InsurancePremiumsMember2021-07-012021-09-300001854401brdg:InsurancePremiumsMember2022-01-012022-09-300001854401brdg:InsurancePremiumsMember2021-01-012021-09-300001854401brdg:OtherAssetManagementAndPropertyIncomeMember2022-07-012022-09-300001854401brdg:OtherAssetManagementAndPropertyIncomeMember2021-07-012021-09-300001854401brdg:OtherAssetManagementAndPropertyIncomeMember2022-01-012022-09-300001854401brdg:OtherAssetManagementAndPropertyIncomeMember2021-01-012021-09-3000018544012022-07-012022-09-3000018544012021-07-012021-09-3000018544012021-01-012021-09-300001854401brdg:CommonControlGroupMember2022-07-012022-09-300001854401brdg:CommonControlGroupMember2021-07-012021-09-300001854401brdg:CommonControlGroupMember2022-01-012022-09-300001854401brdg:CommonControlGroupMember2021-01-012021-09-300001854401us-gaap:ParentMember2022-07-012022-09-300001854401us-gaap:ParentMember2021-07-012021-09-300001854401us-gaap:ParentMember2022-01-012022-09-300001854401us-gaap:ParentMember2021-01-012021-09-300001854401srt:SubsidiariesMember2022-07-012022-09-300001854401srt:SubsidiariesMember2021-07-012021-09-300001854401srt:SubsidiariesMember2022-01-012022-09-300001854401srt:SubsidiariesMember2021-01-012021-09-300001854401us-gaap:CommonStockMemberus-gaap:CommonClassAMember2022-06-300001854401us-gaap:CommonStockMemberus-gaap:CommonClassBMember2022-06-300001854401us-gaap:AdditionalPaidInCapitalMember2022-06-300001854401us-gaap:RetainedEarningsMember2022-06-300001854401us-gaap:AociIncludingPortionAttributableToNoncontrollingInterestMember2022-06-300001854401brdg:NoncontrollingInterestsInSubsidiariesOfOperatingCompanyOrCommonControlGroupMember2022-06-300001854401brdg:NoncontrollingInterestsInBridgeInvestmentGroupHoldingsIncMember2022-06-3000018544012022-06-300001854401us-gaap:RetainedEarningsMember2022-07-012022-09-300001854401brdg:NoncontrollingInterestsInSubsidiariesOfOperatingCompanyOrCommonControlGroupMember2022-07-012022-09-300001854401brdg:NoncontrollingInterestsInBridgeInvestmentGroupHoldingsIncMember2022-07-012022-09-300001854401us-gaap:CommonStockMemberus-gaap:CommonClassAMember2022-07-012022-09-300001854401us-gaap:CommonStockMemberus-gaap:CommonClassBMember2022-07-012022-09-300001854401us-gaap:AdditionalPaidInCapitalMember2022-07-012022-09-300001854401us-gaap:AociIncludingPortionAttributableToNoncontrollingInterestMember2022-07-012022-09-300001854401us-gaap:CommonStockMemberus-gaap:CommonClassAMember2022-09-300001854401us-gaap:CommonStockMemberus-gaap:CommonClassBMember2022-09-300001854401us-gaap:AdditionalPaidInCapitalMember2022-09-300001854401us-gaap:RetainedEarningsMember2022-09-300001854401us-gaap:AociIncludingPortionAttributableToNoncontrollingInterestMember2022-09-300001854401brdg:NoncontrollingInterestsInSubsidiariesOfOperatingCompanyOrCommonControlGroupMember2022-09-300001854401brdg:NoncontrollingInterestsInBridgeInvestmentGroupHoldingsIncMember2022-09-300001854401brdg:CommonControlGroupMember2021-06-300001854401us-gaap:CommonStockMemberus-gaap:CommonClassAMember2021-06-300001854401us-gaap:CommonStockMemberus-gaap:CommonClassBMember2021-06-300001854401us-gaap:AdditionalPaidInCapitalMember2021-06-300001854401us-gaap:RetainedEarningsMember2021-06-300001854401us-gaap:AociIncludingPortionAttributableToNoncontrollingInterestMember2021-06-300001854401brdg:NoncontrollingInterestsInSubsidiariesOfOperatingCompanyOrCommonControlGroupMember2021-06-300001854401brdg:NoncontrollingInterestsInBridgeInvestmentGroupHoldingsIncMember2021-06-3000018544012021-06-300001854401brdg:PriorToTransactionsAndInitialsPublicOfferingMemberbrdg:CommonControlGroupMember2021-07-012021-09-300001854401brdg:PriorToTransactionsAndInitialsPublicOfferingMemberbrdg:NoncontrollingInterestsInSubsidiariesOfOperatingCompanyOrCommonControlGroupMember2021-07-012021-09-300001854401brdg:PriorToTransactionsAndInitialsPublicOfferingMember2021-07-012021-09-300001854401brdg:PriorToTransactionsAndInitialsPublicOfferingMemberus-gaap:AociIncludingPortionAttributableToNoncontrollingInterestMember2021-07-012021-09-300001854401brdg:CommonControlGroupMember2021-07-012021-09-300001854401brdg:NoncontrollingInterestsInSubsidiariesOfOperatingCompanyOrCommonControlGroupMember2021-07-012021-09-300001854401us-gaap:CommonStockMemberus-gaap:CommonClassAMember2021-07-012021-09-300001854401us-gaap:CommonStockMemberus-gaap:CommonClassBMember2021-07-012021-09-300001854401us-gaap:AdditionalPaidInCapitalMember2021-07-012021-09-300001854401us-gaap:CommonStockMemberus-gaap:CommonClassAMemberus-gaap:IPOMember2021-07-012021-09-300001854401us-gaap:AdditionalPaidInCapitalMemberus-gaap:IPOMember2021-07-012021-09-300001854401us-gaap:IPOMemberbrdg:NoncontrollingInterestsInBridgeInvestmentGroupHoldingsIncMember2021-07-012021-09-300001854401us-gaap:IPOMember2021-07-012021-09-300001854401brdg:NoncontrollingInterestsInBridgeInvestmentGroupHoldingsIncMember2021-07-012021-09-300001854401us-gaap:CommonStockMemberus-gaap:OverAllotmentOptionMemberus-gaap:CommonClassAMember2021-07-012021-09-300001854401us-gaap:OverAllotmentOptionMemberus-gaap:AdditionalPaidInCapitalMember2021-07-012021-09-300001854401us-gaap:OverAllotmentOptionMemberbrdg:NoncontrollingInterestsInBridgeInvestmentGroupHoldingsIncMember2021-07-012021-09-300001854401us-gaap:OverAllotmentOptionMember2021-07-012021-09-300001854401us-gaap:AdditionalPaidInCapitalMemberbrdg:SubsequentToTransactionsAndInitialPublicOfferingMember2021-07-012021-09-300001854401brdg:SubsequentToTransactionsAndInitialPublicOfferingMemberbrdg:NoncontrollingInterestsInBridgeInvestmentGroupHoldingsIncMember2021-07-012021-09-300001854401brdg:SubsequentToTransactionsAndInitialPublicOfferingMemberbrdg:NoncontrollingInterestsInSubsidiariesOfOperatingCompanyOrCommonControlGroupMember2021-07-012021-09-300001854401brdg:SubsequentToTransactionsAndInitialPublicOfferingMember2021-07-012021-09-300001854401brdg:SubsequentToTransactionsAndInitialPublicOfferingMemberus-gaap:RetainedEarningsMember2021-07-012021-09-300001854401brdg:SubsequentToTransactionsAndInitialPublicOfferingMemberus-gaap:AociIncludingPortionAttributableToNoncontrollingInterestMember2021-07-012021-09-300001854401us-gaap:CommonStockMemberbrdg:SubsequentToTransactionsAndInitialPublicOfferingMemberus-gaap:CommonClassAMember2021-07-012021-09-300001854401brdg:CommonControlGroupMember2021-09-300001854401us-gaap:CommonStockMemberus-gaap:CommonClassAMember2021-09-300001854401us-gaap:CommonStockMemberus-gaap:CommonClassBMember2021-09-300001854401us-gaap:AdditionalPaidInCapitalMember2021-09-300001854401us-gaap:RetainedEarningsMember2021-09-300001854401us-gaap:AociIncludingPortionAttributableToNoncontrollingInterestMember2021-09-300001854401brdg:NoncontrollingInterestsInSubsidiariesOfOperatingCompanyOrCommonControlGroupMember2021-09-300001854401brdg:NoncontrollingInterestsInBridgeInvestmentGroupHoldingsIncMember2021-09-3000018544012021-09-300001854401us-gaap:CommonStockMemberus-gaap:CommonClassAMember2021-12-310001854401us-gaap:CommonStockMemberus-gaap:CommonClassBMember2021-12-310001854401us-gaap:AdditionalPaidInCapitalMember2021-12-310001854401us-gaap:RetainedEarningsMember2021-12-310001854401us-gaap:AociIncludingPortionAttributableToNoncontrollingInterestMember2021-12-310001854401brdg:NoncontrollingInterestsInSubsidiariesOfOperatingCompanyOrCommonControlGroupMember2021-12-310001854401brdg:NoncontrollingInterestsInBridgeInvestmentGroupHoldingsIncMember2021-12-310001854401us-gaap:RetainedEarningsMember2022-01-012022-09-300001854401brdg:NoncontrollingInterestsInSubsidiariesOfOperatingCompanyOrCommonControlGroupMember2022-01-012022-09-300001854401brdg:NoncontrollingInterestsInBridgeInvestmentGroupHoldingsIncMember2022-01-012022-09-300001854401us-gaap:CommonStockMemberus-gaap:CommonClassAMember2022-01-012022-09-300001854401us-gaap:AdditionalPaidInCapitalMember2022-01-012022-09-300001854401us-gaap:CommonStockMemberus-gaap:CommonClassBMember2022-01-012022-09-300001854401us-gaap:AociIncludingPortionAttributableToNoncontrollingInterestMember2022-01-012022-09-300001854401brdg:CommonControlGroupMember2020-12-310001854401us-gaap:CommonStockMemberus-gaap:CommonClassAMember2020-12-310001854401us-gaap:CommonStockMemberus-gaap:CommonClassBMember2020-12-310001854401us-gaap:AdditionalPaidInCapitalMember2020-12-310001854401us-gaap:RetainedEarningsMember2020-12-310001854401us-gaap:AociIncludingPortionAttributableToNoncontrollingInterestMember2020-12-310001854401brdg:NoncontrollingInterestsInSubsidiariesOfOperatingCompanyOrCommonControlGroupMember2020-12-310001854401brdg:NoncontrollingInterestsInBridgeInvestmentGroupHoldingsIncMember2020-12-3100018544012020-12-310001854401brdg:PriorToTransactionsAndInitialsPublicOfferingMemberbrdg:CommonControlGroupMember2021-01-012021-09-300001854401brdg:PriorToTransactionsAndInitialsPublicOfferingMemberbrdg:NoncontrollingInterestsInSubsidiariesOfOperatingCompanyOrCommonControlGroupMember2021-01-012021-09-300001854401brdg:PriorToTransactionsAndInitialsPublicOfferingMember2021-01-012021-09-300001854401brdg:PriorToTransactionsAndInitialsPublicOfferingMemberus-gaap:AociIncludingPortionAttributableToNoncontrollingInterestMember2021-01-012021-09-300001854401brdg:CommonControlGroupMember2021-01-012021-09-300001854401us-gaap:CommonStockMemberus-gaap:CommonClassAMember2021-01-012021-09-300001854401us-gaap:CommonStockMemberus-gaap:CommonClassBMember2021-01-012021-09-300001854401us-gaap:AdditionalPaidInCapitalMember2021-01-012021-09-300001854401us-gaap:CommonStockMemberus-gaap:CommonClassAMemberus-gaap:IPOMember2021-01-012021-09-300001854401us-gaap:AdditionalPaidInCapitalMemberus-gaap:IPOMember2021-01-012021-09-300001854401us-gaap:IPOMemberbrdg:NoncontrollingInterestsInBridgeInvestmentGroupHoldingsIncMember2021-01-012021-09-300001854401us-gaap:IPOMember2021-01-012021-09-300001854401brdg:NoncontrollingInterestsInBridgeInvestmentGroupHoldingsIncMember2021-01-012021-09-300001854401us-gaap:CommonStockMemberus-gaap:OverAllotmentOptionMemberus-gaap:CommonClassAMember2021-01-012021-09-300001854401us-gaap:OverAllotmentOptionMemberus-gaap:AdditionalPaidInCapitalMember2021-01-012021-09-300001854401us-gaap:OverAllotmentOptionMemberbrdg:NoncontrollingInterestsInBridgeInvestmentGroupHoldingsIncMember2021-01-012021-09-300001854401us-gaap:OverAllotmentOptionMember2021-01-012021-09-300001854401us-gaap:AdditionalPaidInCapitalMemberbrdg:SubsequentToTransactionsAndInitialPublicOfferingMember2021-01-012021-09-300001854401brdg:SubsequentToTransactionsAndInitialPublicOfferingMemberbrdg:NoncontrollingInterestsInBridgeInvestmentGroupHoldingsIncMember2021-01-012021-09-300001854401brdg:SubsequentToTransactionsAndInitialPublicOfferingMemberbrdg:NoncontrollingInterestsInSubsidiariesOfOperatingCompanyOrCommonControlGroupMember2021-01-012021-09-300001854401brdg:SubsequentToTransactionsAndInitialPublicOfferingMember2021-01-012021-09-300001854401brdg:SubsequentToTransactionsAndInitialPublicOfferingMemberus-gaap:RetainedEarningsMember2021-01-012021-09-300001854401brdg:SubsequentToTransactionsAndInitialPublicOfferingMemberus-gaap:AociIncludingPortionAttributableToNoncontrollingInterestMember2021-01-012021-09-300001854401us-gaap:CommonStockMemberbrdg:SubsequentToTransactionsAndInitialPublicOfferingMemberus-gaap:CommonClassAMember2021-01-012021-09-300001854401brdg:ClassAUnitsMembersrt:SubsidiariesMemberus-gaap:IPOMember2021-07-202021-07-200001854401brdg:CommonStockIntoClassACommonStockMember2021-07-202021-07-200001854401us-gaap:ParentMemberus-gaap:CommonClassAMember2022-09-30brdg:vote0001854401us-gaap:ParentMemberus-gaap:CommonClassBMember2022-09-300001854401us-gaap:ParentMemberus-gaap:CommonClassAMemberus-gaap:IPOMember2021-07-202021-07-200001854401us-gaap:ParentMemberus-gaap:IPOMember2021-07-200001854401us-gaap:ParentMemberus-gaap:IPOMember2021-07-202021-07-200001854401us-gaap:ParentMemberbrdg:ClassAUnitsMemberus-gaap:IPOMember2021-07-202021-07-200001854401brdg:OperatingCompanyMemberbrdg:ClassAUnitsMembersrt:SubsidiariesMember2021-07-202021-07-200001854401srt:MinimumMemberbrdg:ContributedBridgeGPsMember2021-07-202021-07-20xbrli:pure0001854401brdg:ContributedBridgeGPsMembersrt:MaximumMember2021-07-202021-07-200001854401brdg:ContributedBridgeGPsMember2022-09-300001854401us-gaap:ParentMemberbrdg:GreenshoeMemberus-gaap:CommonClassAMember2021-08-122021-08-120001854401us-gaap:ParentMemberbrdg:ClassAUnitsMember2021-08-122021-08-120001854401us-gaap:VariableInterestEntityPrimaryBeneficiaryMember2022-09-300001854401us-gaap:ParentMemberbrdg:ClassBUnitsMember2022-09-300001854401brdg:OperatingCompanyMembersrt:SubsidiariesMember2022-01-012022-09-3000018544012021-01-012021-12-310001854401srt:MinimumMember2022-01-012022-09-300001854401srt:MaximumMember2022-01-012022-09-3000018544012022-01-010001854401brdg:GbcMember2022-01-31brdg:segment0001854401brdg:FundsMemberbrdg:FundManagementFeesMember2022-07-012022-09-300001854401brdg:FundsMemberbrdg:FundManagementFeesMember2021-07-012021-09-300001854401brdg:FundsMemberbrdg:FundManagementFeesMember2022-01-012022-09-300001854401brdg:FundsMemberbrdg:FundManagementFeesMember2021-01-012021-09-300001854401brdg:FundManagementFeesMemberbrdg:JointVenturesAndSeparatelyManagedAccountsMember2022-07-012022-09-300001854401brdg:FundManagementFeesMemberbrdg:JointVenturesAndSeparatelyManagedAccountsMember2021-07-012021-09-300001854401brdg:FundManagementFeesMemberbrdg:JointVenturesAndSeparatelyManagedAccountsMember2022-01-012022-09-300001854401brdg:FundManagementFeesMemberbrdg:JointVenturesAndSeparatelyManagedAccountsMember2021-01-012021-09-300001854401brdg:SeniorsHousingMemberbrdg:PropertyManagementAndLeasingFeesMember2022-07-012022-09-300001854401brdg:SeniorsHousingMemberbrdg:PropertyManagementAndLeasingFeesMember2021-07-012021-09-300001854401brdg:SeniorsHousingMemberbrdg:PropertyManagementAndLeasingFeesMember2022-01-012022-09-300001854401brdg:SeniorsHousingMemberbrdg:PropertyManagementAndLeasingFeesMember2021-01-012021-09-300001854401srt:MultifamilyMemberbrdg:PropertyManagementAndLeasingFeesMember2022-07-012022-09-300001854401srt:MultifamilyMemberbrdg:PropertyManagementAndLeasingFeesMember2021-07-012021-09-300001854401srt:MultifamilyMemberbrdg:PropertyManagementAndLeasingFeesMember2022-01-012022-09-300001854401srt:MultifamilyMemberbrdg:PropertyManagementAndLeasingFeesMember2021-01-012021-09-300001854401brdg:PropertyManagementAndLeasingFeesMembersrt:OfficeBuildingMember2022-07-012022-09-300001854401brdg:PropertyManagementAndLeasingFeesMembersrt:OfficeBuildingMember2021-07-012021-09-300001854401brdg:PropertyManagementAndLeasingFeesMembersrt:OfficeBuildingMember2022-01-012022-09-300001854401brdg:PropertyManagementAndLeasingFeesMembersrt:OfficeBuildingMember2021-01-012021-09-300001854401brdg:SingleFamilyRentalMemberbrdg:PropertyManagementAndLeasingFeesMember2022-07-012022-09-300001854401brdg:SingleFamilyRentalMemberbrdg:PropertyManagementAndLeasingFeesMember2021-07-012021-09-300001854401brdg:SingleFamilyRentalMemberbrdg:PropertyManagementAndLeasingFeesMember2022-01-012022-09-300001854401brdg:SingleFamilyRentalMemberbrdg:PropertyManagementAndLeasingFeesMember2021-01-012021-09-300001854401srt:MultifamilyMemberbrdg:ConstructionManagementFeesMember2022-07-012022-09-300001854401srt:MultifamilyMemberbrdg:ConstructionManagementFeesMember2021-07-012021-09-300001854401srt:MultifamilyMemberbrdg:ConstructionManagementFeesMember2022-01-012022-09-300001854401srt:MultifamilyMemberbrdg:ConstructionManagementFeesMember2021-01-012021-09-300001854401srt:OfficeBuildingMemberbrdg:ConstructionManagementFeesMember2022-07-012022-09-300001854401srt:OfficeBuildingMemberbrdg:ConstructionManagementFeesMember2021-07-012021-09-300001854401srt:OfficeBuildingMemberbrdg:ConstructionManagementFeesMember2022-01-012022-09-300001854401srt:OfficeBuildingMemberbrdg:ConstructionManagementFeesMember2021-01-012021-09-300001854401brdg:SeniorsHousingMemberbrdg:ConstructionManagementFeesMember2022-07-012022-09-300001854401brdg:SeniorsHousingMemberbrdg:ConstructionManagementFeesMember2021-07-012021-09-300001854401brdg:SeniorsHousingMemberbrdg:ConstructionManagementFeesMember2022-01-012022-09-300001854401brdg:SeniorsHousingMemberbrdg:ConstructionManagementFeesMember2021-01-012021-09-300001854401brdg:SingleFamilyRentalMemberbrdg:ConstructionManagementFeesMember2022-07-012022-09-300001854401brdg:SingleFamilyRentalMemberbrdg:ConstructionManagementFeesMember2021-07-012021-09-300001854401brdg:SingleFamilyRentalMemberbrdg:ConstructionManagementFeesMember2022-01-012022-09-300001854401brdg:SingleFamilyRentalMemberbrdg:ConstructionManagementFeesMember2021-01-012021-09-300001854401brdg:TransactionFeesMemberbrdg:AcquisitionFeesMember2022-07-012022-09-300001854401brdg:TransactionFeesMemberbrdg:AcquisitionFeesMember2021-07-012021-09-300001854401brdg:TransactionFeesMemberbrdg:AcquisitionFeesMember2022-01-012022-09-300001854401brdg:TransactionFeesMemberbrdg:AcquisitionFeesMember2021-01-012021-09-300001854401brdg:BrokerageFeesMemberbrdg:TransactionFeesMember2022-07-012022-09-300001854401brdg:BrokerageFeesMemberbrdg:TransactionFeesMember2021-07-012021-09-300001854401brdg:BrokerageFeesMemberbrdg:TransactionFeesMember2022-01-012022-09-300001854401brdg:BrokerageFeesMemberbrdg:TransactionFeesMember2021-01-012021-09-300001854401brdg:CommonSharesInPubliclyTradedCompanyMember2022-09-300001854401brdg:CommonSharesInPubliclyTradedCompanyMember2022-01-012022-09-300001854401us-gaap:ExchangeTradedFundsMember2022-09-300001854401us-gaap:ExchangeTradedFundsMember2022-01-012022-09-300001854401us-gaap:MutualFundMember2022-09-300001854401us-gaap:MutualFundMember2022-01-012022-09-300001854401us-gaap:ExchangeTradedFundsMember2021-12-310001854401us-gaap:ExchangeTradedFundsMember2021-01-012021-12-310001854401us-gaap:MutualFundMember2021-12-310001854401us-gaap:MutualFundMember2021-01-012021-12-31brdg:entity0001854401srt:PartnershipInterestMembersrt:SubsidiariesMember2022-09-300001854401srt:PartnershipInterestMembersrt:SubsidiariesMember2021-12-310001854401brdg:InvestmentsInThirdPartyPartnershipsMembersrt:SubsidiariesMember2022-09-300001854401brdg:InvestmentsInThirdPartyPartnershipsMembersrt:SubsidiariesMember2021-12-310001854401us-gaap:OtherInvestmentsMembersrt:SubsidiariesMember2022-09-300001854401us-gaap:OtherInvestmentsMembersrt:SubsidiariesMember2021-12-310001854401brdg:ShortTermNotesReceivablesMembersrt:SubsidiariesMemberbrdg:BridgeLogisticsUsVentureIMember2022-09-300001854401brdg:ShortTermNotesReceivablesMembersrt:SubsidiariesMemberbrdg:BridgeLogisticsUsVentureIMember2021-12-310001854401brdg:ShortTermNotesReceivablesMemberbrdg:BridgeOfficeFundIiMembersrt:SubsidiariesMember2022-09-300001854401brdg:ShortTermNotesReceivablesMemberbrdg:BridgeOfficeFundIiMembersrt:SubsidiariesMember2021-12-310001854401brdg:ShortTermNotesReceivablesMemberbrdg:BridgeSingleFamilyRentalFundIvMembersrt:SubsidiariesMember2022-09-300001854401brdg:ShortTermNotesReceivablesMemberbrdg:BridgeSingleFamilyRentalFundIvMembersrt:SubsidiariesMember2021-12-310001854401brdg:ShortTermNotesReceivablesMemberbrdg:BridgeMultifamilyFundVMembersrt:SubsidiariesMember2022-09-300001854401brdg:ShortTermNotesReceivablesMemberbrdg:BridgeMultifamilyFundVMembersrt:SubsidiariesMember2021-12-310001854401brdg:ShortTermNotesReceivablesMemberbrdg:BridgeSeniorsHousingFundIiiMembersrt:SubsidiariesMember2022-09-300001854401brdg:ShortTermNotesReceivablesMemberbrdg:BridgeSeniorsHousingFundIiiMembersrt:SubsidiariesMember2021-12-310001854401brdg:ShortTermNotesReceivablesMembersrt:SubsidiariesMember2022-09-300001854401brdg:ShortTermNotesReceivablesMembersrt:SubsidiariesMember2021-12-310001854401brdg:EmployeesMemberus-gaap:NotesReceivableMembersrt:SubsidiariesMember2022-09-300001854401brdg:EmployeesMemberus-gaap:NotesReceivableMembersrt:SubsidiariesMember2021-12-310001854401srt:AffiliatedEntityMemberus-gaap:NotesReceivableMembersrt:SubsidiariesMember2022-01-012022-09-300001854401srt:AffiliatedEntityMemberus-gaap:NotesReceivableMembersrt:SubsidiariesMember2022-09-300001854401srt:AffiliatedEntityMemberus-gaap:NotesReceivableMembersrt:SubsidiariesMember2021-12-310001854401srt:SubsidiariesMemberus-gaap:FairValueInputsLevel1Memberbrdg:CommonSharesInPubliclyTradedCompanyMemberus-gaap:FairValueMeasurementsRecurringMember2022-09-300001854401us-gaap:FairValueInputsLevel2Membersrt:SubsidiariesMemberbrdg:CommonSharesInPubliclyTradedCompanyMemberus-gaap:FairValueMeasurementsRecurringMember2022-09-300001854401us-gaap:FairValueInputsLevel3Membersrt:SubsidiariesMemberbrdg:CommonSharesInPubliclyTradedCompanyMemberus-gaap:FairValueMeasurementsRecurringMember2022-09-300001854401srt:SubsidiariesMemberbrdg:CommonSharesInPubliclyTradedCompanyMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueMeasuredAtNetAssetValuePerShareMember2022-09-300001854401srt:SubsidiariesMemberbrdg:CommonSharesInPubliclyTradedCompanyMemberus-gaap:FairValueMeasurementsRecurringMember2022-09-300001854401us-gaap:ExchangeTradedFundsMembersrt:SubsidiariesMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2022-09-300001854401us-gaap:ExchangeTradedFundsMemberus-gaap:FairValueInputsLevel2Membersrt:SubsidiariesMemberus-gaap:FairValueMeasurementsRecurringMember2022-09-300001854401us-gaap:ExchangeTradedFundsMemberus-gaap:FairValueInputsLevel3Membersrt:SubsidiariesMemberus-gaap:FairValueMeasurementsRecurringMember2022-09-300001854401us-gaap:ExchangeTradedFundsMembersrt:SubsidiariesMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueMeasuredAtNetAssetValuePerShareMember2022-09-300001854401us-gaap:ExchangeTradedFundsMembersrt:SubsidiariesMemberus-gaap:FairValueMeasurementsRecurringMember2022-09-300001854401us-gaap:MutualFundMembersrt:SubsidiariesMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2022-09-300001854401us-gaap:MutualFundMemberus-gaap:FairValueInputsLevel2Membersrt:SubsidiariesMemberus-gaap:FairValueMeasurementsRecurringMember2022-09-300001854401us-gaap:MutualFundMemberus-gaap:FairValueInputsLevel3Membersrt:SubsidiariesMemberus-gaap:FairValueMeasurementsRecurringMember2022-09-300001854401us-gaap:MutualFundMembersrt:SubsidiariesMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueMeasuredAtNetAssetValuePerShareMember2022-09-300001854401us-gaap:MutualFundMembersrt:SubsidiariesMemberus-gaap:FairValueMeasurementsRecurringMember2022-09-300001854401srt:SubsidiariesMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberbrdg:AccruedPerformanceAllocationsMember2022-09-300001854401us-gaap:FairValueInputsLevel2Membersrt:SubsidiariesMemberus-gaap:FairValueMeasurementsRecurringMemberbrdg:AccruedPerformanceAllocationsMember2022-09-300001854401us-gaap:FairValueInputsLevel3Membersrt:SubsidiariesMemberus-gaap:FairValueMeasurementsRecurringMemberbrdg:AccruedPerformanceAllocationsMember2022-09-300001854401srt:SubsidiariesMemberus-gaap:FairValueMeasurementsRecurringMemberbrdg:AccruedPerformanceAllocationsMemberus-gaap:FairValueMeasuredAtNetAssetValuePerShareMember2022-09-300001854401srt:SubsidiariesMemberus-gaap:FairValueMeasurementsRecurringMemberbrdg:AccruedPerformanceAllocationsMember2022-09-300001854401brdg:PartnershipInterestsMembersrt:SubsidiariesMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2022-09-300001854401brdg:PartnershipInterestsMemberus-gaap:FairValueInputsLevel2Membersrt:SubsidiariesMemberus-gaap:FairValueMeasurementsRecurringMember2022-09-300001854401us-gaap:FairValueInputsLevel3Memberbrdg:PartnershipInterestsMembersrt:SubsidiariesMemberus-gaap:FairValueMeasurementsRecurringMember2022-09-300001854401brdg:PartnershipInterestsMembersrt:SubsidiariesMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueMeasuredAtNetAssetValuePerShareMember2022-09-300001854401brdg:PartnershipInterestsMembersrt:SubsidiariesMemberus-gaap:FairValueMeasurementsRecurringMember2022-09-300001854401us-gaap:OtherInvestmentsMembersrt:SubsidiariesMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2022-09-300001854401us-gaap:FairValueInputsLevel2Memberus-gaap:OtherInvestmentsMembersrt:SubsidiariesMemberus-gaap:FairValueMeasurementsRecurringMember2022-09-300001854401us-gaap:FairValueInputsLevel3Memberus-gaap:OtherInvestmentsMembersrt:SubsidiariesMemberus-gaap:FairValueMeasurementsRecurringMember2022-09-300001854401us-gaap:OtherInvestmentsMembersrt:SubsidiariesMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueMeasuredAtNetAssetValuePerShareMember2022-09-300001854401us-gaap:OtherInvestmentsMembersrt:SubsidiariesMemberus-gaap:FairValueMeasurementsRecurringMember2022-09-300001854401srt:SubsidiariesMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2022-09-300001854401us-gaap:FairValueInputsLevel2Membersrt:SubsidiariesMemberus-gaap:FairValueMeasurementsRecurringMember2022-09-300001854401us-gaap:FairValueInputsLevel3Membersrt:SubsidiariesMemberus-gaap:FairValueMeasurementsRecurringMember2022-09-300001854401srt:SubsidiariesMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueMeasuredAtNetAssetValuePerShareMember2022-09-300001854401srt:SubsidiariesMemberus-gaap:FairValueMeasurementsRecurringMember2022-09-300001854401us-gaap:NotesPayableOtherPayablesMembersrt:SubsidiariesMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2022-09-300001854401us-gaap:NotesPayableOtherPayablesMemberus-gaap:FairValueInputsLevel2Membersrt:SubsidiariesMemberus-gaap:FairValueMeasurementsRecurringMember2022-09-300001854401us-gaap:FairValueInputsLevel3Memberus-gaap:NotesPayableOtherPayablesMembersrt:SubsidiariesMemberus-gaap:FairValueMeasurementsRecurringMember2022-09-300001854401us-gaap:NotesPayableOtherPayablesMembersrt:SubsidiariesMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueMeasuredAtNetAssetValuePerShareMember2022-09-300001854401us-gaap:NotesPayableOtherPayablesMembersrt:SubsidiariesMemberus-gaap:FairValueMeasurementsRecurringMember2022-09-300001854401us-gaap:ExchangeTradedFundsMembersrt:SubsidiariesMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2021-12-310001854401us-gaap:ExchangeTradedFundsMemberus-gaap:FairValueInputsLevel2Membersrt:SubsidiariesMemberus-gaap:FairValueMeasurementsRecurringMember2021-12-310001854401us-gaap:ExchangeTradedFundsMemberus-gaap:FairValueInputsLevel3Membersrt:SubsidiariesMemberus-gaap:FairValueMeasurementsRecurringMember2021-12-310001854401us-gaap:ExchangeTradedFundsMembersrt:SubsidiariesMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueMeasuredAtNetAssetValuePerShareMember2021-12-310001854401us-gaap:ExchangeTradedFundsMembersrt:SubsidiariesMemberus-gaap:FairValueMeasurementsRecurringMember2021-12-310001854401us-gaap:MutualFundMembersrt:SubsidiariesMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2021-12-310001854401us-gaap:MutualFundMemberus-gaap:FairValueInputsLevel2Membersrt:SubsidiariesMemberus-gaap:FairValueMeasurementsRecurringMember2021-12-310001854401us-gaap:MutualFundMemberus-gaap:FairValueInputsLevel3Membersrt:SubsidiariesMemberus-gaap:FairValueMeasurementsRecurringMember2021-12-310001854401us-gaap:MutualFundMembersrt:SubsidiariesMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueMeasuredAtNetAssetValuePerShareMember2021-12-310001854401us-gaap:MutualFundMembersrt:SubsidiariesMemberus-gaap:FairValueMeasurementsRecurringMember2021-12-310001854401srt:SubsidiariesMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberbrdg:AccruedPerformanceAllocationsMember2021-12-310001854401us-gaap:FairValueInputsLevel2Membersrt:SubsidiariesMemberus-gaap:FairValueMeasurementsRecurringMemberbrdg:AccruedPerformanceAllocationsMember2021-12-310001854401us-gaap:FairValueInputsLevel3Membersrt:SubsidiariesMemberus-gaap:FairValueMeasurementsRecurringMemberbrdg:AccruedPerformanceAllocationsMember2021-12-310001854401srt:SubsidiariesMemberus-gaap:FairValueMeasurementsRecurringMemberbrdg:AccruedPerformanceAllocationsMemberus-gaap:FairValueMeasuredAtNetAssetValuePerShareMember2021-12-310001854401srt:SubsidiariesMemberus-gaap:FairValueMeasurementsRecurringMemberbrdg:AccruedPerformanceAllocationsMember2021-12-310001854401brdg:PartnershipInterestsMembersrt:SubsidiariesMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2021-12-310001854401brdg:PartnershipInterestsMemberus-gaap:FairValueInputsLevel2Membersrt:SubsidiariesMemberus-gaap:FairValueMeasurementsRecurringMember2021-12-310001854401us-gaap:FairValueInputsLevel3Memberbrdg:PartnershipInterestsMembersrt:SubsidiariesMemberus-gaap:FairValueMeasurementsRecurringMember2021-12-310001854401brdg:PartnershipInterestsMembersrt:SubsidiariesMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueMeasuredAtNetAssetValuePerShareMember2021-12-310001854401brdg:PartnershipInterestsMembersrt:SubsidiariesMemberus-gaap:FairValueMeasurementsRecurringMember2021-12-310001854401us-gaap:OtherInvestmentsMembersrt:SubsidiariesMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2021-12-310001854401us-gaap:FairValueInputsLevel2Memberus-gaap:OtherInvestmentsMembersrt:SubsidiariesMemberus-gaap:FairValueMeasurementsRecurringMember2021-12-310001854401us-gaap:FairValueInputsLevel3Memberus-gaap:OtherInvestmentsMembersrt:SubsidiariesMemberus-gaap:FairValueMeasurementsRecurringMember2021-12-310001854401us-gaap:OtherInvestmentsMembersrt:SubsidiariesMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueMeasuredAtNetAssetValuePerShareMember2021-12-310001854401us-gaap:OtherInvestmentsMembersrt:SubsidiariesMemberus-gaap:FairValueMeasurementsRecurringMember2021-12-310001854401srt:SubsidiariesMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2021-12-310001854401us-gaap:FairValueInputsLevel2Membersrt:SubsidiariesMemberus-gaap:FairValueMeasurementsRecurringMember2021-12-310001854401us-gaap:FairValueInputsLevel3Membersrt:SubsidiariesMemberus-gaap:FairValueMeasurementsRecurringMember2021-12-310001854401srt:SubsidiariesMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueMeasuredAtNetAssetValuePerShareMember2021-12-310001854401srt:SubsidiariesMemberus-gaap:FairValueMeasurementsRecurringMember2021-12-310001854401us-gaap:NotesPayableOtherPayablesMembersrt:SubsidiariesMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2021-12-310001854401us-gaap:NotesPayableOtherPayablesMemberus-gaap:FairValueInputsLevel2Membersrt:SubsidiariesMemberus-gaap:FairValueMeasurementsRecurringMember2021-12-310001854401us-gaap:FairValueInputsLevel3Memberus-gaap:NotesPayableOtherPayablesMembersrt:SubsidiariesMemberus-gaap:FairValueMeasurementsRecurringMember2021-12-310001854401us-gaap:NotesPayableOtherPayablesMembersrt:SubsidiariesMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueMeasuredAtNetAssetValuePerShareMember2021-12-310001854401us-gaap:NotesPayableOtherPayablesMembersrt:SubsidiariesMemberus-gaap:FairValueMeasurementsRecurringMember2021-12-310001854401brdg:AccruedPerformanceAllocationsMembersrt:SubsidiariesMemberus-gaap:FairValueMeasuredAtNetAssetValuePerShareMember2022-09-300001854401srt:SubsidiariesMemberbrdg:CompanySponsoredopenEndfundMemberus-gaap:FairValueMeasuredAtNetAssetValuePerShareMember2022-09-300001854401brdg:CompanySponsoredclosedEndfundsMembersrt:SubsidiariesMemberus-gaap:FairValueMeasuredAtNetAssetValuePerShareMember2022-09-300001854401brdg:ThirdPartyclosedEndfundsMembersrt:SubsidiariesMemberus-gaap:FairValueMeasuredAtNetAssetValuePerShareMember2022-09-300001854401srt:SubsidiariesMemberus-gaap:FairValueMeasuredAtNetAssetValuePerShareMember2022-09-300001854401brdg:AccruedPerformanceAllocationsMembersrt:SubsidiariesMemberus-gaap:FairValueMeasuredAtNetAssetValuePerShareMember2021-12-310001854401srt:SubsidiariesMemberbrdg:CompanySponsoredopenEndfundMemberus-gaap:FairValueMeasuredAtNetAssetValuePerShareMember2021-12-310001854401brdg:CompanySponsoredclosedEndfundsMembersrt:SubsidiariesMemberus-gaap:FairValueMeasuredAtNetAssetValuePerShareMember2021-12-310001854401brdg:ThirdPartyclosedEndfundsMembersrt:SubsidiariesMemberus-gaap:FairValueMeasuredAtNetAssetValuePerShareMember2021-12-310001854401srt:SubsidiariesMemberus-gaap:FairValueMeasuredAtNetAssetValuePerShareMember2021-12-310001854401brdg:CompanySponsoredclosedEndfundsMembersrt:MinimumMembersrt:SubsidiariesMember2022-01-012022-09-300001854401brdg:CompanySponsoredclosedEndfundsMembersrt:SubsidiariesMembersrt:MaximumMember2022-01-012022-09-300001854401srt:SubsidiariesMemberus-gaap:FairValueInputsLevel1Memberus-gaap:PortionAtFairValueFairValueDisclosureMember2022-09-300001854401us-gaap:FairValueInputsLevel2Membersrt:SubsidiariesMemberus-gaap:PortionAtFairValueFairValueDisclosureMember2022-09-300001854401us-gaap:FairValueInputsLevel3Membersrt:SubsidiariesMemberus-gaap:PortionAtFairValueFairValueDisclosureMember2022-09-300001854401srt:SubsidiariesMemberus-gaap:PortionAtFairValueFairValueDisclosureMember2022-09-300001854401srt:SubsidiariesMemberus-gaap:CarryingReportedAmountFairValueDisclosureMember2022-09-300001854401srt:SubsidiariesMemberus-gaap:FairValueInputsLevel1Memberus-gaap:PortionAtFairValueFairValueDisclosureMember2021-12-310001854401us-gaap:FairValueInputsLevel2Membersrt:SubsidiariesMemberus-gaap:PortionAtFairValueFairValueDisclosureMember2021-12-310001854401us-gaap:FairValueInputsLevel3Membersrt:SubsidiariesMemberus-gaap:PortionAtFairValueFairValueDisclosureMember2021-12-310001854401srt:SubsidiariesMemberus-gaap:PortionAtFairValueFairValueDisclosureMember2021-12-310001854401srt:SubsidiariesMemberus-gaap:CarryingReportedAmountFairValueDisclosureMember2021-12-310001854401brdg:GbcMember2022-01-312022-01-3100018544012022-01-31brdg:homebrdg:market0001854401brdg:BridgeSFRMember2022-09-300001854401brdg:GbcMember2022-09-300001854401brdg:GbcMember2022-01-012022-09-300001854401brdg:GbcMember2022-09-300001854401brdg:PropertyManagementContractsMember2022-01-012022-09-300001854401srt:MinimumMemberbrdg:FundManagementContractsMember2022-01-012022-09-300001854401brdg:FundManagementContractsMembersrt:MaximumMember2022-01-012022-09-300001854401brdg:TradeNameMember2022-01-012022-09-300001854401brdg:LeaseSecurityDepositFulfillmentMembersrt:SubsidiariesMember2022-09-300001854401srt:SubsidiariesMemberbrdg:LessorLegalLiabilityMember2022-09-300001854401us-gaap:WorkersCompensationInsuranceMembersrt:SubsidiariesMember2022-09-300001854401us-gaap:PropertyInsuranceProductLineMembersrt:SubsidiariesMember2022-01-012022-09-300001854401us-gaap:PropertyInsuranceProductLineMembersrt:SubsidiariesMember2022-09-300001854401us-gaap:GeneralLiabilityMembersrt:SubsidiariesMember2022-01-012022-09-300001854401brdg:MedicalSelfInsuranceReservesMember2022-09-300001854401brdg:MedicalSelfInsuranceReservesMember2021-12-310001854401brdg:MultifamilyPropertiesMembersrt:SubsidiariesMemberbrdg:BridePropertyManagementMember2022-09-300001854401srt:SubsidiariesMemberbrdg:CommercialOfficePropertiesMember2022-09-300001854401srt:SubsidiariesMemberbrdg:BridePropertyManagementMemberbrdg:CommercialOfficePropertiesMember2022-09-300001854401srt:SubsidiariesMemberbrdg:BridePropertyManagementMember2022-09-300001854401srt:MinimumMembersrt:SubsidiariesMember2022-09-300001854401srt:SubsidiariesMembersrt:MaximumMember2022-09-300001854401brdg:MultifamilyPropertiesMembersrt:SubsidiariesMember2022-09-300001854401brdg:LogisticsAndNetLeasePropertiesMembersrt:SubsidiariesMember2022-09-300001854401brdg:SingleFamilyRentalMembersrt:SubsidiariesMember2022-09-300001854401us-gaap:PropertyInsuranceProductLineMembersrt:SubsidiariesMember2022-09-300001854401srt:SubsidiariesMember2022-06-190001854401us-gaap:PropertyInsuranceProductLineMembersrt:SubsidiariesMember2022-06-192022-06-190001854401srt:SubsidiariesMember2022-06-200001854401us-gaap:PropertyInsuranceProductLineMembersrt:SubsidiariesMember2022-06-202022-06-200001854401brdg:MultifamilyPropertiesMemberbrdg:SelfInsuredRetentionMembersrt:SubsidiariesMember2022-09-300001854401us-gaap:GeneralLiabilityMembersrt:SubsidiariesMember2020-06-202020-06-200001854401srt:SubsidiariesMember2020-06-200001854401us-gaap:GeneralLiabilityMembersrt:SubsidiariesMember2022-06-202022-06-200001854401us-gaap:GeneralLiabilityMembersrt:SubsidiariesMember2022-09-300001854401us-gaap:GeneralLiabilityMembersrt:SubsidiariesMember2021-12-310001854401brdg:BridgeSeniorsHousingFundIMember2022-01-012022-09-300001854401brdg:BridgeSeniorsHousingFundIMember2022-09-300001854401brdg:BridgeSeniorsHousingFundIMember2021-12-310001854401brdg:BridgeMultifamilyFundIiiMember2022-01-012022-09-300001854401brdg:BridgeMultifamilyFundIiiMember2022-09-300001854401brdg:BridgeMultifamilyFundIiiMember2021-12-310001854401us-gaap:LineOfCreditMemberus-gaap:RevolvingCreditFacilityMemberbrdg:TheCreditAgreementMember2022-06-030001854401brdg:SecuredOvernightFinancingRateSOFRMemberus-gaap:LineOfCreditMembersrt:MinimumMemberbrdg:VariableRateComponentOneMemberbrdg:TheCreditAgreementMember2022-06-032022-06-030001854401brdg:SecuredOvernightFinancingRateSOFRMemberus-gaap:LineOfCreditMemberbrdg:VariableRateComponentOneMemberbrdg:TheCreditAgreementMembersrt:MaximumMember2022-06-032022-06-030001854401brdg:SecuredOvernightFinancingRateSOFRMemberus-gaap:LineOfCreditMemberbrdg:VariableRateComponentTwoMembersrt:MinimumMemberbrdg:TheCreditAgreementMember2022-06-032022-06-030001854401brdg:SecuredOvernightFinancingRateSOFRMemberus-gaap:LineOfCreditMemberbrdg:VariableRateComponentTwoMemberbrdg:TheCreditAgreementMembersrt:MaximumMember2022-06-032022-06-030001854401us-gaap:LineOfCreditMemberus-gaap:RevolvingCreditFacilityMemberbrdg:TheCreditAgreementMember2022-06-032022-06-030001854401us-gaap:LineOfCreditMemberbrdg:TheCreditAgreementMember2022-06-030001854401us-gaap:LineOfCreditMemberbrdg:SecuredRevolvingLineOfCreditMembersrt:SubsidiariesMemberbrdg:TheCreditAgreementMember2022-06-030001854401brdg:SecuredRevolvingLineOfCreditMembersrt:SubsidiariesMember2020-07-220001854401brdg:SecuredRevolvingLineOfCreditMembersrt:SubsidiariesMember2020-07-222020-07-220001854401us-gaap:LineOfCreditMemberus-gaap:RevolvingCreditFacilityMemberbrdg:TheCreditAgreementMember2022-09-300001854401us-gaap:LineOfCreditMemberbrdg:TheCreditAgreementMember2022-07-012022-09-300001854401us-gaap:LineOfCreditMemberbrdg:TheCreditAgreementMember2022-01-012022-09-300001854401us-gaap:LineOfCreditMemberus-gaap:RevolvingCreditFacilityMemberbrdg:TheCreditAgreementMember2022-07-012022-09-300001854401us-gaap:LineOfCreditMemberus-gaap:RevolvingCreditFacilityMemberbrdg:TheCreditAgreementMember2022-01-012022-09-300001854401us-gaap:LineOfCreditMemberbrdg:TheCreditAgreementMember2021-07-012021-09-300001854401us-gaap:LineOfCreditMemberbrdg:TheCreditAgreementMember2021-01-012021-09-300001854401brdg:A2020PrivatePlacementNotesMemberus-gaap:NotesPayableOtherPayablesMember2020-07-220001854401brdg:A2020PrivatePlacementNotesTrancheOneMemberus-gaap:NotesPayableOtherPayablesMember2020-07-220001854401brdg:A2020PrivatePlacementNotesTrancheTwoMemberus-gaap:NotesPayableOtherPayablesMember2020-07-220001854401brdg:A2022PrivatePlacementNotesMemberus-gaap:NotesPayableOtherPayablesMember2022-06-03brdg:tranche0001854401brdg:A2022PrivatePlacementNotesTrancheOneMemberus-gaap:NotesPayableOtherPayablesMember2022-06-030001854401brdg:A2022PrivatePlacementNotesTrancheTwoMemberus-gaap:NotesPayableOtherPayablesMember2022-06-030001854401brdg:PrivateNotesMemberus-gaap:NotesPayableOtherPayablesMember2022-06-030001854401brdg:PrivateNotesMemberus-gaap:NotesPayableOtherPayablesMember2022-09-300001854401srt:SubsidiariesMemberbrdg:InvestmentInCompanysponsoredFundsMember2022-07-012022-09-300001854401srt:SubsidiariesMemberbrdg:InvestmentInCompanysponsoredFundsMember2021-07-012021-09-300001854401srt:SubsidiariesMemberbrdg:InvestmentInThirdPartyPartnershipsMember2022-07-012022-09-300001854401srt:SubsidiariesMemberbrdg:InvestmentInThirdPartyPartnershipsMember2021-07-012021-09-300001854401brdg:OthersInvestmentsMembersrt:SubsidiariesMember2022-07-012022-09-300001854401brdg:OthersInvestmentsMembersrt:SubsidiariesMember2021-07-012021-09-300001854401brdg:GeneralPartnerNotesPayableMembersrt:SubsidiariesMember2022-07-012022-09-300001854401brdg:GeneralPartnerNotesPayableMembersrt:SubsidiariesMember2021-07-012021-09-300001854401srt:SubsidiariesMemberbrdg:InvestmentInCompanysponsoredFundsMember2022-01-012022-09-300001854401srt:SubsidiariesMemberbrdg:InvestmentInCompanysponsoredFundsMember2021-01-012021-09-300001854401srt:SubsidiariesMemberbrdg:InvestmentInThirdPartyPartnershipsMember2022-01-012022-09-300001854401srt:SubsidiariesMemberbrdg:InvestmentInThirdPartyPartnershipsMember2021-01-012021-09-300001854401brdg:OthersInvestmentsMembersrt:SubsidiariesMember2022-01-012022-09-300001854401brdg:OthersInvestmentsMembersrt:SubsidiariesMember2021-01-012021-09-300001854401brdg:GeneralPartnerNotesPayableMembersrt:SubsidiariesMember2022-01-012022-09-300001854401brdg:GeneralPartnerNotesPayableMembersrt:SubsidiariesMember2021-01-012021-09-300001854401srt:SubsidiariesMember2021-01-012021-12-310001854401us-gaap:IPOMember2022-01-012022-09-300001854401us-gaap:IPOMember2021-01-012021-12-310001854401us-gaap:CommonClassAMember2022-01-010001854401us-gaap:CapitalUnitClassAMember2022-01-010001854401brdg:GbcMember2022-01-012022-01-310001854401brdg:GbcMemberus-gaap:CommonClassAMember2022-01-310001854401us-gaap:ParentMemberus-gaap:CommonClassAMember2022-01-012022-09-300001854401us-gaap:ParentMemberus-gaap:CommonClassAMember2022-07-012022-09-30brdg:vote_per_share0001854401us-gaap:ParentMemberus-gaap:CommonClassAMember2021-12-310001854401us-gaap:ParentMemberbrdg:ClassARestrictedStockMember2021-12-310001854401us-gaap:ParentMemberus-gaap:CommonClassBMember2021-12-310001854401us-gaap:ParentMemberbrdg:ClassARestrictedStockMember2022-01-012022-09-300001854401us-gaap:ParentMemberus-gaap:CommonClassBMember2022-01-012022-09-300001854401us-gaap:ParentMemberbrdg:ClassARestrictedStockMember2022-09-300001854401us-gaap:CommonClassAMember2022-03-252022-03-250001854401us-gaap:CommonClassAMember2022-06-172022-06-1700018544012022-09-162022-09-160001854401us-gaap:CommonClassAMember2022-09-162022-09-160001854401us-gaap:CommonClassAMember2022-01-012022-09-300001854401srt:SubsidiariesMemberus-gaap:CommonClassBMemberus-gaap:IPOMember2022-09-300001854401srt:SubsidiariesMemberus-gaap:CommonClassBMemberus-gaap:IPOMember2021-01-012021-12-310001854401brdg:PriorInitialPublicOfferingMember2022-07-012022-09-300001854401brdg:PriorInitialPublicOfferingMember2022-01-012022-09-300001854401brdg:PriorInitialPublicOfferingMember2021-07-012021-09-300001854401brdg:PriorInitialPublicOfferingMember2021-01-012021-09-300001854401us-gaap:CommonClassAMembersrt:SubsidiariesMember2022-09-300001854401srt:SubsidiariesMemberus-gaap:CommonClassBMember2022-09-300001854401us-gaap:CommonClassAMembersrt:SubsidiariesMember2021-12-310001854401srt:SubsidiariesMemberus-gaap:CommonClassBMember2021-12-310001854401us-gaap:CommonClassAMembersrt:SubsidiariesMember2022-01-012022-09-300001854401us-gaap:LetterOfCreditMembersrt:SubsidiariesMember2022-01-012022-09-300001854401us-gaap:LetterOfCreditMembersrt:SubsidiariesMember2022-09-300001854401us-gaap:VariableInterestEntityPrimaryBeneficiaryMember2022-09-300001854401us-gaap:VariableInterestEntityPrimaryBeneficiaryMember2021-12-310001854401srt:AffiliatedEntityMemberbrdg:TaxReceivableAgreementMember2022-09-300001854401srt:AffiliatedEntityMemberbrdg:TaxReceivableAgreementMember2021-12-310001854401us-gaap:RestrictedStockUnitsRSUMemberbrdg:TwoThousandTwentyOneIncentiveAwardPlanMemberus-gaap:CommonClassAMembersrt:SubsidiariesMember2021-07-060001854401us-gaap:RestrictedStockUnitsRSUMember2021-07-060001854401us-gaap:RestrictedStockUnitsRSUMember2022-09-300001854401us-gaap:RestrictedStockUnitsRSUMembersrt:SubsidiariesMember2022-07-012022-09-300001854401us-gaap:RestrictedStockUnitsRSUMembersrt:SubsidiariesMember2022-01-012022-09-300001854401us-gaap:RestrictedStockUnitsRSUMember2022-01-012022-09-300001854401brdg:RestrictedStockAndRsusMember2022-01-012022-09-300001854401brdg:ClassARestrictedStockMember2021-12-310001854401brdg:ClassARestrictedStockMember2022-01-012022-09-300001854401brdg:ClassARestrictedStockMember2022-09-300001854401us-gaap:RestrictedStockMember2022-01-012022-09-300001854401us-gaap:RestrictedStockMember2022-09-300001854401srt:MinimumMembersrt:SubsidiariesMemberbrdg:FundManagersMember2022-09-300001854401srt:SubsidiariesMemberbrdg:FundManagersMembersrt:MaximumMember2022-09-300001854401brdg:AntidilutiveAwardsMembersrt:SubsidiariesMember2022-01-012022-09-300001854401brdg:ProfitInterestAwardsMember2022-08-012022-08-310001854401brdg:ProfitInterestAwardsMember2022-09-300001854401brdg:ProfitInterestAwardsMember2022-01-012022-09-300001854401brdg:AntidilutiveProfitsInterestAwardsMembersrt:SubsidiariesMember2022-07-012022-09-300001854401brdg:AntidilutiveProfitsInterestAwardsMembersrt:SubsidiariesMember2021-07-012021-09-300001854401brdg:AntidilutiveProfitsInterestAwardsMembersrt:SubsidiariesMember2022-01-012022-09-300001854401brdg:AntidilutiveProfitsInterestAwardsMembersrt:SubsidiariesMember2021-01-012021-09-300001854401srt:SubsidiariesMemberbrdg:ProfitInterestAwardsMember2022-07-012022-09-300001854401srt:SubsidiariesMemberbrdg:ProfitInterestAwardsMember2021-07-012021-09-300001854401srt:SubsidiariesMemberbrdg:ProfitInterestAwardsMember2022-01-012022-09-300001854401srt:SubsidiariesMemberbrdg:ProfitInterestAwardsMember2021-01-012021-09-300001854401us-gaap:RestrictedStockUnitsRSUMembersrt:SubsidiariesMember2021-07-012021-09-300001854401us-gaap:RestrictedStockUnitsRSUMembersrt:SubsidiariesMember2021-01-012021-09-300001854401brdg:RestrictedStockAndRsusMember2022-09-300001854401brdg:ProfitInterestAwardsMemberus-gaap:ShareBasedCompensationAwardTrancheOneMember2022-01-012022-09-300001854401us-gaap:ShareBasedCompensationAwardTrancheTwoMemberbrdg:ProfitInterestAwardsMember2022-01-012022-09-300001854401brdg:ProfitInterestAwardsMemberus-gaap:ShareBasedCompensationAwardTrancheThreeMember2022-01-012022-09-300001854401us-gaap:RestrictedStockUnitsRSUMemberus-gaap:ShareBasedCompensationAwardTrancheThreeMember2022-01-012022-09-300001854401us-gaap:RestrictedStockUnitsRSUMemberus-gaap:ShareBasedCompensationAwardTrancheOneMember2022-01-012022-09-300001854401us-gaap:ShareBasedCompensationAwardTrancheTwoMemberus-gaap:RestrictedStockUnitsRSUMember2022-01-012022-09-3000018544012021-07-162021-09-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

x QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended September 30, 2022

OR

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from________to

Commission File Number: 001-40622

BRIDGE INVESTMENT GROUP HOLDINGS INC.

(Exact name of registrant as specified in its charter)

| | | | | |

| Delaware | 82-2769085 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

| |

111 East Sego Lily Drive, Suite 400 Salt Lake City , Utah | 84070 |

| (Address of principal executive offices) | (Zip Code) |

(Registrant’s telephone number, including area code): (801) 716-4500

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading

Symbol(s) | | Name of each exchange

on which registered |

| Class A common stock, $0.01 par value per share | | BRDG | | New York Stock Exchange |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | |

| Large accelerated filer | o | | Accelerated filer | o |

| | | | |

| Non-accelerated filer | x | | Smaller reporting company | o |

| | | | |

| Emerging growth company | x | | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

As of November 1, 2022, the registrant had 29,247,221 shares of Class A common stock ($0.01 par value per share) outstanding and 85,551,127 shares of Class B common stock ($0.01 par value per share) outstanding.

TABLE OF CONTENTS

| | | | | | | | |

| | Page |

| |

| | |

| |

| | |

| | |

| | |

| Condensed Consolidated Balance Sheets as of September 30, 2022 (Unaudited) and December 31, 2021 | |

| Condensed Consolidated and Combined Statements of Operations (Unaudited) for the Three and Nine Months Ended September 30, 2022 and 2021 | |

| Condensed Consolidated and Combined Statements of Comprehensive Income (Unaudited) for the Three and Nine Months Ended September 30, 2022 and 2021 | |

| Condensed Consolidated and Combined Statements of Changes in Shareholders’/Members’ Equity (Unaudited) for the Three and Nine Months Ended September 30, 2022 and 2021 | |

| Condensed Consolidated and Combined Statements of Cash Flows (Unaudited) for the Nine Months Ended September 30, 2022 and 2021 | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This quarterly report on Form 10-Q contains forward-looking statements within the meaning of Section 27A of the U.S. Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the U.S. Securities Exchange Act of 1934, as amended, or the Exchange Act, about, among other things, our operations, taxes, earnings and financial performance, and dividends. All statements other than statements of historical facts contained in this report may be forward-looking statements. Statements regarding our future results of operations and financial position, business strategy and plans and objectives of management for future operations, including, among others, statements regarding expected growth, future capital expenditures, fund performance and debt service obligations, are forward-looking statements. In some cases, you can identify forward-looking statements by terms such as “outlook,” “indicator,” “may,” “will,” “should,” “expects,” “plans,” “seek,” “anticipates,” “plan,” “forecasts,” “could,” “intends,” “targets,” “projects,” “contemplates,” “believes,” “estimates,” “predicts,” “potential” or “continue” or the negative of these terms or other similar expressions. Accordingly, we caution you that any such forward looking statements are not guarantees of future performance and are subject to known and unknown risks, assumptions and uncertainties that are difficult to predict and beyond our ability to control. Although we believe that the expectations reflected in these forward-looking statements are reasonable as of the date made, actual results, performance or achievements may prove to be materially different from the results expressed or implied by the forward-looking statements. If one or more events related to these or other risks or uncertainties materialize, or if our underlying assumptions prove to be incorrect, actual results may differ materially from what we anticipate.

These forward-looking statements speak only as of the date of this quarterly report and are subject to a number of important factors that could cause actual results to differ materially from those in the forward-looking statements, including those described in Part II, Item 1A, “Risk Factors” of this report and Part I, Item 1A, “Risk Factors” in our annual report on Form 10-K filed with the Securities and Exchange Commission (“SEC”) on March 18, 2022.

You should read this quarterly report and the documents that we reference in this quarterly report completely and with the understanding that our actual future results may be materially different from what we expect. We qualify all of our forward-looking statements by these cautionary statements. Except as required by applicable law, we do not plan to publicly update or revise any forward-looking statements contained herein, whether as a result of any new information, future events, changed circumstances or otherwise.

CERTAIN DEFINITIONS

As used in this quarterly report on Form 10-Q, unless the context otherwise requires, references to:

•“we,” “us,” “our,” the “Company,” “Bridge,” “Bridge Investment Group” and similar references refer: (1) following the consummation of the Transactions, including our IPO, to Bridge Investment Group Holdings Inc., and, unless otherwise stated, all of its subsidiaries, including Bridge Investment Group Holdings LLC (the “Operating Company”) and, unless otherwise stated, all of the Operating Company’s subsidiaries, and (2) prior to the completion of the IPO, to the Operating Company and, unless otherwise stated, all of the Operating Company’s subsidiaries and the Contributed Bridge GPs.

•“assets under management” or “AUM” refers to the assets we manage. Our AUM represents the sum of (a) the fair value of the assets of the funds and vehicles we manage, plus (b) the contractual amount of any uncalled capital commitments to those funds and vehicles (including our commitments to the funds and vehicles and those of Bridge affiliates). Our AUM is not reduced by any outstanding indebtedness or other accrued but unpaid liabilities of the assets we manage. Our calculations of AUM and fee-earning AUM may differ from the calculations of other investment managers. As a result, these measures may not be comparable to similar measures presented by other investment managers. In addition, our calculation of AUM (but not fee-earning AUM) includes uncalled commitments to (and the fair value of the assets in) the funds and vehicles we manage from Bridge and Bridge affiliates, regardless of whether such commitments or investments are subject to fees. Our definition of AUM is not based on any definition contained in the agreements governing the funds and vehicles we manage or advise.

•“BIGRM” refers to Bridge Investment Group Risk Management, Inc. BIGRM is incorporated in the State of Utah and is licensed under the Utah State Captive Insurance Companies Act.

•“Bridge GPs” refers to the following entities:

◦Bridge Office Fund GP LLC (“BOF I GP”)

◦Bridge Office Fund II GP LLC (“BOF II GP”)

◦Bridge Office Fund III GP LLC (“BOF III GP”)

◦Bridge Seniors Housing & Medical Properties Fund GP LLC (“BSH I GP”)

◦Bridge Seniors Housing & Medical Properties Fund II GP LLC (“BSH II GP”)

◦Bridge Seniors Housing Fund III GP LLC (“BSH III GP”)

◦Bridge Opportunity Zone Fund GP LLC (“BOZ I GP”)

◦Bridge Opportunity Zone Fund II GP LLC (“BOZ II GP”)

◦Bridge Opportunity Zone Fund III GP LLC (“BOZ III GP”)

◦Bridge Opportunity Zone Fund IV GP LLC (“BOZ IV GP”)

◦Bridge Opportunity Zone Fund V GP LLC (“BOZ V GP”)

◦Bridge MF&CO Fund III GP LLC (“BMF III GP”)

◦Bridge Multifamily Fund IV GP LLC (“BMF IV GP”)

◦Bridge Multifamily Fund V GP LLC (“BMF V GP”)

◦Bridge Workforce and Affordable Housing Fund GP LLC (“BWH I GP”)

◦Bridge Workforce and Affordable Housing Fund II GP LLC (“BWH II GP”)

◦Bridge Debt Strategies Fund GP LLC (“BDS I GP”)

◦Bridge Debt Strategies Fund II GP LLC (“BDS II GP”)

◦Bridge Debt Strategies Fund III GP LLC (“BDS III GP”)

◦Bridge Debt Strategies Fund IV GP LLC (“BDS IV GP”)

◦Bridge Agency MBS Fund GP LLC (“BAMBS GP”)

◦Bridge Net Lease Income Fund GP LLC (“BNLI GP”)

◦Bridge Logistics U.S. Venture I GP LLC (“BLV I GP”)

◦Bridge Logistics Value Fund II GP LLC (“BLV II GP”)

◦Bridge Logistics Developer GP LLC (“BLD GP”)

◦Bridge Single-Family Rental Fund IV GP LLC (“BSFR IV GP”)

◦Bridge Solar Energy Development Fund GP LLC (“BSED GP”)

◦Bridge Investment Group Ventures Fund GP LLC (“BIGVF GP”)

•“Class A common stock” refers to the Class A common stock, $0.01 par value per share, of the Company.

•“Class A Units” refers to the Class A common units of the Operating Company.

•“Class B common stock” refers to the Class B common stock, $0.01 par value per share, of the Company.

•“Class B Units” refers to the Class B common units of the Operating Company.

•“Continuing Equity Owners” refers collectively to direct or indirect holders of Class A Units and Class B common stock who may exchange at each of their respective options (subject in certain circumstances to time-based vesting requirements and certain other restrictions), in whole or in part from time to time, their Class A Units (along with an equal number of shares of Class B common stock (and such shares shall be immediately cancelled)) for, at our election, cash or newly issued shares of Class A common stock.

•“Contributed Bridge GPs” refers to the following entities:

◦BOF I GP

◦BOF II GP

◦BSH I GP

◦BSH II GP

◦BSH III GP

◦BOZ I GP

◦BOZ II GP

◦BOZ III GP

◦BOZ IV GP

◦BMF III GP

◦BMF IV GP

◦BWH I GP

◦BWH II GP

◦BDS II GP

◦BDS III GP

◦BDS IV GP

•“fee-earning AUM” refers to the assets we manage from which we earn management fee or other revenue.

•“IPO” refers to the initial public offering of shares of the Company’s Class A common stock.

•“LLC Interests” refers to the Class A Units and the Class B Units.

•“Operating Company,” “Bridge Investment Group LLC” and “Bridge Investment Group Holdings LLC” refer to Bridge Investment Group Holdings LLC, a Delaware limited liability company, which was converted to a limited liability company organized under the laws of the State of Delaware from a Utah limited liability company formerly named “Bridge Investment Group LLC” in connection with the IPO.

•“Original Equity Owners” refers to the owners of LLC Interests in the Operating Company, collectively, prior to the IPO.

•“Transactions” refers to the IPO and certain organizational transactions that were effected in connection with the IPO, and the application of the net proceeds therefrom. Refer to Note 1, “Organization,” in the condensed consolidated and combined financial statements included elsewhere in this quarterly report on Form 10-Q for a description of the Transactions.

PART I. FINANCIAL INFORMATION

Item 1. Financial Statements

BRIDGE INVESTMENT GROUP HOLDINGS INC.

Condensed Consolidated Balance Sheets

(Dollar amounts in thousands, except per share data)

| | | | | | | | | | | |

| September 30, 2022 | | December 31, 2021 |

| Assets | (Unaudited) | | (Audited) |

| Cash and cash equivalents | $ | 191,493 | | | $ | 78,417 | |

| Restricted cash | 8,966 | | | 5,455 | |

| Marketable securities, at fair value | 9,509 | | | 8,035 | |

| Receivables from affiliates | 52,895 | | | 35,379 | |

| Notes receivable from affiliates | 65,474 | | | 118,508 | |

| Other assets | 80,888 | | | 44,463 | |

| Other investments | 83,398 | | | 44,006 | |

| Accrued performance allocations | 559,160 | | | 439,548 | |

| Intangible assets, net | 5,378 | | | 3,441 | |

| Goodwill | 55,982 | | | 9,830 | |

| Deferred tax assets, net | 66,275 | | | 59,210 | |

| Total assets | $ | 1,179,418 | | | $ | 846,292 | |

| Liabilities and shareholdersʼ equity | | | |

| Accrued performance allocations compensation | $ | 62,752 | | | $ | 41,020 | |

| Accrued compensation and benefits | 18,097 | | | 15,107 | |

| Accounts payable and accrued expenses | 30,621 | | | 13,586 | |

| Due to affiliates | 52,110 | | | 46,134 | |

| General Partner notes payable, at fair value | 9,786 | | | 12,003 | |

| Insurance loss reserves | 9,425 | | | 8,086 | |

| Self-insurance reserves and unearned premiums | 5,268 | | | 3,504 | |

| Other liabilities | 31,184 | | | 8,973 | |

| Notes payable | 297,164 | | | 148,142 | |

| Total liabilities | $ | 516,407 | | | $ | 296,555 | |

| Commitments and contingencies (Note 17) | — | | | — | |

| Shareholdersʼ equity: | | | |

Preferred stock, $0.01 par value, 20,000,000 authorized, 0 issued and outstanding as of September 30, 2022 and December 31, 2021, respectively | — | | | — | |

Class A common stock, $0.01 par value, 500,000,000 authorized; 29,247,881 and 25,159,799 issued and outstanding as of September 30, 2022 and December 31, 2021, respectively | 292 | | | 230 | |

Class B common stock, $0.01 par value, 238,087,544 and 239,208,722 authorized; 85,551,127 and 86,672,305 issued and outstanding as of September 30, 2022 and December 31, 2021, respectively | 856 | | | 867 | |

| Additional paid-in capital | 61,244 | | | 53,527 | |

| Retained earnings | 22,502 | | | 17,184 | |

| Accumulated other comprehensive loss | (187) | | | (21) | |

| Bridge Investment Group Holdings Inc. equity | 84,707 | | | 71,787 | |

| Non-controlling interests in Bridge Investment Group Holdings LLC | 312,296 | | | 272,482 | |

| Non-controlling interests in Bridge Investment Group Holdings Inc. | 266,008 | | | 205,468 | |

| Total shareholdersʼ equity | 663,011 | | | 549,737 | |

| Total liabilities and shareholdersʼ equity | $ | 1,179,418 | | | $ | 846,292 | |

See accompanying notes to condensed consolidated and combined financial statements.

BRIDGE INVESTMENT GROUP HOLDINGS INC.

Condensed Consolidated and Combined Statements of Operations (Unaudited)

(Dollar amounts in thousands, except per share data)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2022 | | 2021 | | 2022 | | 2021 |

| Revenues: | | | | | | | |

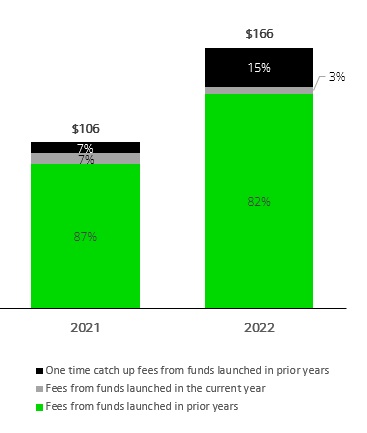

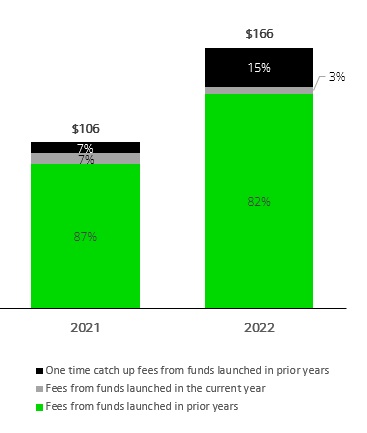

| Fund management fees | $ | 64,096 | | | $ | 40,576 | | | $ | 166,176 | | | $ | 105,963 | |

| Property management and leasing fees | 18,788 | | | 22,510 | | | 56,683 | | | 53,592 | |

| Construction management fees | 3,414 | | | 2,097 | | | 7,727 | | | 5,988 | |

| Development fees | 986 | | | 1,018 | | | 3,037 | | | 2,567 | |

| Transaction fees | 11,532 | | | 21,907 | | | 51,172 | | | 43,475 | |

| Fund administration fees | 3,808 | | | — | | | 11,105 | | | — | |

| Insurance premiums | 3,387 | | | 2,530 | | | 8,648 | | | 6,446 | |

| Other asset management and property income | 4,413 | | | 1,533 | | | 9,027 | | | 4,664 | |

| Total revenues | 110,424 | | | 92,171 | | | 313,575 | | | 222,695 | |

| Investment income: | | | | | | | |

| Incentive fees | — | | | — | | | — | | | 910 | |

| Performance allocations: | | | | | | | |

| Realized | 22,308 | | | 30,999 | | | 64,826 | | | 72,184 | |

| Unrealized | (16,367) | | | 53,042 | | | 119,611 | | | 111,009 | |

| Earnings from investments in real estate | 818 | | | 823 | | | 2,109 | | | 1,799 | |

| Total investment income | 6,759 | | | 84,864 | | | 186,546 | | | 185,902 | |

| Expenses: | | | | | | | |

| Employee compensation and benefits | 54,968 | | | 31,763 | | | 149,140 | | | 101,220 | |

| Incentive fee compensation | — | | | — | | | — | | | 82 | |

| Performance allocations compensation: | | | | | | | |

| Realized | 1,321 | | | 1,855 | | | 4,047 | | | 6,096 | |

| Unrealized | 3,789 | | | 2,682 | | | 21,014 | | | 10,159 | |

| Loss and loss adjustment expenses | 2,204 | | | 1,429 | | | 5,395 | | | 4,346 | |

| Third-party operating expenses | 6,125 | | | 11,581 | | | 19,642 | | | 26,325 | |

| General and administrative expenses | 10,685 | | | 6,703 | | | 29,961 | | | 16,196 | |

| Depreciation and amortization | 703 | | | 699 | | | 2,223 | | | 2,179 | |

| Total expenses | 79,795 | | | 56,712 | | | 231,422 | | | 166,603 | |

| Other income (expense): | | | | | | | |

| Realized and unrealized gains, net | 399 | | | 2,565 | | | 4,315 | | | 8,663 | |

| Interest income | 1,904 | | | 1,008 | | | 4,466 | | | 2,172 | |

| Interest expense | (4,247) | | | (2,407) | | | (8,769) | | | (6,547) | |

| Total other income (expense) | (1,944) | | | 1,166 | | | 12 | | | 4,288 | |

| Income before provision for income taxes | 35,444 | | | 121,489 | | | 268,711 | | | 246,282 | |

| Income tax provision | (3,203) | | | (2,607) | | | (14,585) | | | (3,441) | |

| Net income | 32,241 | | | 118,882 | | | 254,126 | | | 242,841 | |

| Net income attributable to non-controlling interests in Bridge Investment Group Holdings LLC | 1,381 | | | 60,900 | | | 87,842 | | | 70,663 | |

| Net income attributable to Bridge Investment Group Holdings LLC | 30,860 | | | 57,982 | | | 166,284 | | | 172,178 | |

| Net income attributable to Common Control Group prior to Transactions and IPO | — | | | 3,775 | | | — | | | 117,971 | |

| Net income attributable to non-controlling interests in Bridge Investment Group Holdings Inc. subsequent to Transactions and IPO | 25,861 | | | 43,904 | | | 138,574 | | | 43,904 | |

| Net income attributable to Bridge Investment Group Holdings Inc. subsequent to Transactions and IPO | $ | 4,999 | | | $ | 10,303 | | | $ | 27,710 | | | $ | 10,303 | |

| | | | | | | |

Earnings per share of Class A common stock—Basic and Diluted (Note 21)1 | $ | 0.17 | | | $ | 0.41 | | | $ | 0.96 | | | $ | 0.41 | |

Weighted-average shares of Class A common stock outstanding—Basic and Diluted (Note 21)1 | 24,157,236 | | | 22,284,351 | | | 23,778,524 | | | 22,284,351 | |

1 For the three and nine months ended September 30, 2021, the earnings per share amounts are for the period following the Transaction and IPO from July 16, 2021 through September 30, 2021. Refer to Note 1, “Organization” and Note 21, “Earnings per Share” for additional information.

See accompanying notes to condensed consolidated and combined financial statements.

BRIDGE INVESTMENT GROUP HOLDINGS INC.

Condensed Consolidated and Combined Statements of Comprehensive Income (Unaudited)

(Dollar amounts in thousands)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2022 | | 2021 | | 2022 | | 2021 |

| | | | | | | |

| Net income | $ | 32,241 | | | $ | 118,882 | | | $ | 254,126 | | | $ | 242,841 | |

| Other comprehensive income (loss) - foreign currency translation adjustments, net of tax | (162) | | | (13) | | | (166) | | | (6) | |

| Total comprehensive income | 32,079 | | | 118,869 | | | 253,960 | | | 242,835 | |

| Less: comprehensive income attributable to non-controlling interests in Bridge Investment Group Holdings LLC | 1,381 | | | 60,900 | | | 87,842 | | | 70,663 | |

| Comprehensive income attributable to Bridge Investment Group Holdings LLC | 30,698 | | | 57,969 | | | 166,118 | | | 172,172 | |

| Less: comprehensive income attributable to Common Control Group prior to Transactions and IPO | — | | | 3,775 | | | — | | | 117,971 | |

| Less: comprehensive income attributable to non-controlling interests in Bridge Investment Group Holdings Inc. subsequent to Transactions and IPO | 25,861 | | | 43,904 | | | 138,574 | | | 43,904 | |

| Comprehensive income attributable to Bridge Investment Group Holdings Inc. subsequent to Transactions and IPO | $ | 4,837 | | | $ | 10,290 | | | $ | 27,544 | | | $ | 10,297 | |

See accompanying notes to condensed consolidated and combined financial statements.

BRIDGE INVESTMENT GROUP HOLDINGS INC.

Condensed Consolidated and Combined Statements of Changes in Shareholders’/Members’ Equity (Unaudited)

(Dollar amounts in thousands, except per share data)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Class A

Common Stock | | Class B

Common Stock | | Additional Paid-In

Capital | | Retained

Earnings | | Accumulated Other

Comprehensive Income

(Loss) | | NCI in Operating Company or CCG(1) | | NCI in Bridge Investment Group Holdings Inc.(2) | | Total Shareholdersʼ/

Membersʼ Equity |

| Balance as of June 30, 2022 | | | $ | 291 | | | $ | 857 | | | $ | 60,962 | | | $ | 26,364 | | | $ | (25) | | | $ | 323,141 | | | $ | 269,407 | | | $ | 680,997 | |

| Net income | | | — | | | — | | | — | | | 4,999 | | | — | | | 1,381 | | | 25,861 | | | 32,241 | |

| | | | | | | | | | | | | | | | | |

| Exchange of Class A Units for Class A common stock and redemption of corresponding Class B common stock including the deferred tax effect and amounts payable under the Tax Receivable Agreement | | | 1 | | | (1) | | | (2) | | | — | | | — | | | — | | | — | | | (2) | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Share-based compensation, net of forfeitures | | | — | | | — | | | 4,358 | | | — | | | — | | | 822 | | | 4,444 | | | 9,624 | |

| Capital contributions | | | — | | | — | | | — | | | — | | | — | | | 12 | | | — | | | 12 | |

| Distributions | | | — | | | — | | | — | | | — | | | — | | | (13,060) | | | (37,778) | | | (50,838) | |

Dividends on Class A Common Stock/Units, $0.30 per share | | | — | | | — | | | — | | | (8,861) | | | — | | | — | | | — | | | (8,861) | |

| Foreign currency translation adjustment | | | — | | | — | | | — | | | — | | | (162) | | | — | | | — | | | (162) | |

| Reallocation of equity | | | — | | | — | | | (4,074) | | | — | | | — | | | — | | | 4,074 | | | — | |

| Balance as of September 30, 2022 | | | $ | 292 | | | $ | 856 | | | $ | 61,244 | | | $ | 22,502 | | | $ | (187) | | | $ | 312,296 | | | $ | 266,008 | | | $ | 663,011 | |

(1)Non-controlling interests (“NCI”) in Bridge Investment Group Holdings LLC or Common Control Group

(2)NCI in Bridge Investment Group Holdings Inc.

BRIDGE INVESTMENT GROUP HOLDINGS INC.

Condensed Consolidated and Combined Statements of Changes in Shareholders’/Members’ Equity (Unaudited)

(Dollar amounts in thousands, except per share data)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net Investment in CCG(1) | | Class A

Common Stock | | Class B

Common Stock | | Additional Paid-In

Capital | | Retained

Earnings | | Accumulated Other

Comprehensive Income

(Loss) | | NCI in Operating Company or CCG(2) | | NCI in Bridge Investment Group Holdings Inc.(3) | | Total Shareholdersʼ/

Membersʼ Equity |

| Balance as of June 30, 2021 | $ | 157,253 | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | 11 | | | $ | 12,377 | | | $ | — | | | $ | 169,641 | |

| Net income prior to Transactions and IPO | 3,775 | | | — | | | — | | | — | | | — | | | — | | | 1,799 | | | — | | | 5,574 | |

| Foreign currency translation adjustment prior to Transactions and IPO | — | | | — | | | — | | | — | | | — | | | (11) | | | — | | | — | | | (11) | |

| Share-based compensation prior to Transactions and IPO | 196 | | | — | | | — | | | — | | | — | | | — | | | 19 | | | — | | | 215 | |

| Distributions prior to Transactions and IPO | (18,377) | | | — | | | — | | | — | | | — | | | — | | | (3,186) | | | — | | | (21,563) | |

| Settlement of accrued performance allocations compensation liability with equity | 14,247 | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | 14,247 | |

| Recognition of non-controlling interests in certain subsidiaries concurrent with Transactions and IPO | (142,986) | | | — | | | — | | | — | | | — | | | — | | | 142,986 | | | — | | | — | |

| Derecognition of Bridge Debt Strategies Fund GP LLC | 2,337 | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | 2,337 | |

| Effects of Transactions and purchase of Operating Company Class A Units | (16,445) | | | 28 | | | 975 | | | 15,442 | | | — | | | — | | | — | | | — | | | — | |

| Issuance of Class A common stock sold in IPO, net of underwriting discount and issuance costs | — | | | 187 | | | — | | | 277,006 | | | — | | | — | | | — | | | (139,875) | | | 137,318 | |

| Purchase of membership interests in the Operating Company | — | | | — | | | (108) | | | (157,955) | | | — | | | — | | | — | | | 158,063 | | | — | |

| Issuance of Class A common stock from Underwriters' exercise of over-allotment option, net of underwriting discount and issuance costs | — | | | 14 | | | — | | | 18,174 | | | — | | | — | | | — | | | (18,188) | | | — | |

| Deferred tax effect resulting from purchase of Class A Units, net of amounts payable under Tax Receivable Agreement | — | | | — | | | — | | | 18,730 | | | — | | | — | | | — | | | — | | | 18,730 | |

| Equity reallocation between controlling and non-controlling interests subsequent to Transactions and IPO | — | | | — | | | — | | | (119,149) | | | — | | | — | | | — | | | 119,149 | | | — | |

| Capital Contributions subsequent to Transactions and IPO | — | | | — | | | — | | | — | | | — | | | — | | | 186 | | | — | | | 186 | |

| Net income subsequent to Transactions and IPO | — | | | — | | | — | | | — | | | 10,303 | | | — | | | 59,101 | | | 43,904 | | | 113,308 | |

| Foreign currency translation subsequent to Transactions and IPO | — | | | — | | | — | | | — | | | — | | | (2) | | | — | | | — | | | (2) | |

| Share-based compensation subsequent to Transactions and IPO | — | | | 1 | | | — | | | 531 | | | — | | | — | | | 4 | | | 1,702 | | | 2,238 | |

| Distributions subsequent to Transactions and IPO | — | | | — | | | — | | | — | | | — | | | — | | | (18,515) | | | (5,628) | | | (24,143) | |

| Balance as of September 30, 2021 | $ | — | | | $ | 230 | | | $ | 867 | | | $ | 52,779 | | | $ | 10,303 | | | $ | (2) | | | $ | 194,771 | | | $ | 159,127 | | | $ | 418,075 | |

For a description of the Transactions related to our initial public offering (“IPO”) refer to Note 1, “Organization.”

(1)Net investment in Common Control Group

(2)NCI in Bridge Investment Group Holdings LLC or Common Control Group

(3)NCI in Bridge Investment Group Holdings Inc.

See accompanying notes to condensed consolidated and combined financial statements.

BRIDGE INVESTMENT GROUP HOLDINGS INC.

Condensed Consolidated and Combined Statements of Changes in Shareholders’/Members’ Equity (Unaudited)

(Dollar amounts in thousands, except per share data)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Class A

Common Stock | | Class B

Common Stock | | Additional Paid-In

Capital | | Retained

Earnings | | Accumulated Other

Comprehensive Income

(Loss) | | NCI in Operating Company or CCG(1) | | NCI in Bridge Investment Group Holdings Inc.(2) | | Total Shareholdersʼ/

Membersʼ Equity |

| Balance as of December 31, 2021 | | | $ | 230 | | | $ | 867 | | | $ | 53,527 | | | $ | 17,184 | | | $ | (21) | | | $ | 272,482 | | | $ | 205,468 | | | $ | 549,737 | |

| Net income | | | — | | | — | | | — | | | 27,710 | | | — | | | 87,842 | | | 138,574 | | | 254,126 | |

| Conversion of 2019 profits interest awards | | | 8 | | | — | | | (8) | | | — | | | — | | | — | | | — | | | — | |

| Exchange of Class A Units for Class A common stock and redemption of corresponding Class B common stock including the deferred tax effect and amounts payable under the Tax Receivable Agreement | | | 11 | | | (11) | | | 778 | | | — | | | — | | | — | | | — | | | 778 | |

| Issuance of Class A Units for acquisition | | | — | | | — | | | — | | | — | | | — | | | — | | | 14,930 | | | 14,930 | |

| Fair value of non-controlling interest in acquired business | | | — | | | — | | | — | | | — | | | — | | | 20,053 | | | — | | | 20,053 | |

| Share-based compensation, net of forfeitures | | | 43 | | | — | | | 8,046 | | | — | | | — | | | 836 | | | 14,517 | | | 23,442 | |

| Capital contributions | | | — | | | — | | | — | | | — | | | — | | | 213 | | | — | | | 213 | |