Filed Pursuant to Rule 424(b)(4)

Registration No. 333-257290

18,750,000 Shares

Class A Common Stock

Bridge Investment Group Holdings Inc.

This is an initial public offering of shares of Class A common stock of Bridge Investment Group Holdings Inc. We are selling 18,750,000 shares of Class A common stock.

Prior to this offering, there has been no public market for the Class A common stock. We have been approved to list our Class A common stock on the New York Stock Exchange, or NYSE, under the symbol “BRDG.”

We will have two classes of common stock outstanding after this offering: Class A common stock and Class B common stock. Each share of our Class A common stock entitles its holder to one vote per share and each share of our Class B common stock entitles its holder to ten votes per share on all matters presented to our stockholders generally.

At our request, the underwriters have reserved up to 6.1% of the shares of Class A common stock to be issued by us and offered by this prospectus for sale, at the initial public offering price, to our directors, officers, employees, business associates and related persons through a directed share program. See “Underwriting” for more information.

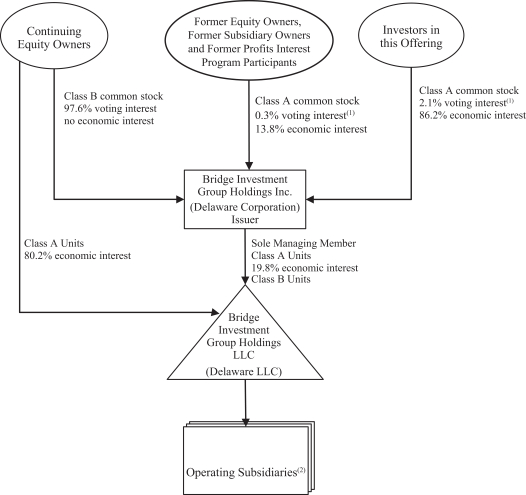

We will be a holding company, and upon consummation of this offering, our principal asset will consist of Class A Units (as defined below) that we will acquire indirectly from the Former Equity Owners (as defined below), the Former Subsidiary Owners (as defined below), the Former Profits Interest Program Participants (as defined below) and directly from Bridge Investment Group Holdings LLC with the net proceeds from this offering. Bridge Investment Group Holdings LLC will use a portion of the net proceeds from this offering to redeem the Class A Units of certain of the Original Equity Owners (as defined below). Certain holders of Class A Units received in exchange for existing membership interests in Bridge Investment Group Holdings LLC, whom we refer to as “Former Equity Owners,” will exchange (or transfer through a merger) their direct or indirect ownership of Class A Units for shares of Class A common stock and certain other holders of Class A Units, whom we refer to as “Continuing Equity Owners,” will continue to own their Class A Units. Certain of the current owners of our active general partners, which we refer to as the “Former Subsidiary Owners” will contribute a portion of their interests in such entities to us in exchange for shares of Class A common stock, and we will further contribute such interests to Bridge Investment Group Holdings LLC in exchange for Class A Units. In addition, certain individuals who hold existing awards under Bridge Investment Group Holdings LLC’s profits interest award program, whom we refer to as the “Former Profits Interest Program Participants,” will exchange such awards for Class A Units and restricted shares of Class A common stock with similar vesting requirements.

Immediately following this offering, the holders of our Class A common stock issued in this offering collectively will hold 86.2% of the economic interests in us and 2.1% of the voting power in us, the Former Equity Owners, the Former Subsidiary Owners and the Former Profits Interest Program Participants, through their ownership of Class A common stock, collectively will hold 13.8% of the economic interests in us and 0.3% of the voting power in us, and the Continuing Equity Owners, through their ownership of all of the outstanding Class B common stock, collectively will hold no economic interest in us and the remaining 97.6% of the voting power in us. We will be the sole managing member of Bridge Investment Group Holdings LLC. We will operate and control all of the business and affairs of Bridge Investment Group Holdings LLC and its direct and indirect subsidiaries and, through Bridge Investment Group Holdings LLC and its direct and indirect subsidiaries, conduct our business.

Following this offering, we will be a “controlled company” within the meaning of the NYSE rules. See “Our Organizational Structure” and “Management—Controlled Company Exception.”

We are an “emerging growth company,” as defined in Section 2(a) of the Securities Act of 1933, as amended, or the Securities Act, and will be subject to reduced disclosure and public reporting requirements. This prospectus complies with the requirements that apply to an issuer that is an emerging growth company.

Investing in our Class A common stock involves risks. See “Risk Factors” beginning on page 35 to read about factors you should consider before buying shares of our Class A common stock.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

| Per Share |

Total | |||||||

| Initial public offering price |

$ | 16.00 | $ | 300,000,000 | ||||

| Underwriting discounts and commissions(1) |

$ | 1.08 | $ | 20,250,000 | ||||

| Proceeds, before expenses, to Bridge Investment Group Holdings Inc. |

$ | 14.92 | $ | 279,750,000 | ||||

| (1) | We have agreed to reimburse the underwriters for certain expenses in connection with this offering. See “Underwriting.” |

The underwriters have the option to purchase up to an additional 2,812,500 shares of Class A common stock from us at the initial public offering price less the underwriting discounts and commissions within 30 days of the date of this prospectus.

The underwriters expect to deliver the shares of Class A common stock against payment in New York, New York on July 20, 2021.

| Morgan Stanley | J.P. Morgan | Citigroup | ||

|

Wells Fargo Securities UBS Investment Bank AmeriVet Securities C.L. King & Associates Siebert Williams Shank | ||||

Prospectus dated July 15, 2021.