Exhibit 99.1

BRIDGE INVESTMENT GROUP HOLDINGS INC. REPORTS SECOND QUARTER 2021 RESULTS

SALT LAKE CITY, UTAH—Bridge Investment Group Holdings Inc. (NYSE: BRDG) (“Bridge” or the “Company”) today reported its financial results for its second quarter ended June 30, 2021.

Total Revenue and Investment Income for Bridge Investment Group Holdings LLC (the “Operating Company”) were $72.0 million and $79.9 million, respectively, for the quarter ended June 30, 2021.

Net Income applicable to the Operating Company was $83.2 million for the quarter ended June 30, 2021.

Distributable Earnings to the Operating Company were $55.7 million, 100% of which has been or will be distributed to the owners of the Operating Company as of the close of business on June 30, 2021.

On July 20, 2021, the Company closed its Initial Public Offering of 18,750,000 shares of Class A common stock at a public offering price of $16.00 per share.

In releasing these quarterly results, Robert Morse, Bridge’s Executive Chairman, commented, “Our successful IPO is an important step in Bridge’s evolution as a high-performing and purpose-built alternative asset investment management company. We believe our specialized investment focus on the most attractive sectors within real estate and our vertical integration into property management drives attractive returns. We have continued to expand our areas of focus to include Logistics, and greater penetration of the global investor base, initiatives we expect to further amplify our growth and returns.”

Mr. Morse continued, “In addition to reporting strong total revenue and investment income, we are proud that our second quarter results represent new highs for fee-paying AUM, fee-related earnings, realized performance fees and distributable earnings. We see enormous growth opportunity for Bridge’s differentiated approach to investment management, and we look forward to sharing more with our shareholders in the quarters and years ahead.”

Jonathan Slager, Bridge’s Chief Executive Officer, added “We are excited to share our first earnings update as a public company and to report record second-quarter results. The $16 trillion commercial real estate market has experienced a strong recovery year-to-date across property sectors. We believe Bridge is well positioned to capitalize on these trends given recent strategy launches in Logistics and an active pipeline of next generation strategies. We believe our ability to raise and deploy capital is largely a function of our strong performance, and we look forward to driving similar value creation for our public shareholders as they benefit from growth in our net income and distributable earnings over time.”

Additional Information

Bridge Investment Group Holdings Inc. issued a full detailed presentation of its second quarter 2021 results, which can be viewed at www.bridgeig.com on the Investors section of our home page. The presentation is titled “Second Quarter 2021 Earnings Presentation.”

Conference Call and Webcast Information

The Company will host a conference call on August 11, 2021 at 8:30 a.m. ET to discuss its second quarter results. Interested parties may access the conference call live over the phone by dialing 1-877-405-1210 (Toll Free) or 1-201-689-8721 (Toll/International) and requesting Bridge Investment Group Holdings Inc.’s Second Quarter 2021 Earnings Conference Call. Participants are asked to dial in a few minutes prior to the call to register for the event. The event will also be available live via webcast which can be accessed here.

An audio replay of the conference call will be available approximately three hours after the conference call until 11:59 pm ET on August 25, 2021 and can be accessed by dialing 1-877-660-6853 (domestic) or 1-201-612-7415 (international) and providing the passcode 13721951.

About Bridge Investment Group Holdings Inc.

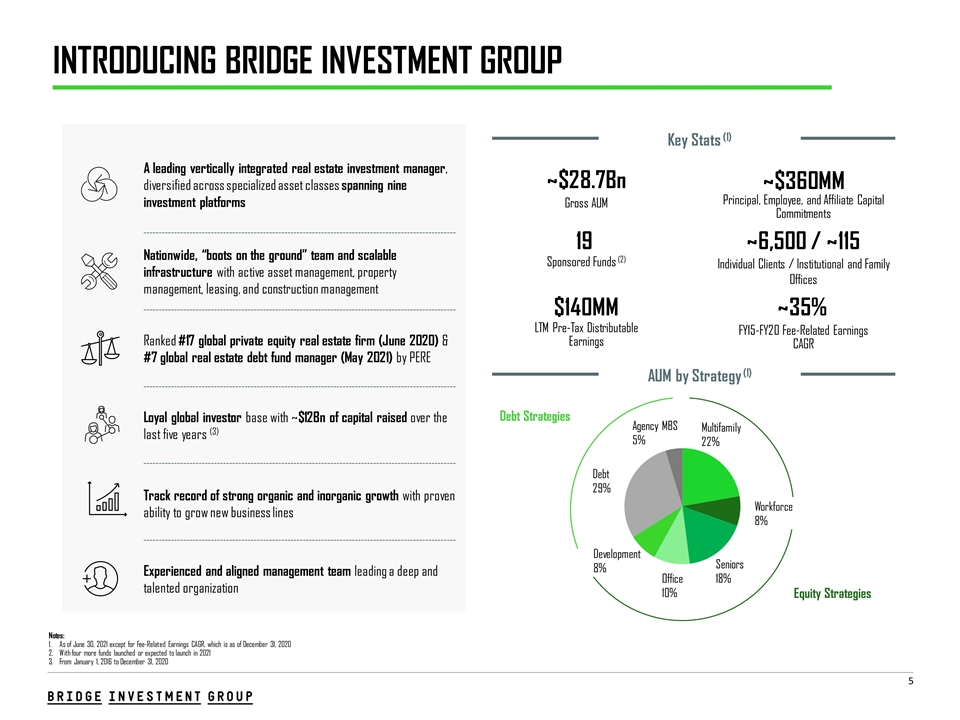

Bridge is a leading, vertically integrated real estate investment manager, diversified across specialized asset classes, with approximately $28.7 billion of assets under management as of June 30, 2021. Bridge combines its nationwide operating platform with dedicated teams of investment professionals focused on select U.S. real estate verticals: multifamily, affordable housing, seniors housing, office, development, logistics net lease, logistics properties, debt strategies and agency mortgage-backed securities.

Forward-Looking Statements

This earnings release contains certain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, which relate to future events or our future performance or financial condition. All statements other than statements of historical facts may be forward-looking statements. In some cases, you can identify forward-looking statements by terms such as “outlook,” “could,” “believes,” “expects,” “potential,” “opportunity,” “continues,” “may,” “will,” “should,” “over time,” “seeks,” “predicts,” “intends,” “plans,” “estimates,” “anticipates,” “foresees” or negative versions of those words, other comparable words or other statements that do not relate to historical or factual matters. Accordingly, we caution you that any such forward-looking statements are based on our beliefs, assumptions and expectations as of the date made of our future performance, taking into account all information available to us at that time. These statements are not guarantees of future performance, condition or results and involve a number of risks and uncertainties that are difficult to predict and beyond our control. Actual results may differ materially from those express or implied in the forward-looking statements as a result of a number of factors, including but not limited to those risks described from time to time in our filings with the Securities and Exchange Commission. Any forward-looking statement speaks only as of the date on which it is made. Bridge Investment Group Holdings Inc. undertakes no duty to publicly update any forward-looking statements made herein or on the webcast/conference call, whether as a result of new information, future developments or otherwise, except as required by law.

Nothing in this press release constitutes an offer to sell or solicitation of an offer to buy any securities of the Company or an investment fund managed by the Company or its affiliates.

Investor Relations Contact:

Charlotte Morse

Bridge Investment Group Holdings Inc.

(877) 866-4540

AUGUST 11, 2021 2nd Quarter Earnings Supplemental Notes:

DISCLAIMER Notes: The information contained herein does not constitute or form part of, and should not be construed as, an offer or invitation to subscribe for, underwrite or otherwise acquire, any securities of Bridge Investment Group Holdings Inc. (“Bridge” or the “Company”) or any affiliate of Bridge, or any fund or other investment vehicle managed by Bridge or an affiliate of Bridge. This presentation should not form the basis of, or be relied on in connection with, any contract to purchase or subscribe for any securities of Bridge or any fund or other investment vehicle managed by Bridge or an affiliate of Bridge, or in connection with any other contract or commitment whatsoever. This presentation does not constitute a “prospectus” within the meaning of the Securities Act of 1933, as amended. Any decision to purchase securities of Bridge or any of its affiliates should be made solely on the basis of the information contained in a prospectus to be issued by Bridge in relation to a specific offering. Forward-Looking Statements This presentation contains forward-looking statements. All statements other than statements of historical facts contained in this presentation may be forward-looking statements. Statements regarding our future results of operations and financial position, business strategy and plans and objectives of management for future operations, including, among others, statements regarding expected growth, capital raising, expectations or targets related to financial and non-financial measures, future capital expenditures, fund performance and debt service obligations, are forward-looking statements. In some cases, you can identify forward-looking statements by terms, such as “may,” “will,” “should,” “expects,” “plans,” “seek,” “anticipates,” “plan,” “forecasts,” “outlook,” “could,” “intends,” “targets,” “projects,” “contemplates,” “believes,” “estimates,” “predicts,” “potential” or “continue” or the negative of these terms or other similar expressions. Accordingly, we caution you that any such forward-looking statements are not guarantees of future performance and are subject to risks, assumptions and uncertainties that are difficult to predict and beyond our ability to control. Although we believe that the expectations reflected in these forward-looking statements are reasonable as of the date made, actual results may prove to be materially different from the results expressed or implied by the forward-looking statements. If one or more events related to these forward-looking statements or other risks or uncertainties materialize, or if our underlying assumptions prove to be incorrect, actual results may differ materially from what we anticipate. Many of the important factors that will determine these results are beyond our ability to control or predict. We believe these factors include but are not limited to those risk factors described under the section entitled “Risk Factors” in Amendment No. 2 to Form S-1 filed with the United States Securities and Exchange Commission (the “SEC”) on July 7, 2021 and accessible on the SEC’s website at www.sec.gov. These factors should not be construed as exhaustive and should be read in conjunction with other cautionary statements included in this report and our other filings. Accordingly, you should not place undue reliance on any such forward-looking statements. Any forward-looking statement speaks only as of the date on which it is made, and, except as otherwise required by law, we do not undertake any obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments or otherwise. New factors emerge from time to time, and it is not possible for us to predict which will arise. We cannot assess the impact of each factor on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. Industry Information Unless otherwise indicated, information contained in this presentation concerning our industry, competitive position and the markets in which we operate is based on information from independent industry and research organizations, other third-party sources and management estimates. Management estimates are derived from publicly available information released by independent industry analysts and other third-party sources, as well as data from our internal research, and are based on assumptions made by us upon reviewing such data, and our experience in, and knowledge of, such industry and markets, which we believe to be reasonable. In addition, projections, assumptions and estimates of the future performance of the industry in which we operate and our future performance are necessarily subject to uncertainty and risk due to a variety of factors, which could cause results to differ materially from those expressed in the estimates made by the independent parties and by us. Non-GAAP Financial Measures This presentation uses financial measures that are not presented in accordance with generally accepted accounted principles in the United States (“GAAP”), such as Distributable Earnings, Fee Related Earnings, Fee Related Revenues and Performance Related Earnings, to supplement financial information presented in accordance with GAAP. There are limitations to the use of the non-GAAP financial measures presented in this presentation. For example, the non-GAAP financial measures may not be comparable to similarly titled measures of other companies. Other companies may calculate non-GAAP financial measures differently than the Company, limiting the usefulness of those measures for comparative purposes.

TODAY’S SPEAKERS 2 ROBERT MORSE Executive Chairman JONATHAN SLAGER Chief Executive Officer KATIE ELSNAB Chief Accounting Officer DEAN ALLARA Vice Chairman & Head of Client Solutions Group

CHAIRMAN COMMENTARY

INTRODUCING BRIDGE INVESTMENT GROUP Notes: As of June 30, 2021 except for Fee-Related Earnings CAGR, which is as of December 31, 2020 With four more funds launched or expected to launch in 2021 From January 1, 2016 to December 31, 2020 4 A leading vertically integrated real estate investment manager, diversified across specialized asset classes spanning nine investment platforms Nationwide, “boots on the ground” team and scalable infrastructure with active asset management, property management, leasing, and construction management Ranked #17 global private equity real estate firm (June 2020) & #7 global real estate debt fund manager (May 2021) by PERE Loyal global investor base with ~$12Bn of capital raised over the last five years (3) Key Stats (1) ~$28.7Bn Gross AUM ~$360MM Principal, Employee, and Affiliate Capital Commitments LTM Pre-Tax Distributable Earnings $140MM 19 Sponsored Funds (2) ~6,500 / ~115 Individual Clients / Institutional and Family Offices AUM by Strategy (1) Equity Strategies Debt Strategies FY15-FY20 Fee-Related Earnings CAGR ~35% Experienced and aligned management team leading a deep and talented organization Track record of strong organic and inorganic growth with proven ability to grow new business lines

14 Strong Tailwinds from Favorable Market Trends Diversified and Synergistic Business Model Spanning Nine Investment Platforms Vertically Integrated Business Model and Scalable Infrastructure Drive Competitive Advantages and Attractive Investment Returns National Footprint with High-touch Operating Model and Local Expertise High Proportion of Recurring Fees and “Sticky” Contractual Revenue Streams from Long-duration Capital Proven Record of Fundraising Success with a Loyal Investor Base Significant Organic and Inorganic Opportunities to Accelerate Growth Long-tenured Senior Management Team with High Alignment and Support of Deep and Talented Employee Pool BRIDGE INVESTMENT GROUP KEY INVESTMENT HIGHLIGHTS

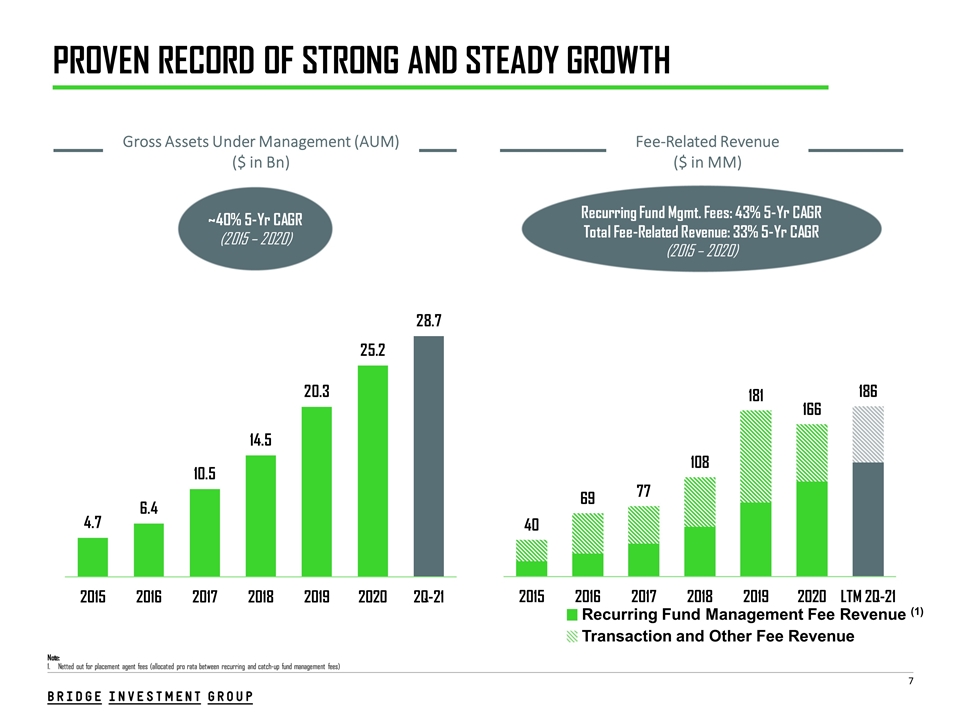

10 Gross Assets Under Management (AUM) ($ in Bn) Fee-Related Revenue ($ in MM) PROVEN RECORD OF STRONG AND STEADY GROWTH Recurring Fund Management Fee Revenue (1) ~40% 5-Yr CAGR (2015 – 2020) Recurring Fund Mgmt. Fees: 43% 5-Yr CAGR Total Fee-Related Revenue: 33% 5-Yr CAGR (2015 – 2020) Note: Netted out for placement agent fees (allocated pro rata between recurring and catch-up fund management fees) Transaction and Other Fee Revenue

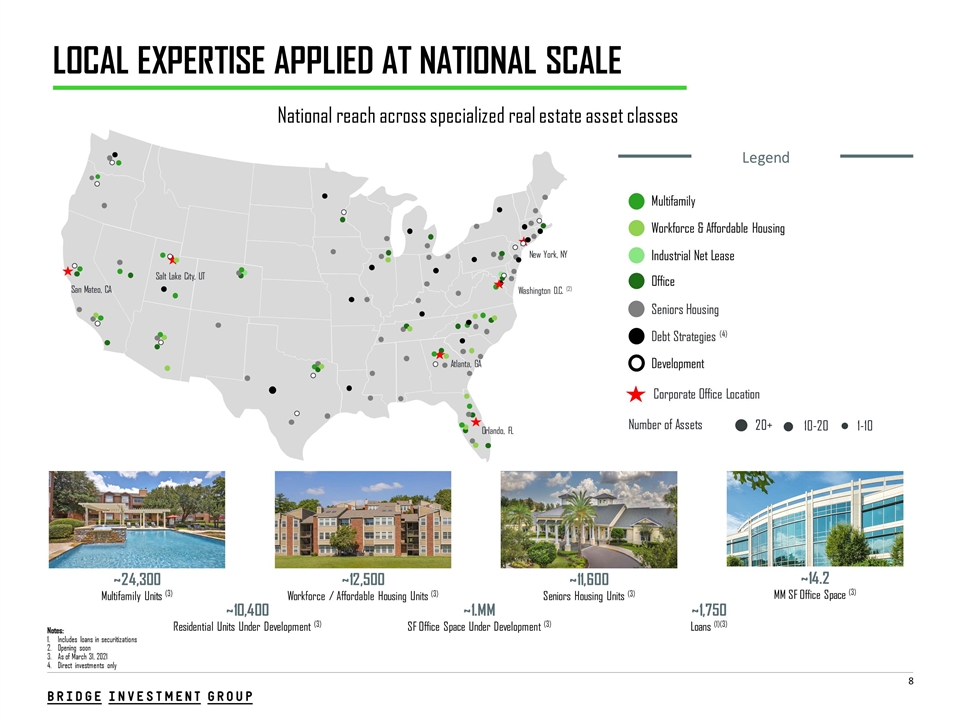

Multifamily 3 Corporate Office Location Number of Assets 20+ 10-20 1-10 New York, NY Orlando, FL Atlanta, GA San Mateo, CA Salt Lake City, UT Legend ~24,300 Multifamily Units (3) Industrial Net Lease Development Office Debt Strategies (4) Seniors Housing Workforce & Affordable Housing ~12,500 Workforce / Affordable Housing Units (3) ~11,600 Seniors Housing Units (3) ~14.2 MM SF Office Space (3) ~10,400 Residential Units Under Development (3) ~1.MM SF Office Space Under Development (3) ~1,750 Loans (1)(3) Notes: Includes loans in securitizations Opening soon As of March 31, 2021 Direct investments only Washington D.C. (2) LOCAL EXPERTISE APPLIED AT NATIONAL SCALE National reach across specialized real estate asset classes

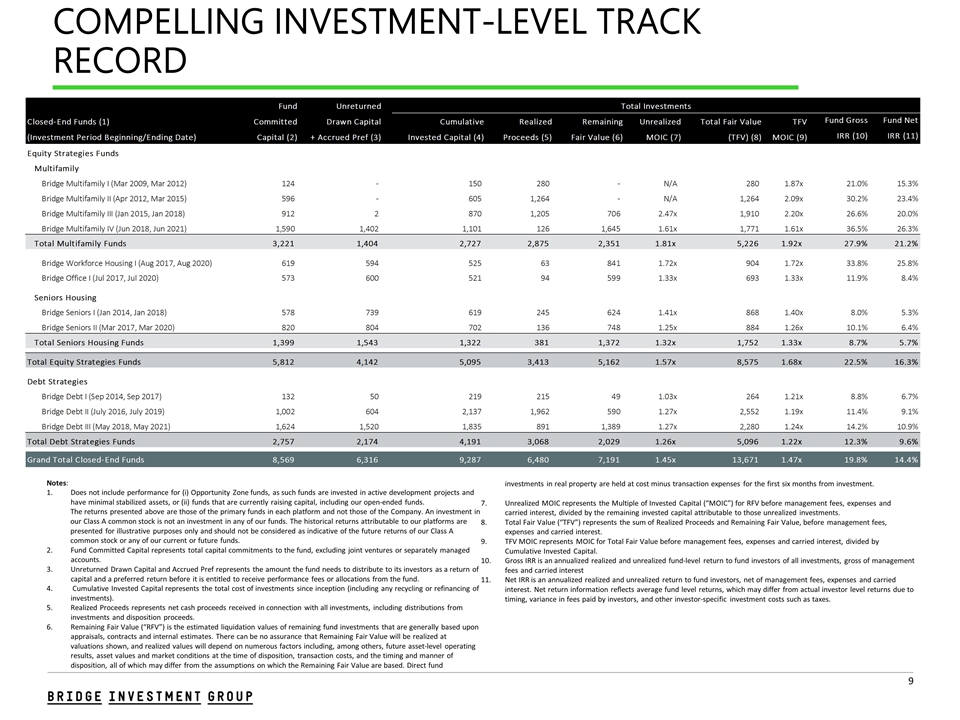

13 Notes: Does not include performance for (i) Opportunity Zone funds, as such funds are invested in active development projects and have minimal stabilized assets, or (ii) funds that are currently raising capital, including our open-ended funds. The returns presented above are those of the primary funds in each platform and not those of the Company. An investment in our Class A common stock is not an investment in any of our funds. The historical returns attributable to our platforms are presented for illustrative purposes only and should not be considered as indicative of the future returns of our Class A common stock or any of our current or future funds. Fund Committed Capital represents total capital commitments to the fund, excluding joint ventures or separately managed accounts. Unreturned Drawn Capital and Accrued Pref represents the amount the fund needs to distribute to its investors as a return of capital and a preferred return before it is entitled to receive performance fees or allocations from the fund. Cumulative Invested Capital represents the total cost of investments since inception (including any recycling or refinancing of investments). Realized Proceeds represents net cash proceeds received in connection with all investments, including distributions from investments and disposition proceeds. Remaining Fair Value (“RFV”) is the estimated liquidation values of remaining fund investments that are generally based upon appraisals, contracts and internal estimates. There can be no assurance that Remaining Fair Value will be realized at valuations shown, and realized values will depend on numerous factors including, among others, future asset-level operating results, asset values and market conditions at the time of disposition, transaction costs, and the timing and manner of disposition, all of which may differ from the assumptions on which the Remaining Fair Value are based. Direct fund investments in real property are held at cost minus transaction expenses for the first six months from investment. Unrealized MOIC represents the Multiple of Invested Capital (“MOIC”) for RFV before management fees, expenses and carried interest, divided by the remaining invested capital attributable to those unrealized investments. Total Fair Value (“TFV”) represents the sum of Realized Proceeds and Remaining Fair Value, before management fees, expenses and carried interest. TFV MOIC represents MOIC for Total Fair Value before management fees, expenses and carried interest, divided by Cumulative Invested Capital. Gross IRR is an annualized realized and unrealized fund-level return to fund investors of all investments, gross of management fees and carried interest Net IRR is an annualized realized and unrealized return to fund investors, net of management fees, expenses and carried interest. Net return information reflects average fund level returns, which may differ from actual investor level returns due to timing, variance in fees paid by investors, and other investor-specific investment costs such as taxes. COMPELLING INVESTMENT-LEVEL TRACK RECORD

SIGNIFICANT INVESTMENT EXPERTISE COLIN APPLE Co-CIO, Multifamily V Multifamily Workforce & Affordable Housing Office Debt Strategies Development AMBS Seniors Logistics Properties Logistics Net Lease ROBB CHAPIN CEO/CIO, Seniors Housing RICHARD STAYNER CIO, Workforce & Affordable Housing BROCK ANDRUS Deputy CIO, Workforce & Affordable Housing JAMES CHUNG CIO, Debt Strategies JEEHAE LEE Deputy CIO, Debt Strategies DAVID COELHO CIO, Development & Opportunity Zones MATT DEGRAW Co-CIO, Multifamily V, President, Bridge Property Mgmt. BLAKE PEEPER Co-CIO, Seniors Housing JOHN WARD CIO, Office JEFF SHAW CEO, Bridge Commercial Real Estate MOHIT CHANDARANA CIO, AMBS MIKE SODO CEO, Bridge Logistics Net Lease BRANDON FLICKINGER Co-CIO, Bridge Logistics Net Lease MATT TUCKER Co-CIO, Bridge Logistics Net Lease JAY CORNFORTH CEO/CIO, Bridge Logistics Properties BRIAN GAGNE Co-CIO, Bridge Logistics Properties RACHEL DILLER Partner, Acquisitions, Workforce & Affordable Housing

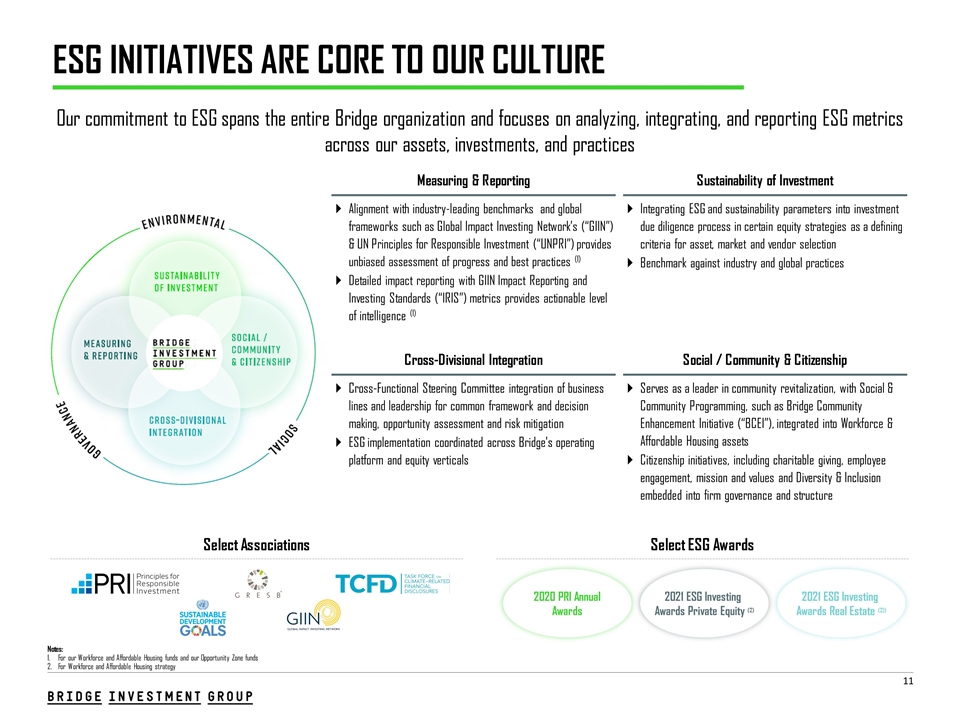

Notes: Alignment with industry-leading benchmarks and global frameworks such as Global Impact Investing Network’s (“GIIN”) & UN Principles for Responsible Investment (“UNPRI”) provides unbiased assessment of progress and best practices (1) Detailed impact reporting with GIIN Impact Reporting and Investing Standards (“IRIS”) metrics provides actionable level of intelligence (1) Measuring & Reporting ESG INITIATIVES ARE CORE TO OUR CULTURE Our commitment to ESG spans the entire Bridge organization and focuses on analyzing, integrating, and reporting ESG metrics across our assets, investments, and practices Integrating ESG and sustainability parameters into investment due diligence process in certain equity strategies as a defining criteria for asset, market and vendor selection Benchmark against industry and global practices Sustainability of Investment Cross-Functional Steering Committee integration of business lines and leadership for common framework and decision making, opportunity assessment and risk mitigation ESG implementation coordinated across Bridge's operating platform and equity verticals Cross-Divisional Integration Serves as a leader in community revitalization, with Social & Community Programming, such as Bridge Community Enhancement Initiative (“BCEI”), integrated into Workforce & Affordable Housing assets Citizenship initiatives, including charitable giving, employee engagement, mission and values and Diversity & Inclusion embedded into firm governance and structure Social / Community & Citizenship Select Associations Select ESG Awards 2020 PRI Annual Awards 2021 ESG Investing Awards Private Equity (2) 2021 ESG Investing Awards Real Estate (2)) Notes: For our Workforce and Affordable Housing funds and our Opportunity Zone funds For Workforce and Affordable Housing strategy

2nd Quarter Investment Highlights

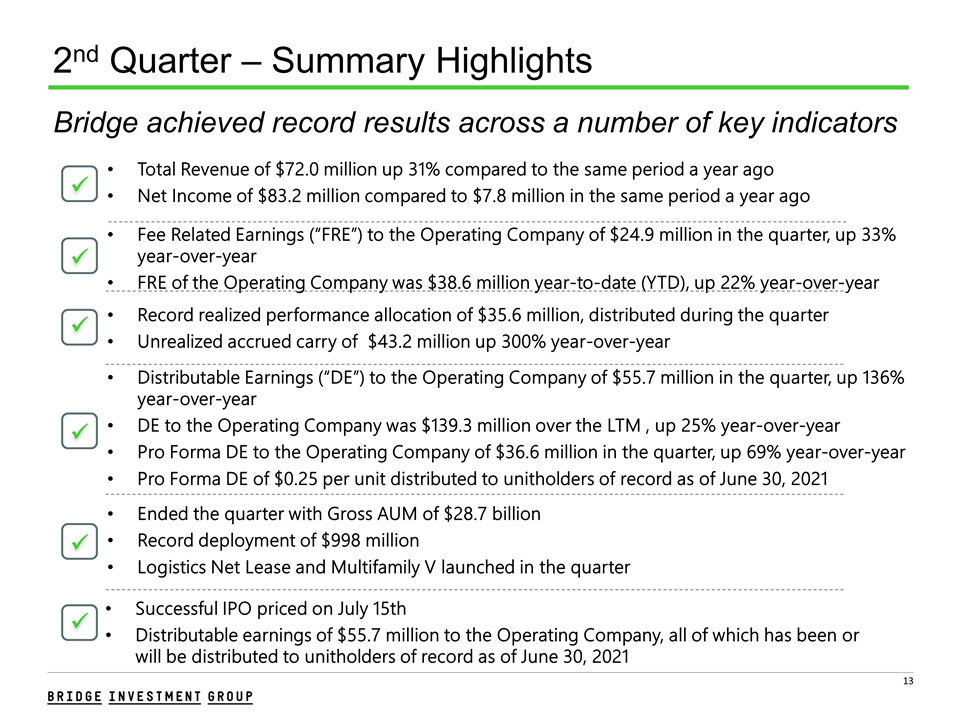

2nd Quarter – Summary Highlights Fee Related Earnings (“FRE”) to the Operating Company of $24.9 million in the quarter, up 33% year-over-year FRE of the Operating Company was $38.6 million year-to-date (YTD), up 22% year-over-year ü Record realized performance allocation of $35.6 million, distributed during the quarter Unrealized accrued carry of $43.2 million up 300% year-over-year ü Distributable Earnings (“DE”) to the Operating Company of $55.7 million in the quarter, up 136% year-over-year DE to the Operating Company was $139.3 million over the LTM , up 25% year-over-year Pro Forma DE to the Operating Company of $36.6 million in the quarter, up 69% year-over-year Pro Forma DE of $0.25 per unit distributed to unitholders of record as of June 30, 2021 ü Ended the quarter with Gross AUM of $28.7 billion Record deployment of $998 million Logistics Net Lease and Multifamily V launched in the quarter ü Successful IPO priced on July 15th Distributable earnings of $55.7 million to the Operating Company, all of which has been or will be distributed to unitholders of record as of June 30, 2021 ü Bridge achieved record results across a number of key indicators Total Revenue of $72.0 million up 31% compared to the same period a year ago Net Income of $83.2 million compared to $7.8 million in the same period a year ago ü

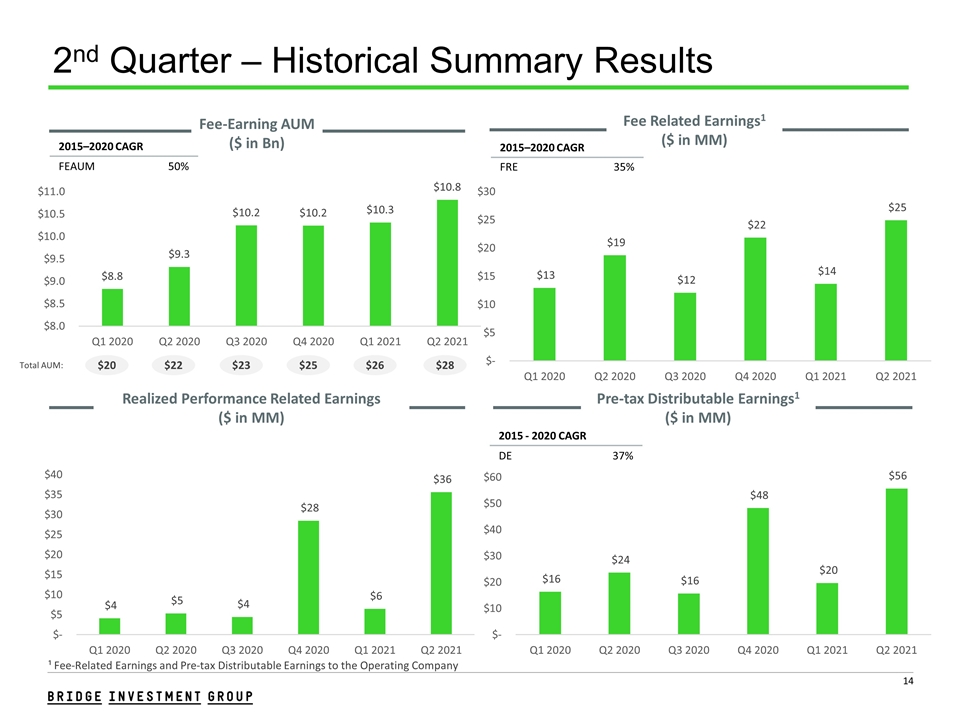

Fee-Earning AUM ($ in Bn) 2015–2020 CAGR FEAUM 50% Fee Related Earnings1 ($ in MM) 2015–2020 CAGR FRE 35% Pre-tax Distributable Earnings1 ($ in MM) 2015 - 2020 CAGR DE 37% Realized Performance Related Earnings ($ in MM) 2nd Quarter – Historical Summary Results Total AUM: $20 $22 $23 $25 $26 $28 ¹ Fee-Related Earnings and Pre-tax Distributable Earnings to the Operating Company

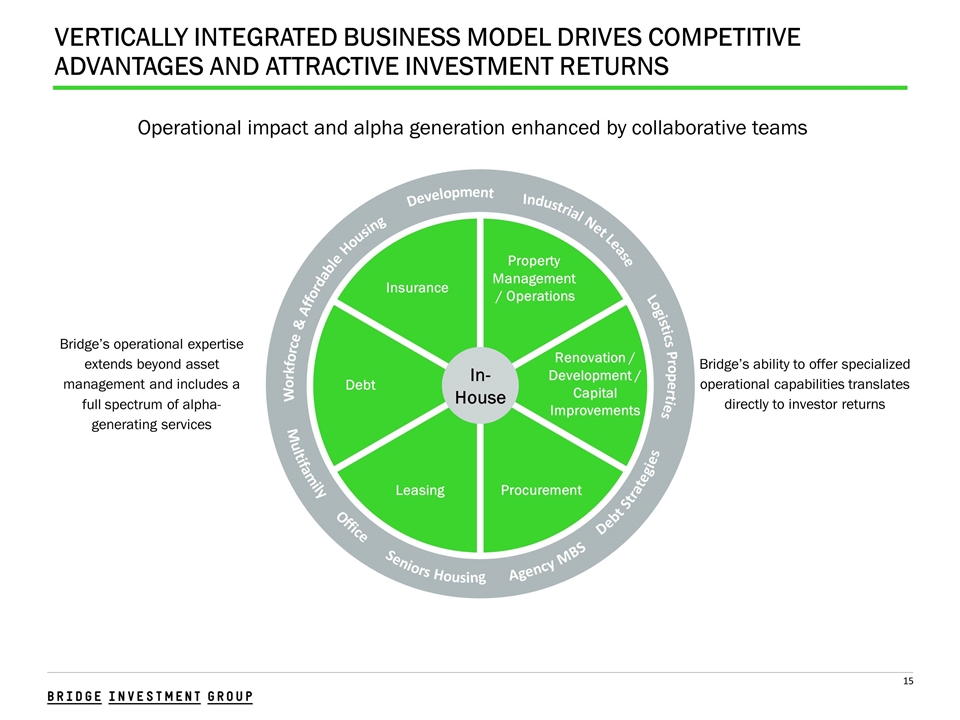

VERTICALLY INTEGRATED BUSINESS MODEL DRIVES COMPETITIVE ADVANTAGES AND ATTRACTIVE INVESTMENT RETURNS Operational impact and alpha generation enhanced by collaborative teams Bridge’s operational expertise extends beyond asset management and includes a full spectrum of alpha-generating services Bridge’s ability to offer specialized operational capabilities translates directly to investor returns 18 Workforce & Affordable Housing Development Industrial Net Lease Agency MBS Office Multifamily Seniors Housing In-House Logistics Properties Debt Strategies Logistics Property Management / Operations Renovation / Development / Capital Improvements Debt Procurement Insurance Leasing

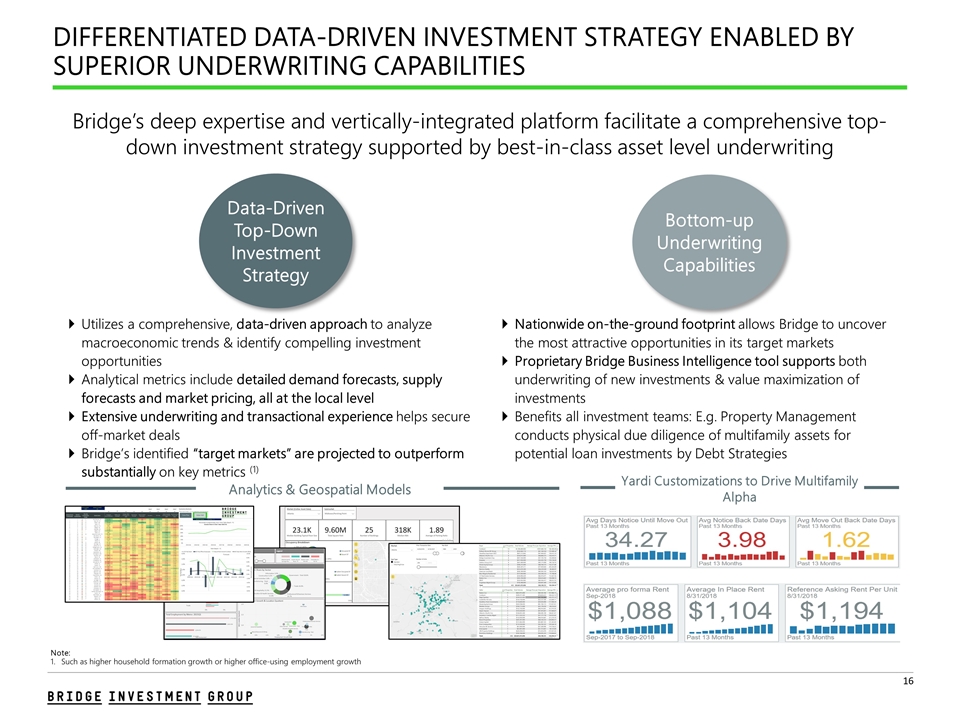

DIFFERENTIATED DATA-DRIVEN INVESTMENT STRATEGY ENABLED BY SUPERIOR UNDERWRITING CAPABILITIES 9 Bridge’s deep expertise and vertically-integrated platform facilitate a comprehensive top-down investment strategy supported by best-in-class asset level underwriting Data-Driven Top-Down Investment Strategy Bottom-up Underwriting Capabilities Note: Such as higher household formation growth or higher office-using employment growth Nationwide on-the-ground footprint allows Bridge to uncover the most attractive opportunities in its target markets Proprietary Bridge Business Intelligence tool supports both underwriting of new investments & value maximization of investments Benefits all investment teams: E.g. Property Management conducts physical due diligence of multifamily assets for potential loan investments by Debt Strategies Utilizes a comprehensive, data-driven approach to analyze macroeconomic trends & identify compelling investment opportunities Analytical metrics include detailed demand forecasts, supply forecasts and market pricing, all at the local level Extensive underwriting and transactional experience helps secure off-market deals Bridge’s identified “target markets” are projected to outperform substantially on key metrics (1) Analytics & Geospatial Models Yardi Customizations to Drive Multifamily Alpha

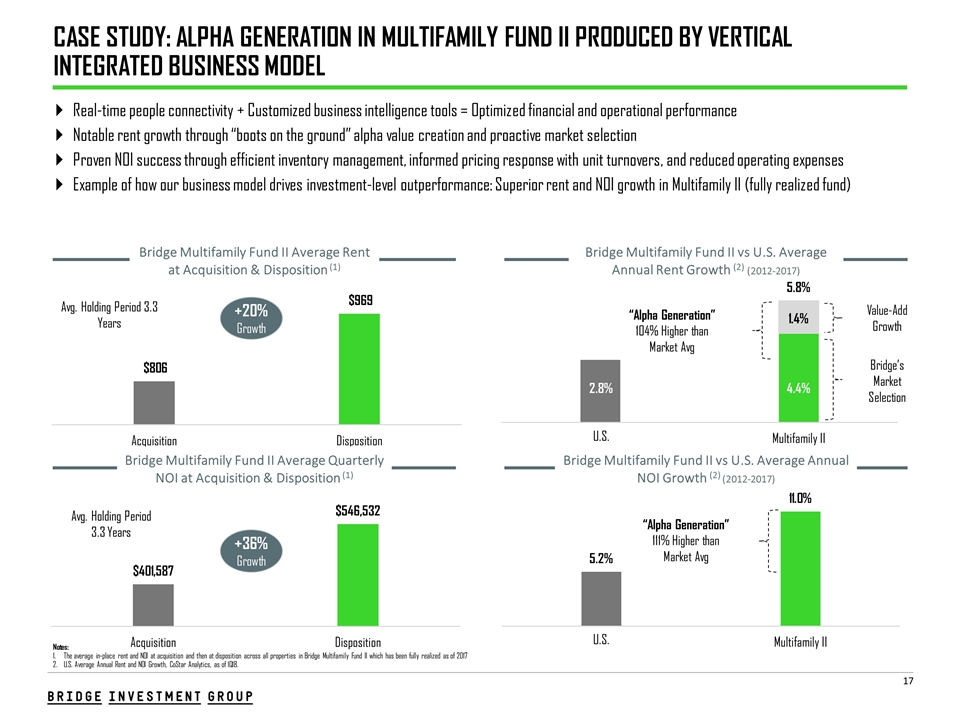

Notes: The average in-place rent and NOI at acquisition and then at disposition across all properties in Bridge Multifamily Fund II which has been fully realized as of 2017 U.S. Average Annual Rent and NOI Growth, CoStar Analytics, as of 1Q18. Bridge Multifamily Fund II vs U.S. Average Annual Rent Growth (2) (2012-2017) CASE STUDY: ALPHA GENERATION IN MULTIFAMILY FUND II PRODUCED BY VERTICAL INTEGRATED BUSINESS MODEL Real-time people connectivity + Customized business intelligence tools = Optimized financial and operational performance Notable rent growth through “boots on the ground” alpha value creation and proactive market selection Proven NOI success through efficient inventory management, informed pricing response with unit turnovers, and reduced operating expenses Example of how our business model drives investment-level outperformance: Superior rent and NOI growth in Multifamily II (fully realized fund) Bridge’s Market Selection Value-Add Growth Avg. Holding Period 3.3 Years “Alpha Generation” 104% Higher than Market Avg 1.4% 4.4% 2.8% Avg. Holding Period 3.3 Years “Alpha Generation” 111% Higher than Market Avg Bridge Multifamily Fund II Average Rent at Acquisition & Disposition (1) Bridge Multifamily Fund II vs U.S. Average Annual NOI Growth (2) (2012-2017) Bridge Multifamily Fund II Average Quarterly NOI at Acquisition & Disposition (1) +20% Growth +36% Growth 5.8% U.S. U.S.

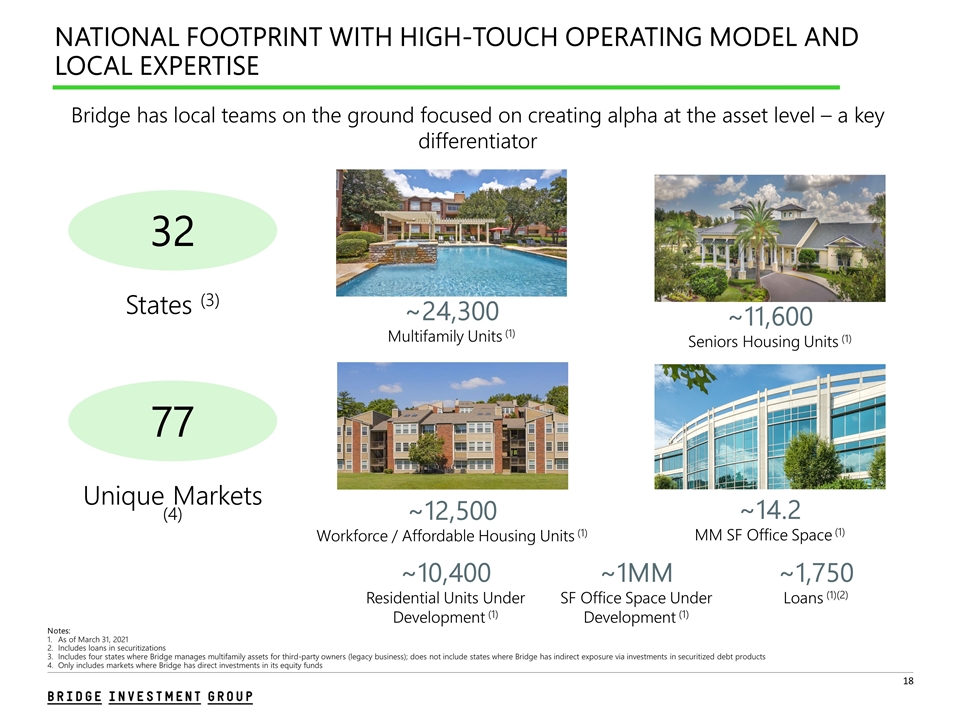

19 Notes: As of March 31, 2021 Includes loans in securitizations Includes four states where Bridge manages multifamily assets for third-party owners (legacy business); does not include states where Bridge has indirect exposure via investments in securitized debt products Only includes markets where Bridge has direct investments in its equity funds ~24,300 Multifamily Units (1) ~12,500 Workforce / Affordable Housing Units (1) ~11,600 Seniors Housing Units (1) ~14.2 MM SF Office Space (1) ~10,400 Residential Units Under Development (1) ~1MM SF Office Space Under Development (1) ~1,750 Loans (1)(2) NATIONAL FOOTPRINT WITH HIGH-TOUCH OPERATING MODEL AND LOCAL EXPERTISE Bridge has local teams on the ground focused on creating alpha at the asset level – a key differentiator 77 Unique Markets (4) 32 States (3)

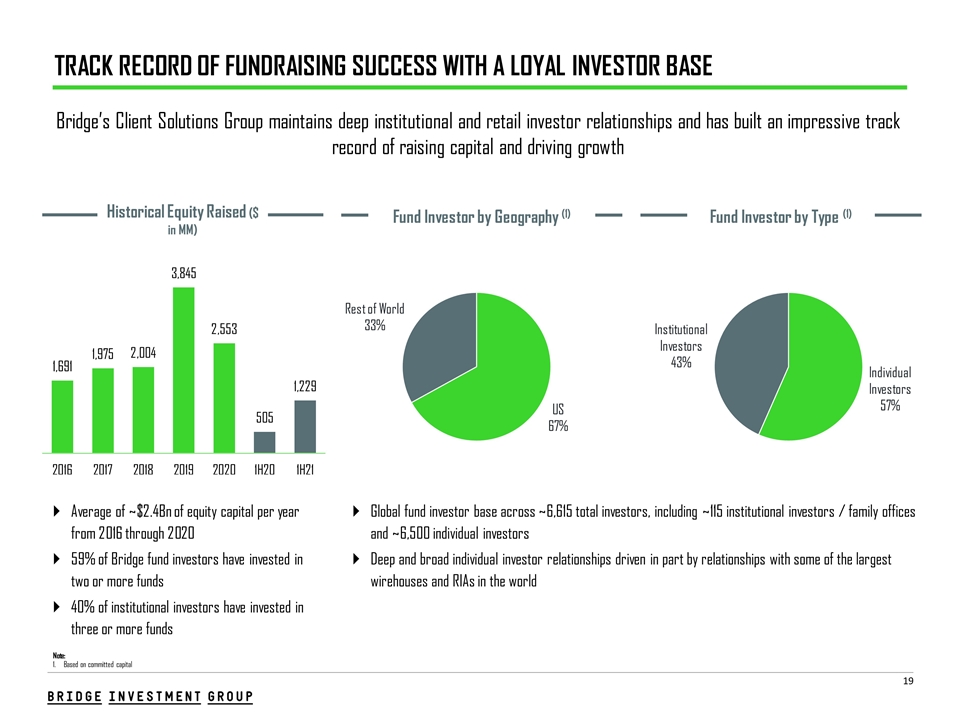

21 TRACK RECORD OF FUNDRAISING SUCCESS WITH A LOYAL INVESTOR BASE Average of ~$2.4Bn of equity capital per year from 2016 through 2020 59% of Bridge fund investors have invested in two or more funds 40% of institutional investors have invested in three or more funds Global fund investor base across ~6,615 total investors, including ~115 institutional investors / family offices and ~6,500 individual investors Deep and broad individual investor relationships driven in part by relationships with some of the largest wirehouses and RIAs in the world Fund Investor by Geography (1) Fund Investor by Type (1) Historical Equity Raised ($ in MM) Bridge’s Client Solutions Group maintains deep institutional and retail investor relationships and has built an impressive track record of raising capital and driving growth Note: Based on committed capital

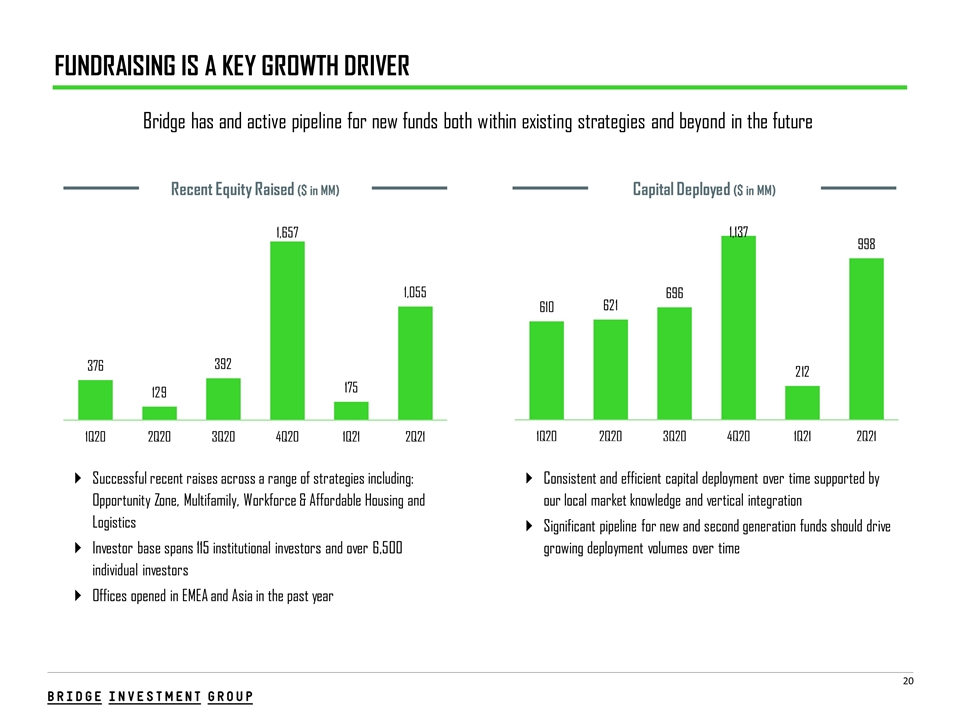

21 FUNDRAISING IS A KEY GROWTH DRIVER Successful recent raises across a range of strategies including: Opportunity Zone, Multifamily, Workforce & Affordable Housing and Logistics Investor base spans 115 institutional investors and over 6,500 individual investors Offices opened in EMEA and Asia in the past year Recent Equity Raised ($ in MM) Bridge has and active pipeline for new funds both within existing strategies and beyond in the future Capital Deployed ($ in MM) Consistent and efficient capital deployment over time supported by our local market knowledge and vertical integration Significant pipeline for new and second generation funds should drive growing deployment volumes over time

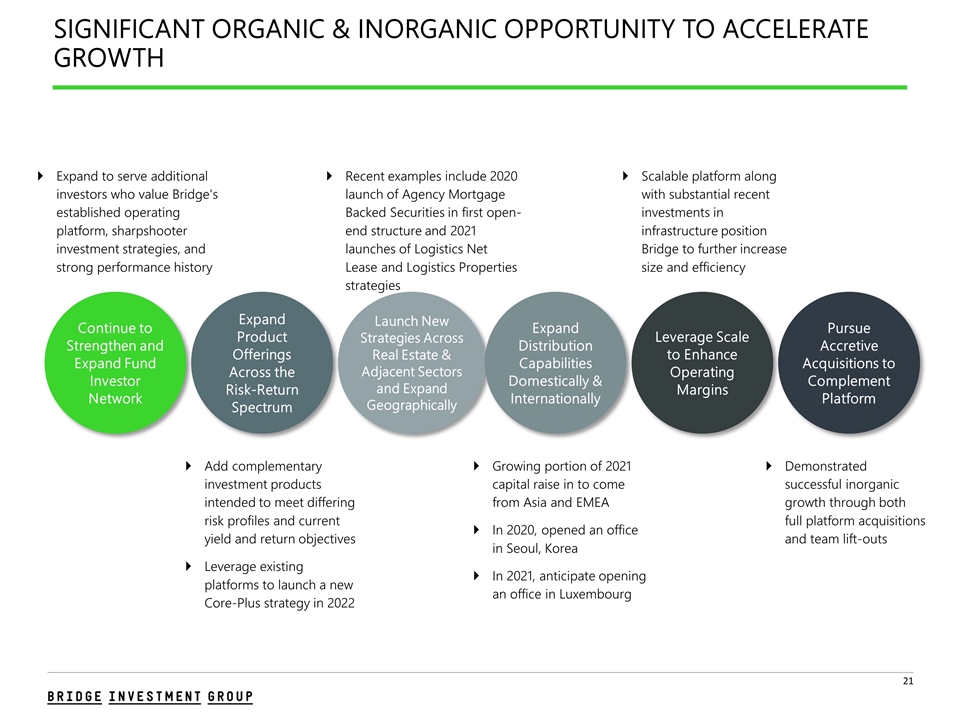

23 SIGNIFICANT ORGANIC & INORGANIC OPPORTUNITY TO ACCELERATE GROWTH Continue to Strengthen and Expand Fund Investor Network Expand Product Offerings Across the Risk-Return Spectrum Launch New Strategies Across Real Estate & Adjacent Sectors and Expand Geographically Leverage Scale to Enhance Operating Margins Pursue Accretive Acquisitions to Complement Platform Expand Distribution Capabilities Domestically & Internationally Expand to serve additional investors who value Bridge's established operating platform, sharpshooter investment strategies, and strong performance history Add complementary investment products intended to meet differing risk profiles and current yield and return objectives Leverage existing platforms to launch a new Core-Plus strategy in 2022 Growing portion of 2021 capital raise in to come from Asia and EMEA In 2020, opened an office in Seoul, Korea In 2021, anticipate opening an office in Luxembourg Demonstrated successful inorganic growth through both full platform acquisitions and team lift-outs Recent examples include 2020 launch of Agency Mortgage Backed Securities in first open-end structure and 2021 launches of Logistics Net Lease and Logistics Properties strategies Scalable platform along with substantial recent investments in infrastructure position Bridge to further increase size and efficiency

2nd Quarter Financial Review

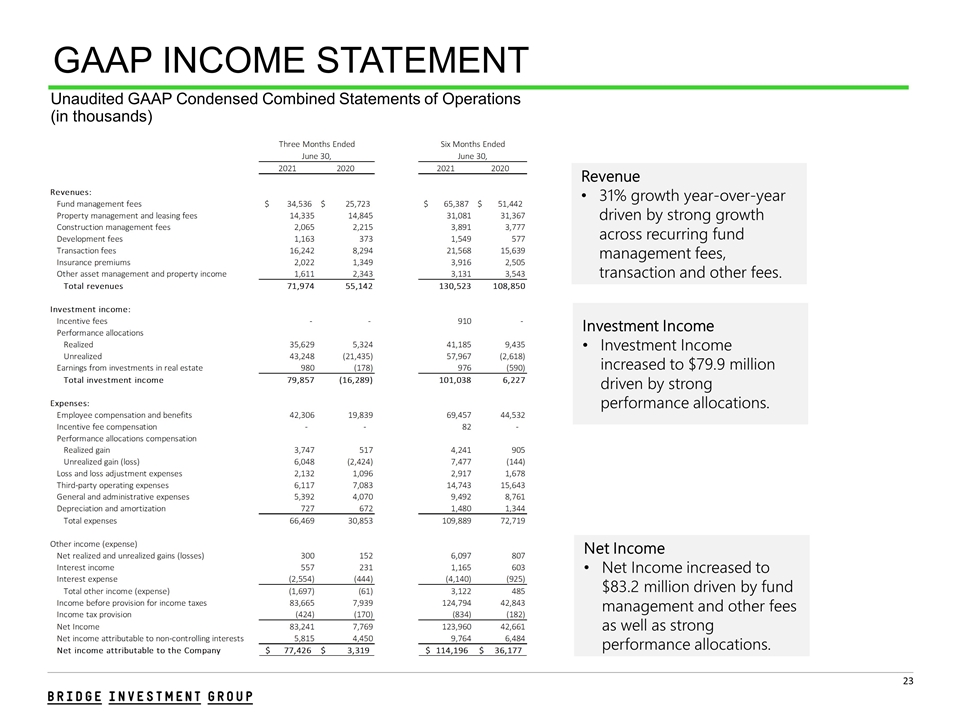

GAAP INCOME STATEMENT Unaudited GAAP Condensed Combined Statements of Operations (in thousands) Revenue 31% growth year-over-year driven by strong growth across recurring fund management fees, transaction and other fees. Investment Income Investment Income increased to $79.9 million driven by strong performance allocations. Net Income Net Income increased to $83.2 million driven by fund management and other fees as well as strong performance allocations.

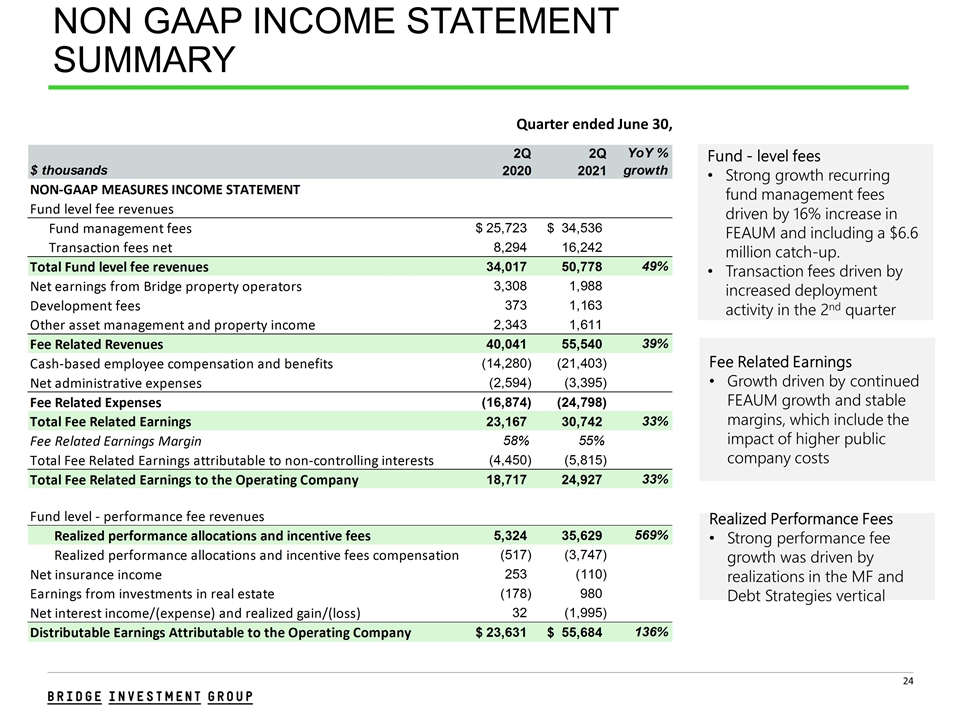

NON GAAP INCOME STATEMENT SUMMARY 1 Quarter ended June 30, Fee Related Earnings Growth driven by continued FEAUM growth and stable margins, which include the impact of higher public company costs Fund - level fees Strong growth recurring fund management fees driven by 16% increase in FEAUM and including a $6.6 million catch-up. Transaction fees driven by increased deployment activity in the 2nd quarter Realized Performance Fees Strong performance fee growth was driven by realizations in the MF and Debt Strategies vertical

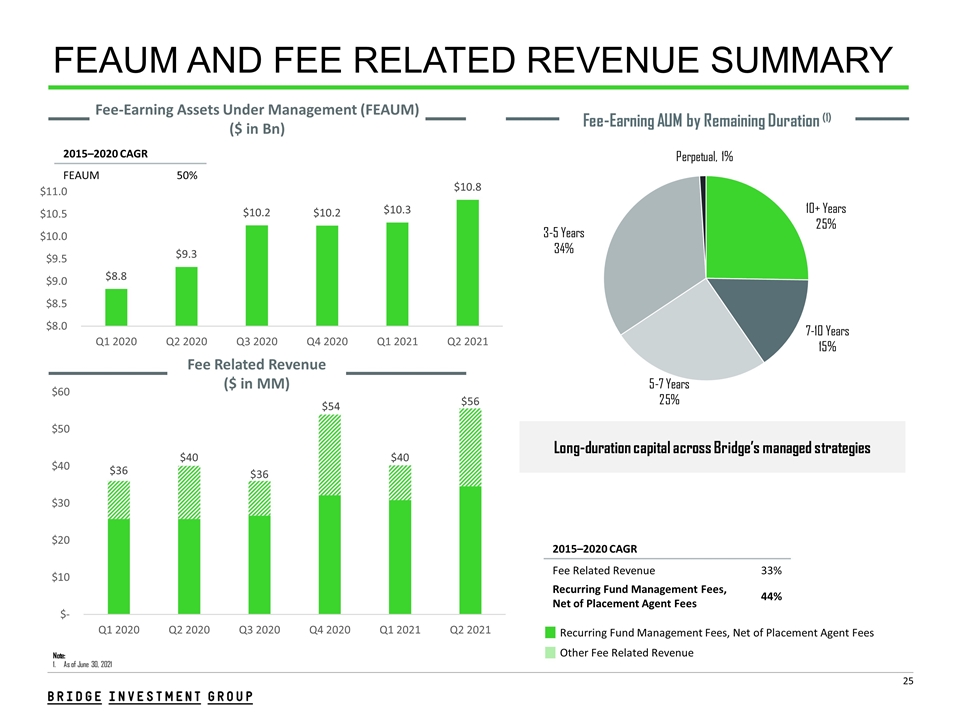

10 FEAUM AND FEE RELATED REVENUE SUMMARY Recurring Fund Management Fees, Net of Placement Agent Fees Fee-Earning Assets Under Management (FEAUM) ($ in Bn) Fee Related Revenue ($ in MM) Other Fee Related Revenue 2015–2020 CAGR FEAUM 50% 2015–2020 CAGR Fee Related Revenue 33% Recurring Fund Management Fees, Net of Placement Agent Fees 44% Fee-Earning AUM by Remaining Duration (1) Long-duration capital across Bridge’s managed strategies Note: As of June 30, 2021

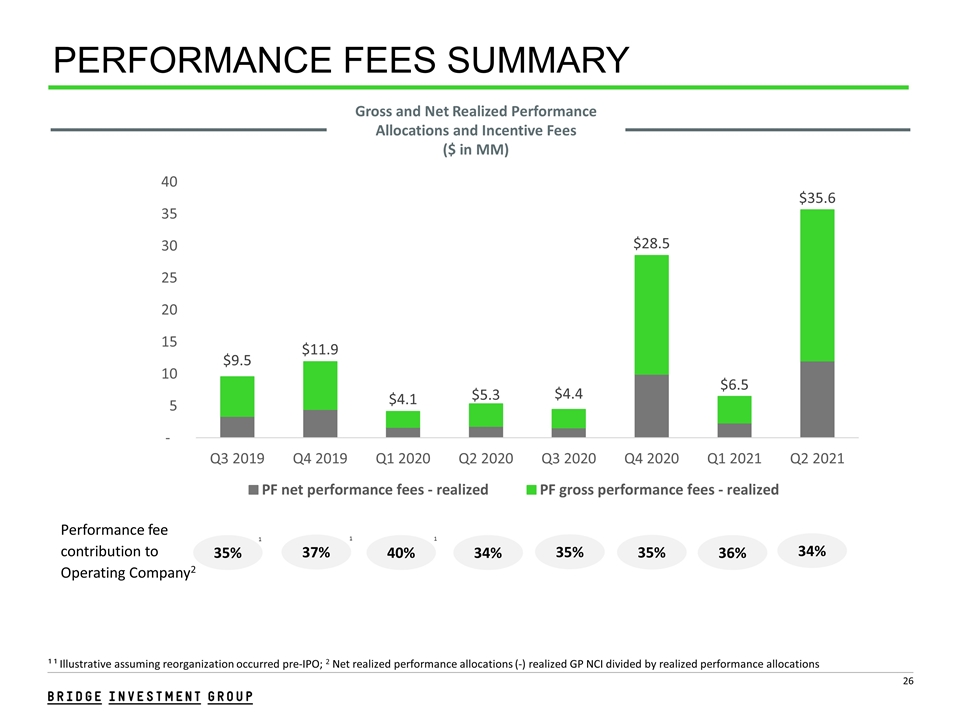

PERFORMANCE FEES SUMMARY 1 Gross and Net Realized Performance Allocations and Incentive Fees ($ in MM) Performance fee contribution to Operating Company2 35% ¹ ¹ Illustrative assuming reorganization occurred pre-IPO; 2 Net realized performance allocations (-) realized GP NCI divided by realized performance allocations 1 37% 1 40% 1 34% 35% 35% 36% 34%

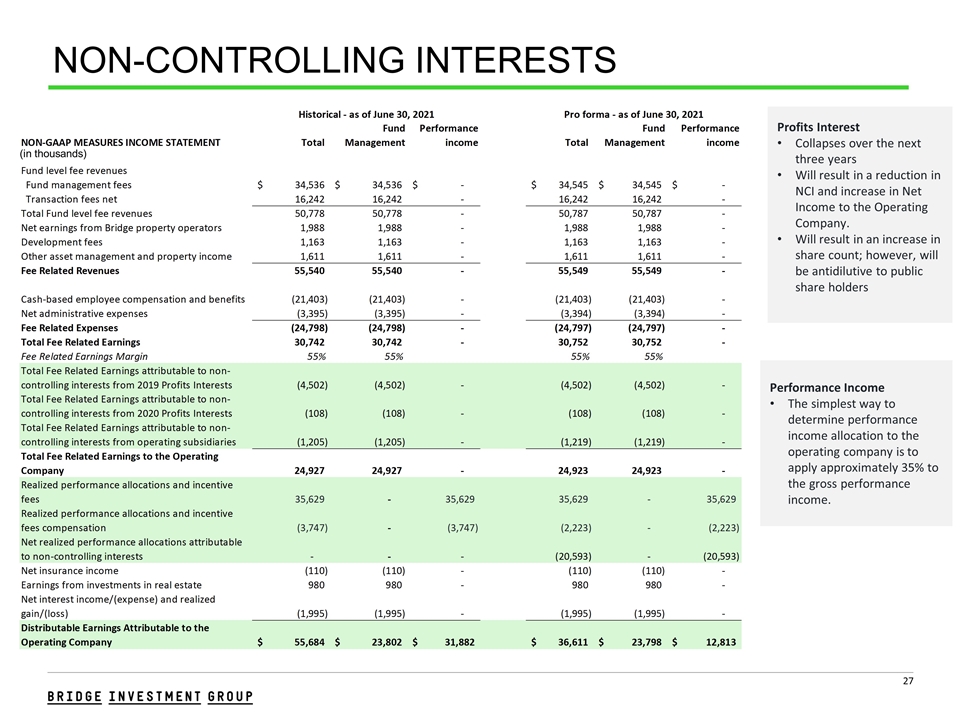

NON-CONTROLLING INTERESTS 1 Performance Income The simplest way to determine performance income allocation to the operating company is to apply approximately 35% to the gross performance income. Profits Interest Collapses over the next three years Will result in a reduction in NCI and increase in Net Income to the Operating Company. Will result in an increase in share count; however, will be antidilutive to public share holders (in thousands)

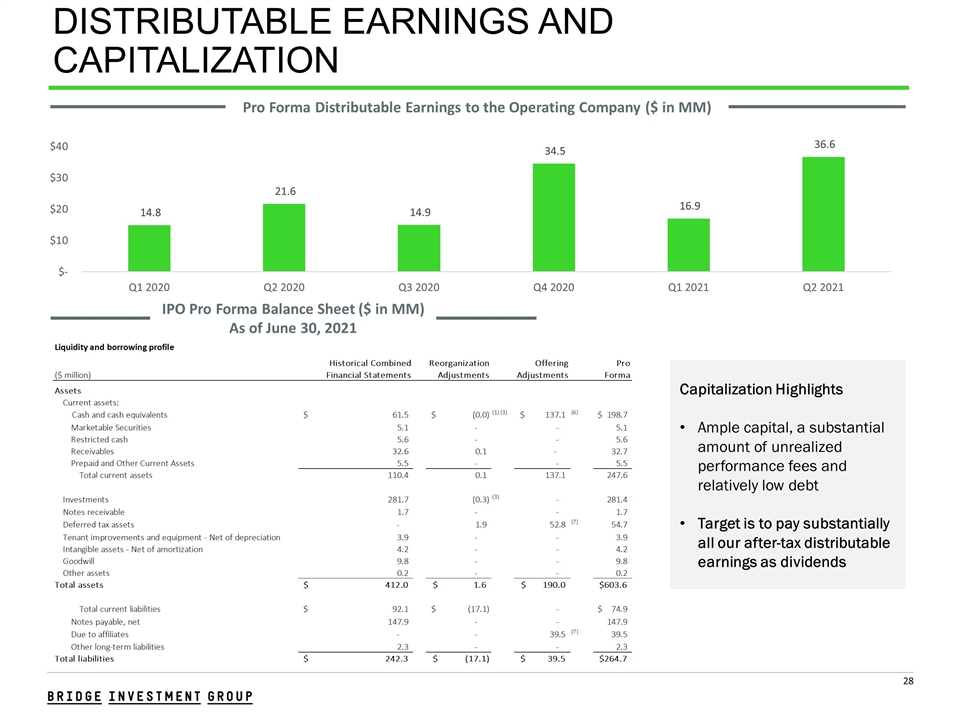

DISTRIBUTABLE EARNINGS AND CAPITALIZATION 1 IPO Pro Forma Balance Sheet ($ in MM) As of June 30, 2021 Pro Forma Distributable Earnings to the Operating Company ($ in MM) Capitalization Highlights Ample capital, a substantial amount of unrealized performance fees and relatively low debt Target is to pay substantially all our after-tax distributable earnings as dividends

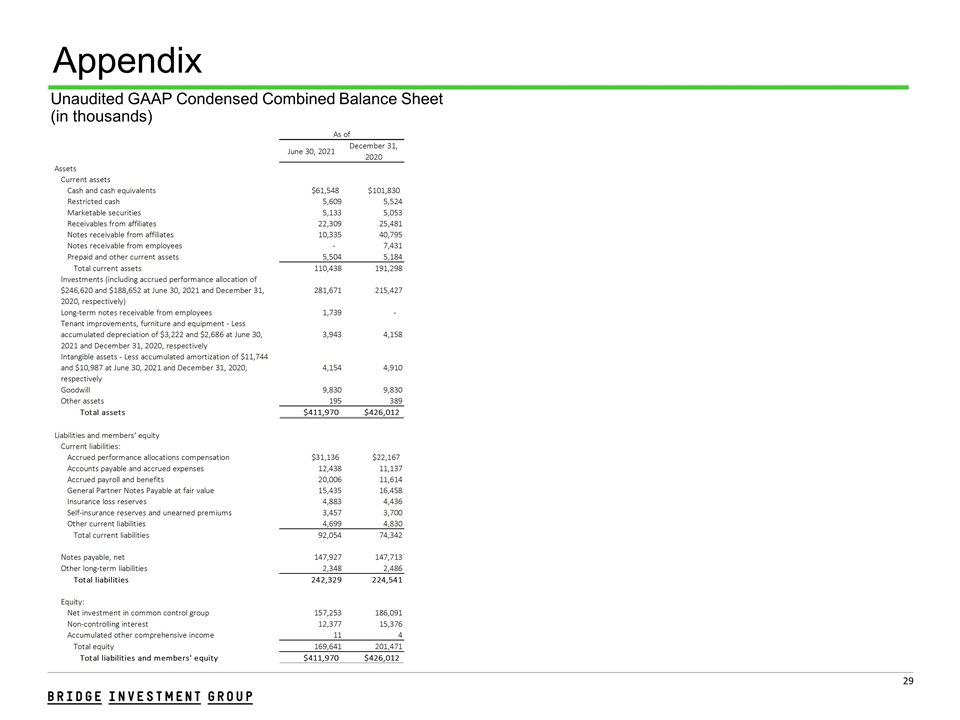

Appendix Unaudited GAAP Condensed Combined Balance Sheet (in thousands)

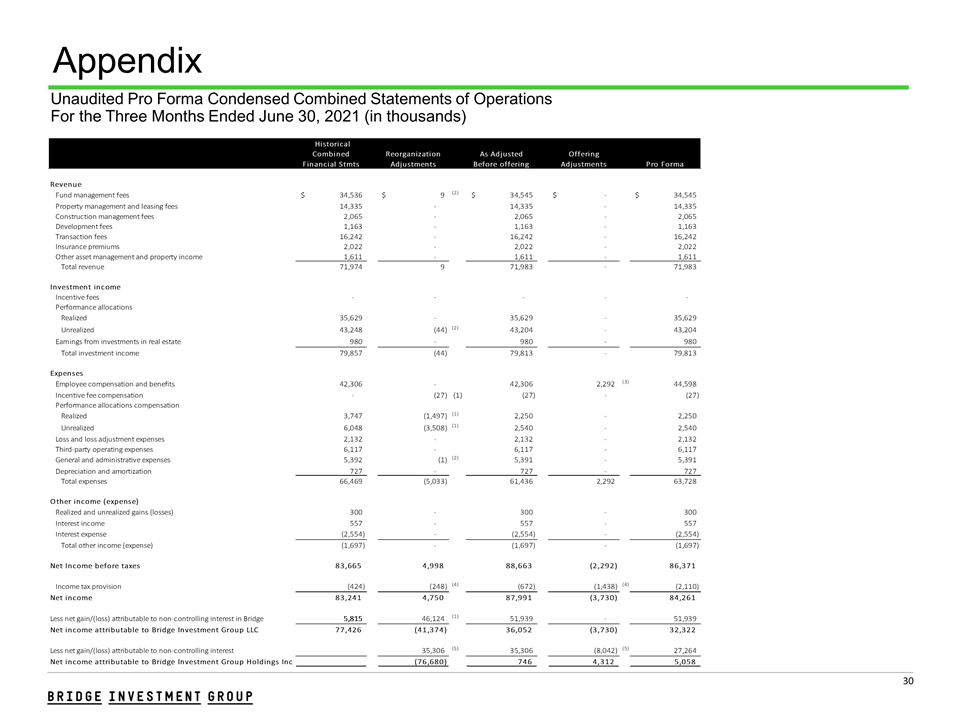

Appendix Unaudited Pro Forma Condensed Combined Statements of Operations For the Three Months Ended June 30, 2021 (in thousands)

Appendix Notes to Unaudited Pro Forma Condensed Combined Statements of Operations and Other Data Please see the Unaudited Pro Forma Condensed Financial Information included in the Form S-1 for more information. Represents the contribution of the Contributed GP Entities to Bridge Investment Group Holdings Inc. Represents the derecognition of equity interests in BDS I GP. As part of the IPO, the Company granted 2,193,993 shares of restricted stock that vest over a five-year period to employees. This adjustment reflects compensation expense associated with this grant had it occurred at the beginning of the year presented. Assumes blended statutory tax rate of 25% at Bridge Investment Group Holdings Inc., which was calculated assuming the U.S. federal rates currently in effect and the statutory rates applicable to each state, local and foreign jurisdiction where we estimate our income will be apportioned. Assumes that the underwriters do not exercise their option to purchase additional shares of Class A common stock, Bridge Investment Group Holdings Inc. will own 19.8% of the economic interest of the Operating Company, and the Continuing Equity Owners of the Operating Company will own the remaining 80.2%.

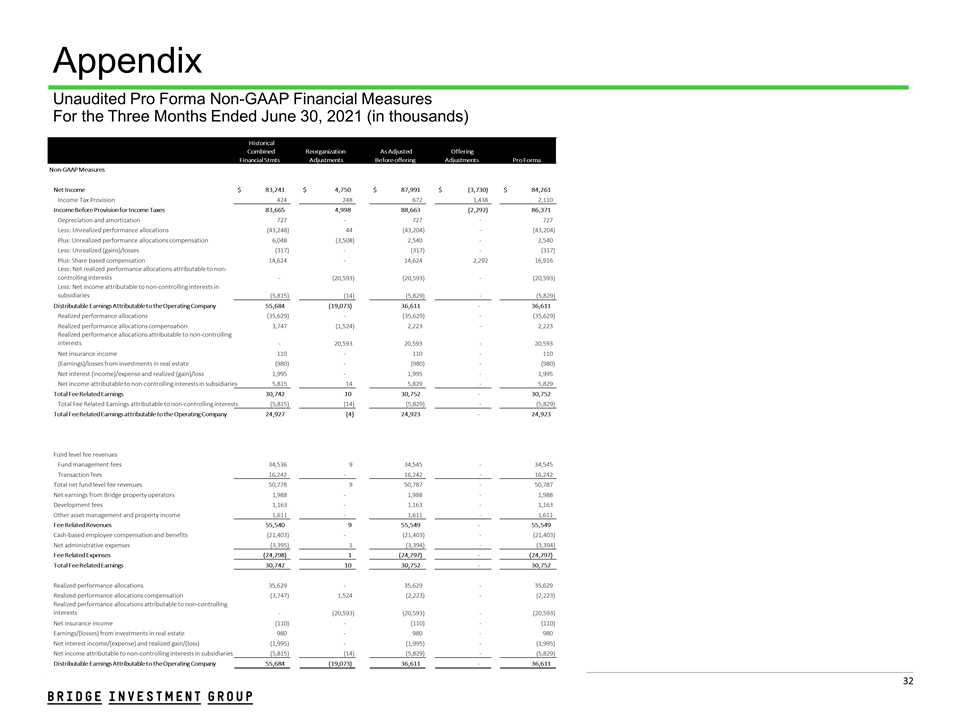

Appendix Unaudited Pro Forma Non-GAAP Financial Measures For the Three Months Ended June 30, 2021 (in thousands) Historical Combined Financial Stmts Reorganization Adjustments As Adjusted Before offering Offering Adjustments Pro Forma Non-GAAP Measures Net Income 83,241 $ 4,750 $ 87,991 $ (3,730) $ 84,261 $ Income Tax Provision 424 248 672 1,438 2,110 Income Before Provision for Income Taxes 83,665 4,998 88,663 (2,292) 86,371 Depreciation and amortization 727 - 727 - 727 Less: Unrealized performance allocations (43,248) 44 (43,204) - (43,204) Plus: Unrealized performance allocations compensation 6,048 (3,508) 2,540 - 2,540 Less: Unrealized (gains)/losses (317) - (317) - (317) Plus: Share based compensation 14,624 - 14,624 2,292 16,916 Less: Net realized performance allocations attributable to non- controlling interests - (20,593) (20,593) - (20,593) Less: Net income attributable to non-controlling interests in subsidiaries (5,815) (14) (5,829) - (5,829) Distributable Earnings Attributable to the Operating Company 55,684 (19,073) 36,611 - 36,611 Realized performance allocations (35,629) - (35,629) - (35,629) Realized performance allocations compensation 3,747 (1,524) 2,223 - 2,223 Realized performance allocations attributable to non-controlling interests - 20,593 20,593 - 20,593 Net insurance income 110 - 110 - 110 (Earnings)/losses from investments in real estate (980) - (980) - (980) Net interest (income)/expense and realized (gain)/loss 1,995 - 1,995 - 1,995 Net income attributable to non-controlling interests in subsidiaries 5,815 14 5,829 - 5,829 Total Fee Related Earnings 30,742 10 30,752 - 30,752 Total Fee Related Earnings attributable to non-controlling interests (5,815) (14) (5,829) - (5,829) Total Fee Related Earnings attributable to the Operating Company 24,927 (4) 24,923 - 24,923 Fund level fee revenues Fund management fees 34,536 9 34,545 - 34,545 Transaction fees 16,242 - 16,242 - 16,242 Total net fund level fee revenues 50,778 9 50,787 - 50,787 Net earnings from Bridge property operators 1,988 - 1,988 - 1,988 Development fees 1,163 - 1,163 - 1,163 Other asset management and property income 1,611 - 1,611 - 1,611 Fee Related Revenues 55,540 9 55,549 - 55,549 Cash-based employee compensation and benefits (21,403) - (21,403) - (21,403) Net administrative expenses (3,395) 1 (3,394) - (3,394) Fee Related Expenses (24,798) 1 (24,797) - (24,797) Total Fee Related Earnings 30,742 10 30,752 - 30,752 Realized performance allocations 35,629 - 35,629 - 35,629 Realized performance allocations compensation (3,747) 1,524 (2,223) - (2,223) Realized performance allocations attributable to non-controlling interests - (20,593) (20,593) - (20,593) Net insurance income (110) - (110) - (110) Earnings/(losses) from investments in real estate 980 - 980 - 980 Net interest income/(expense) and realized gain/(loss) (1,995) - (1,995) - (1,995) Net income attributable to non-controlling interests in subsidiaries (5,815) (14) (5,829) - (5,829) Distributable Earnings Attributable to the Operating Company 55,684 (19,073) 36,611 - 36,611

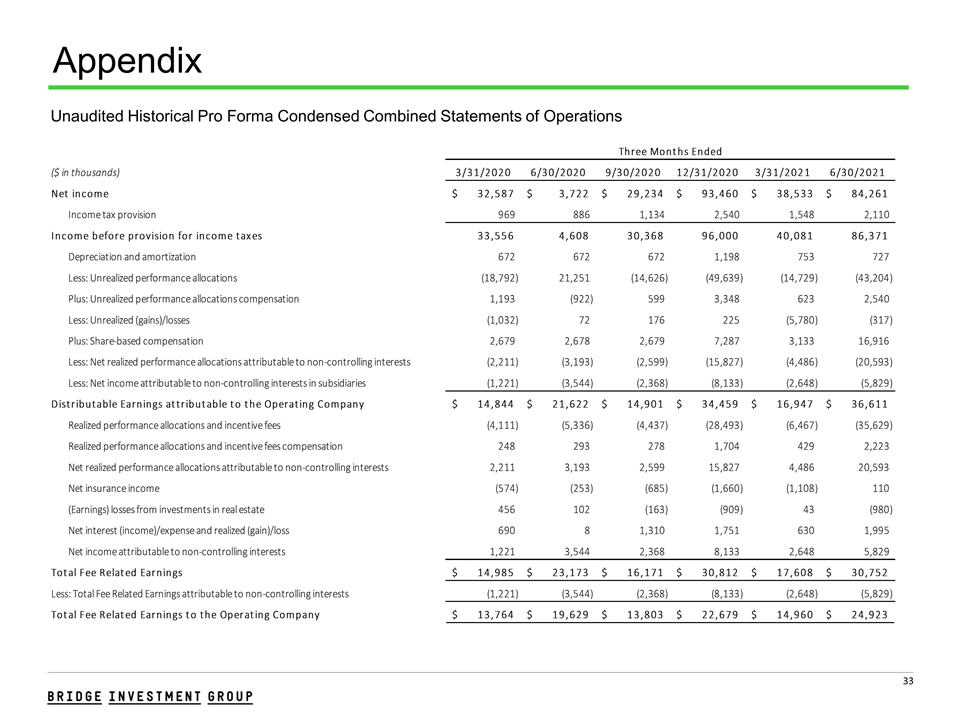

Appendix Unaudited Historical Pro Forma Condensed Combined Statements of Operations

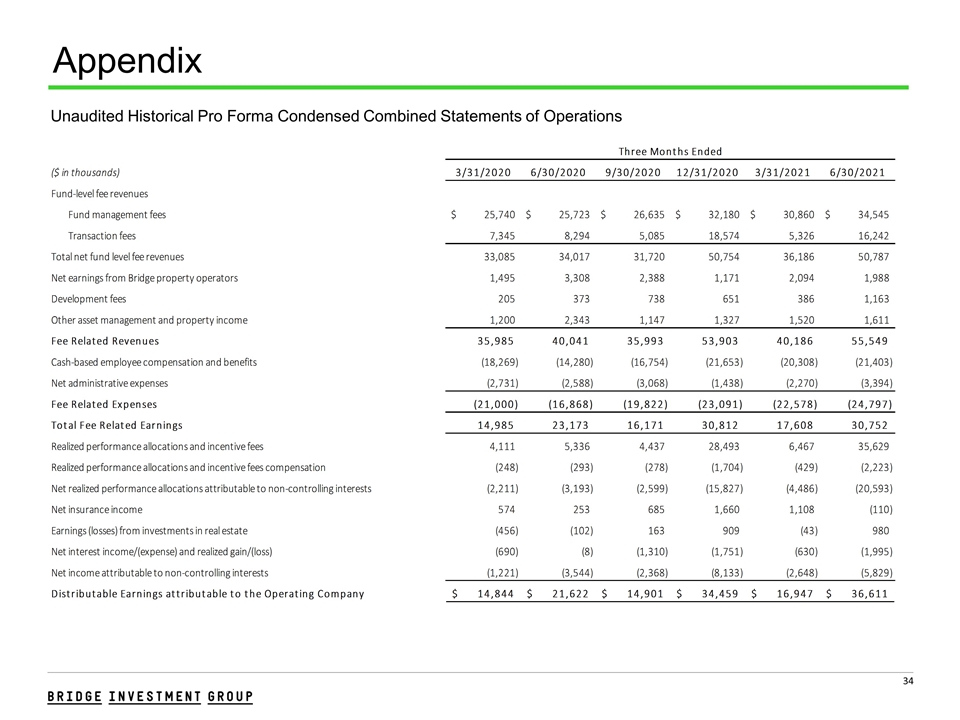

Appendix Unaudited Historical Pro Forma Condensed Combined Statements of Operations

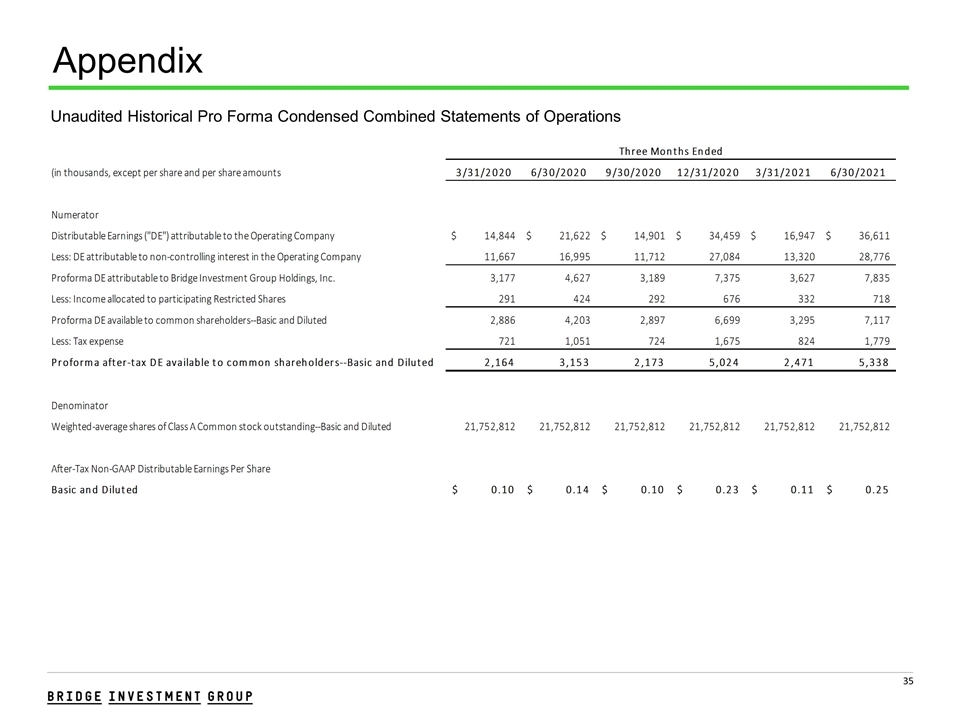

Appendix Unaudited Historical Pro Forma Condensed Combined Statements of Operations

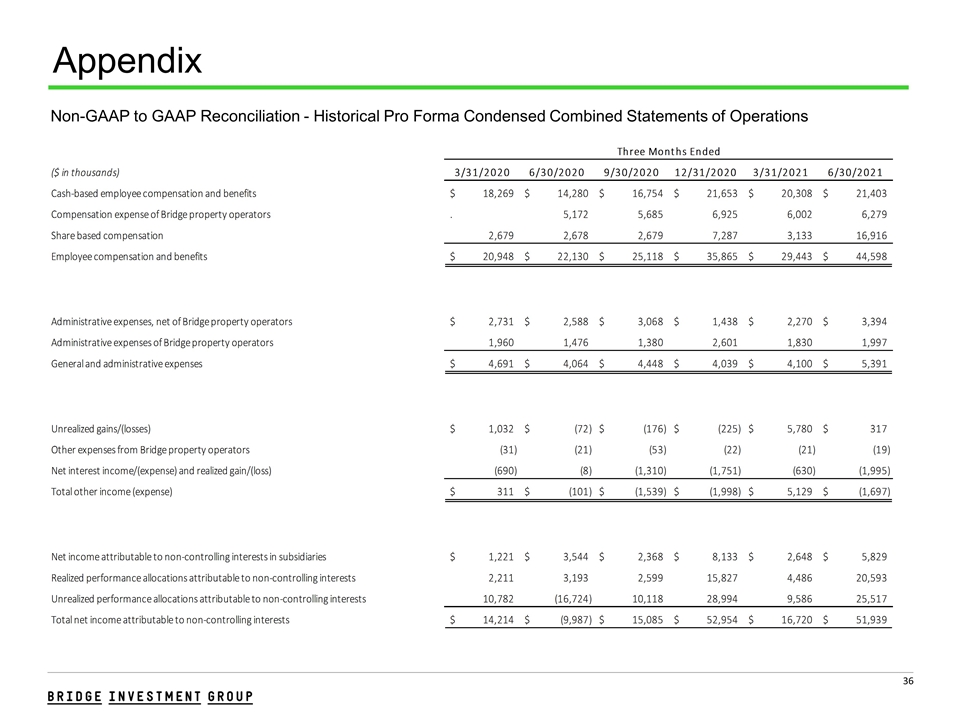

Appendix Non-GAAP to GAAP Reconciliation - Historical Pro Forma Condensed Combined Statements of Operations

Glossary Assets Under Management Assets under management, or AUM, represents the sum of (a) the fair value of the assets of the funds and vehicles we manage, plus (b) the contractual amount of any uncalled capital commitments to those funds and vehicles (including our commitments to the funds and vehicles and those of Bridge affiliates). Our AUM is not reduced by any outstanding indebtedness or other accrued but unpaid liabilities of the assets we manage. Our calculations of AUM and fee-earning AUM may differ from the calculations of other investment managers. As a result, these measures may not be comparable to similar measures presented by other investment managers. In addition, our calculation of AUM (but not fee-earning AUM) includes uncalled commitments to (and the fair value of the assets in) the funds and vehicles we manage from Bridge and Bridge affiliates, regardless of whether such commitments or investments are subject to fees. Our definition of AUM is not based on any definition contained in the agreements governing the funds and vehicles we manage or advise. Distributable Earnings Distributable Earnings, or DE, is a key performance measure used in our industry and is evaluated regularly by management in making resource deployment and compensation decisions, and in assessing our performance. DE differs from net income before provision for income taxes, computed in accordance with U.S. GAAP in that it does not include depreciation and amortization, unrealized performance allocations and related compensation expense, unrealized gains (losses), share-based compensation, net income attributable to non-controlling interests, charges (credits) related to corporate actions and non-recurring items. Although we believe the inclusion or exclusion of these items provides investors with a meaningful indication of our core operating performance, the use of DE without consideration of the related U.S. GAAP measures is not adequate due to the adjustments described herein. This measure supplements and should be considered in addition to and not in lieu of the results of operations discussed further under “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Key Components of our Results of Operations—Combined Results of Operations” prepared in accordance with U.S. GAAP. Our calculations of DE may differ from the calculations of other investment managers. As a result, these measures may not be comparable to similar measures presented by other investment managers. Fee-Earning AUM Fee-Earning AUM, or FEAUM, reflects the assets from which we earn management fee revenue. The assets we manage that are included in our FEAUM typically pay management fees based on capital commitments, invested capital or, in certain cases, NAV, depending on the fee terms. Fee Related Earnings Fee Related Earnings, or FRE, is a supplemental performance measure used to assess our ability of to generate profits from fee-based revenues that are measured and received on a recurring basis. FRE differs from income before provision for income taxes computed in accordance with U.S. GAAP in that it adjusts for the items included in the calculation of Distributable Earnings, and also adjusts Distributable Earnings to exclude realized performance allocations income, net insurance income, earnings from investments in real estate, net interest (interest income less interest expense), net realized gain/(loss), and, if applicable, certain general and administrative expenses when the timing of any future payment is uncertain. FRE is not a measure of performance calculated in accordance with U.S. GAAP. The use of FRE without consideration of the related U.S. GAAP measures is not adequate due to the adjustments described herein. Our calculations of FRE may differ from the calculations of other investment managers. As a result, these measures may not be comparable to similar measures presented by other investment managers.

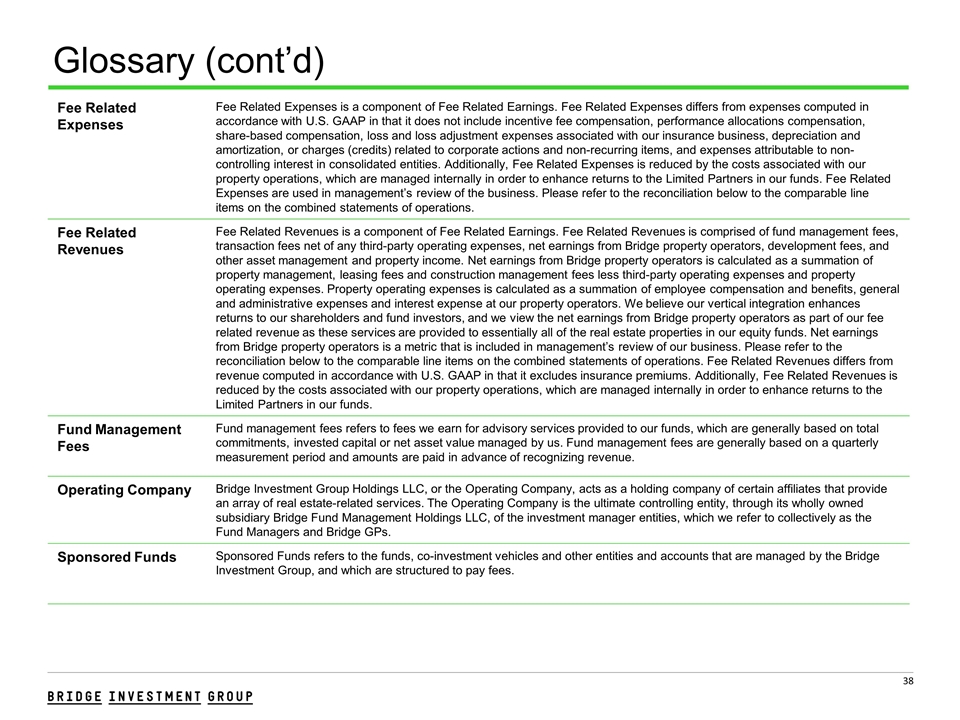

Glossary (cont’d) Fee Related Expenses Fee Related Expenses is a component of Fee Related Earnings. Fee Related Expenses differs from expenses computed in accordance with U.S. GAAP in that it does not include incentive fee compensation, performance allocations compensation, share-based compensation, loss and loss adjustment expenses associated with our insurance business, depreciation and amortization, or charges (credits) related to corporate actions and non-recurring items, and expenses attributable to non-controlling interest in consolidated entities. Additionally, Fee Related Expenses is reduced by the costs associated with our property operations, which are managed internally in order to enhance returns to the Limited Partners in our funds. Fee Related Expenses are used in management’s review of the business. Please refer to the reconciliation below to the comparable line items on the combined statements of operations. Fee Related Revenues Fee Related Revenues is a component of Fee Related Earnings. Fee Related Revenues is comprised of fund management fees, transaction fees net of any third-party operating expenses, net earnings from Bridge property operators, development fees, and other asset management and property income. Net earnings from Bridge property operators is calculated as a summation of property management, leasing fees and construction management fees less third-party operating expenses and property operating expenses. Property operating expenses is calculated as a summation of employee compensation and benefits, general and administrative expenses and interest expense at our property operators. We believe our vertical integration enhances returns to our shareholders and fund investors, and we view the net earnings from Bridge property operators as part of our fee related revenue as these services are provided to essentially all of the real estate properties in our equity funds. Net earnings from Bridge property operators is a metric that is included in management’s review of our business. Please refer to the reconciliation below to the comparable line items on the combined statements of operations. Fee Related Revenues differs from revenue computed in accordance with U.S. GAAP in that it excludes insurance premiums. Additionally, Fee Related Revenues is reduced by the costs associated with our property operations, which are managed internally in order to enhance returns to the Limited Partners in our funds. Fund Management Fees Fund management fees refers to fees we earn for advisory services provided to our funds, which are generally based on total commitments, invested capital or net asset value managed by us. Fund management fees are generally based on a quarterly measurement period and amounts are paid in advance of recognizing revenue. Operating Company Bridge Investment Group Holdings LLC, or the Operating Company, acts as a holding company of certain affiliates that provide an array of real estate-related services. The Operating Company is the ultimate controlling entity, through its wholly owned subsidiary Bridge Fund Management Holdings LLC, of the investment manager entities, which we refer to collectively as the Fund Managers and Bridge GPs. Sponsored Funds Sponsored Funds refers to the funds, co-investment vehicles and other entities and accounts that are managed by the Bridge Investment Group, and which are structured to pay fees.