UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☒ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material under §240.14a-12

Bridge Investment Group Holdings Inc.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

☒ No fee required

☐ Fee paid previously with preliminary materials

☐ Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11

Bridge Investment Group Holdings Inc.

NOTICE & PROXY STATEMENT

Annual Meeting of Stockholders

May 5, 2022

9:00 a.m. Eastern time (7:00 a.m. Mountain time)

BRIDGE INVESTMENT GROUP HOLDINGS INC.

111 East Sego Lily Drive, Suite 400

Salt Lake City, Utah 84070

March 24, 2022

To Our Stockholders:

You are cordially invited to attend the 2022 Annual Meeting of Stockholders (the “Annual Meeting”) of Bridge Investment Group Holdings Inc. at 9:00 a.m. Eastern time (7:00 a.m. Mountain time), on Thursday, May 5, 2022. The Annual Meeting will be a virtual meeting, which will be conducted via live webcast that will provide stockholders with the ability to participate in the Annual Meeting, vote their shares and ask questions.

The Notice of Meeting and Proxy Statement on the following pages describe the matters to be presented at the Annual Meeting. Please see the section called “Who can attend the Annual Meeting?” of the proxy statement for more information about how to attend the Annual Meeting online.

Whether or not you attend the Annual Meeting online, it is important that your shares be represented and voted at the Annual Meeting. Therefore, I urge you to promptly vote and submit your proxy by phone, via the Internet, or, if you received paper copies of these materials, by signing, dating and returning the enclosed proxy card in the enclosed envelope, which requires no postage if mailed in the United States. If you have previously received our Notice of Internet Availability of Proxy Materials, then instructions regarding how you can vote are contained in that notice. If you have received a proxy card, then instructions regarding how you can vote are contained on the proxy card. If you decide to attend the Annual Meeting, you will be able to vote online, even if you have previously submitted your proxy.

Thank you for your support.

Sincerely,

Robert Morse

Executive Chairman

i

BRIDGE INVESTMENT GROUP HOLDINGS INC.

111 East Sego Lily Drive, Suite 400

Salt Lake City, Utah 84070

Notice of Annual Meeting of Stockholders

To Be Held Thursday, May 5, 2022

The Annual Meeting of Stockholders (the “Annual Meeting”) of Bridge Investment Group Holdings Inc., a Delaware corporation (the “Company”), will be held at 9:00 a.m. Eastern time (7:00 a.m. Mountain time) on Thursday, May 5, 2022. The Annual Meeting will be a virtual meeting, which will be conducted via live webcast. You will be able to attend the Annual Meeting online and submit your questions during the Annual Meeting by visiting www.proxydocs.com/BRDG and entering your control number included in your Notice of Internet Availability of Proxy Materials (the “Internet Notice”), on your proxy card or on the instructions that accompanied your proxy materials. The Annual Meeting will be held for the following purposes:

Holders of record of our outstanding shares of capital stock, composed of Class A common stock and Class B common stock, subject to those restrictions set forth in the Operating Company LLC Agreement, as of the close of business on March 11, 2022 are entitled to notice of and to vote at the Annual Meeting, or any continuation, postponement or adjournment of the Annual Meeting. A complete list of such stockholders will be open to the examination of any stockholder for a period of ten days prior to the Annual Meeting for a purpose germane to the Annual Meeting at our principal executive offices of 111 East Sego Lily Drive, Suite 400, Salt Lake City, Utah 84070 during ordinary business hours. The list of these stockholders will also be available during the Annual Meeting after entering the control number included on your Internet Notice, on your proxy card or on the instructions that accompanied your proxy materials. The Annual Meeting may be continued or adjourned from time to time without notice other than by announcement at the Annual Meeting.

It is important that your shares be represented regardless of the number of shares you may hold. Whether or not you plan to attend the Annual Meeting online, we urge you to vote your shares via the toll-free telephone number or over the Internet, as described in the enclosed materials. If you received a copy of the proxy card by mail, you may sign, date and mail the proxy card in the enclosed return envelope. Promptly voting your shares will ensure the presence of a quorum at the Annual Meeting and will save us the expense of further solicitation. Submitting your proxy now will not prevent you from voting your shares at the Annual Meeting if you desire to do so, as your proxy is revocable at your option.

ii

By Order of the board of directors

Matthew Grant

Senior Managing Director, General Counsel and Secretary

Salt Lake City, Utah

March 24, 2022

iii

Certain Definitions

In connection with the closing of our initial public offering of our Class A common stock in July 2021 (the “IPO”), we effected certain organizational transactions which we refer to as the “Transactions”. As used herein, unless the context otherwise requires, references to:

Bridge Investment Group Holdings Inc. is a holding company and the sole managing member of the Operating Company, and its principal assets consist of Class A Units.

iv

BRIDGE INVESTMENT GROUP HOLDINGS INC.

111 East Sego Lily Drive, Suite 400

Salt Lake City, Utah 84070

Proxy Statement

This proxy statement is furnished in connection with the solicitation by the board of directors of Bridge Investment Group Holdings Inc. of proxies to be voted at our Annual Meeting of Stockholders to be held on Thursday, May 5, 2022 (the “Annual Meeting”), at 9:00 a.m. Eastern time (7:00 a.m. Mountain time), and at any continuation, postponement, or adjournment of the Annual Meeting. The Annual Meeting will be a virtual meeting, which will be conducted via live webcast. You will be able to attend the Annual Meeting online and submit your questions during the Annual Meeting by visiting www.proxydocs.com/BRDG and entering your control number included in your Notice of Internet Availability of Proxy Materials (the “Internet Notice”), on your proxy card or on the instructions that accompanied your proxy materials.

Holders of record of outstanding shares of capital stock, subject to the Operating Company LLC Agreement, comprised of shares of our Class A common stock, $0.01 par value per share, and our Class B common stock, $0.01 par value per share (together, our “common stock”), as of the close of business on March 11, 2022 (the “Record Date”), will be entitled to notice of and to vote at the Annual Meeting and any continuation, postponement, or adjournment of the Annual Meeting, and will vote together as a single class on all matters presented at the Annual Meeting. As of the Record Date, there were 28,136,101 shares of Class A common stock and 86,612,489 shares of Class B common stock outstanding and entitled to vote at the Annual Meeting. Each share of Class A common stock and Class B common stock is entitled to one vote and ten votes, respectively, on any matter presented to stockholders at the Annual Meeting. Class A common stock and Class B common stock represent 3.1% and 96.9% of the voting power of our common stock, respectively.

This proxy statement and the Company’s Annual Report to Stockholders for the year ended December 31, 2021 (the “2021 Annual Report”) will be released on or about March 24, 2022 to our stockholders on the Record Date.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE STOCKHOLDER MEETING TO BE HELD ON THURSDAY, MAY 5, 2022

This Proxy Statement and our 2021 Annual Report to Stockholders are available at http://www.proxydocs.com/BRDG

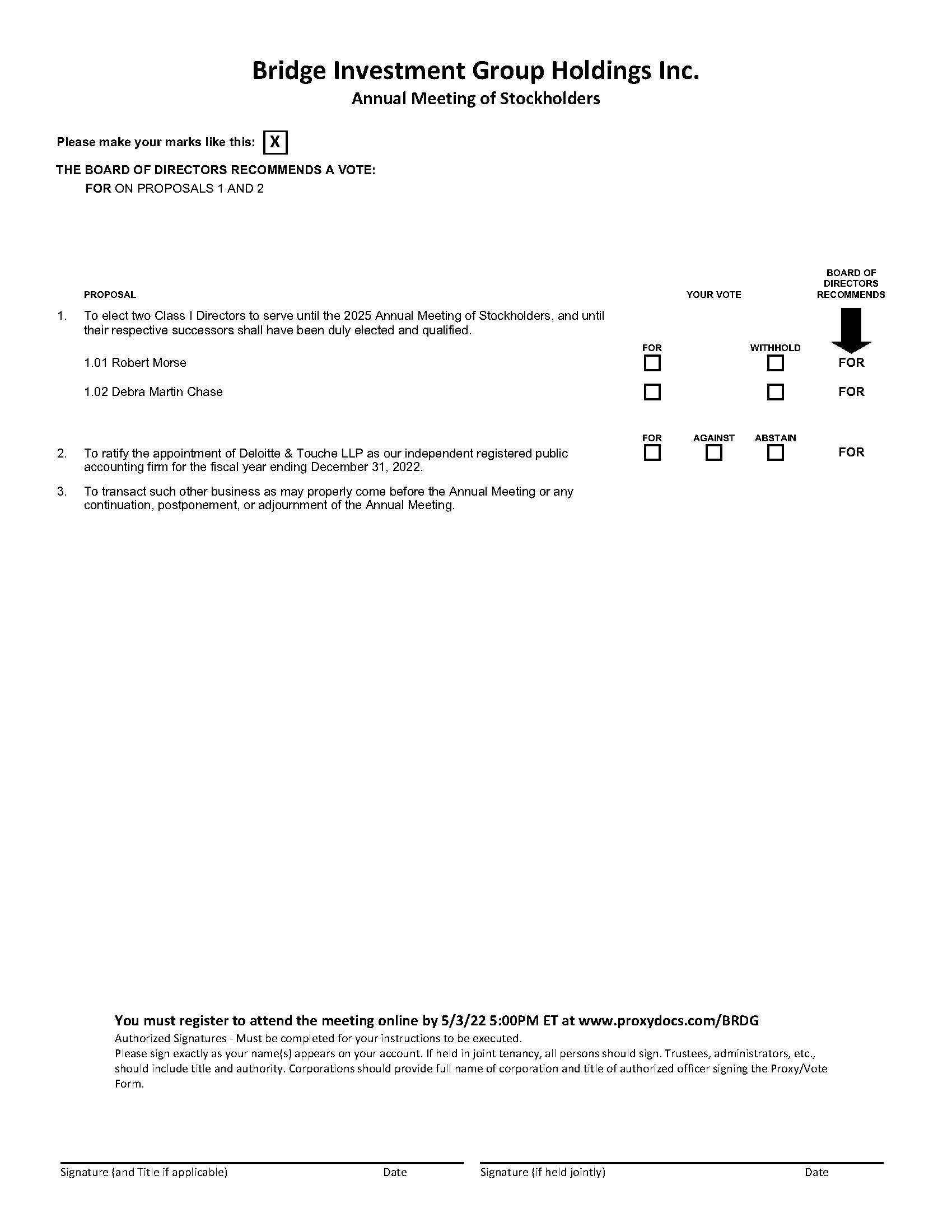

Proposals

At the Annual Meeting, our stockholders will be asked:

1

We know of no other business that will be presented at the Annual Meeting. If any other matter properly comes before the stockholders for a vote at the Annual Meeting, however, the proxy holders named on the Company’s proxy card will vote your shares in accordance with their best judgment.

Recommendations of the Board of Directors

The board of directors recommends that you vote your shares as indicated below. If you return a properly completed proxy card, or vote your shares by telephone or Internet, your shares of common stock will be voted on your behalf as you direct. If not otherwise specified, the shares of common stock represented by the proxies will be voted, and the board of directors recommends that you vote:

If any other matter properly comes before the stockholders for a vote at the Annual Meeting, the proxy holders named on the Company’s proxy card will vote your shares in accordance with their best judgment.

Information About This Proxy Statement

Why you received this proxy statement. You are viewing or have received these proxy materials because our board of directors is soliciting your proxy to vote your shares at the Annual Meeting. This proxy statement includes information that we are required to provide to you under the rules of the Securities and Exchange Commission (“SEC”) and that is designed to assist you in voting your shares.

Notice of Internet Availability of Proxy Materials. As permitted by SEC rules, we are making this proxy statement and our 2021 Annual Report available to our stockholders electronically via the Internet. This process allows us to provide our stockholders with the information they need in a more timely manner, while reducing the environmental impact and lowering the costs of printing and distributing the proxy materials. On or about March 24, 2022, we mailed to our stockholders an Internet Notice containing instructions on how to access this proxy statement and our 2021 Annual Report and vote online. If you received an Internet Notice by mail, you will not receive a printed copy of the proxy materials in the mail unless you specifically request them. Instead, the Internet Notice instructs you on how to access and review all of the important information contained in the proxy statement and 2021 Annual Report. The Internet Notice also instructs you on how you may submit your proxy over the Internet. If you received an Internet Notice by mail and would like to receive a printed copy of our proxy materials, you should follow the instructions for requesting such materials contained on the Internet Notice.

Printed Copies of Our Proxy Materials. If you received printed copies of our proxy materials, then instructions regarding how you can vote are contained on the proxy card included in the materials.

Householding. The SEC’s rules permit us to deliver a single set of proxy materials to one address shared by two or more of our stockholders. This delivery method is referred to as “householding” and can result in significant cost savings. To take advantage of this opportunity, we have delivered only one set of proxy materials to multiple stockholders who share an address, unless we received contrary instructions from the impacted stockholders prior to the mailing date. We agree to deliver promptly, upon written or oral request, a separate copy of the proxy materials, as requested, to any stockholder at the shared address to which a single copy of those documents was delivered. If you prefer to receive separate copies of the proxy materials, contact Mediant Communications, Inc. at 1-866-648-8133, by website at www.investorelections.com/BRDG, or by email at paper@investorelections.com. You will need your control number.

If you are currently a stockholder sharing an address with another stockholder and wish to receive only one copy of future proxy materials for your household, please contact Mediant Communications, Inc. using one of the above contact methods.

2

Questions and Answers About The 2022 Annual Meeting of Stockholders

Who is entitled to vote at the Annual Meeting?

The Record Date for the Annual Meeting is March 11, 2022. You are entitled to vote at the Annual Meeting only if you were a stockholder of record at the close of business on that date, or if you hold a valid proxy for the Annual Meeting. Each outstanding share of Class A common stock is entitled to one vote, and each outstanding share of Class B common stock is entitled to ten votes, in each case, for all matters before the Annual Meeting. Holders of Class A common stock and Class B common stock, subject to the Operating Company LLC Agreement, vote together as a single class on any matter (including the election of directors and the ratification of our independent registered public accounting firm) that is submitted to a vote of stockholders, unless otherwise required by law or our Amended and Restated Certificate of Incorporation. As of the close of business on the Record Date, there were 28,136,101 shares of Class A common stock and 86,612,489 shares of Class B common stock outstanding and entitled to vote at the Annual Meeting. Each share of Class A common stock and Class B common stock is entitled to one vote and ten votes, respectively, on any matter presented to stockholders at the Annual Meeting. Class A common stock and Class B common stock represent 3.1% and 96.9% of the voting power of our common stock, respectively.

What is the difference between being a “record holder” and holding shares in “street name”?

A record holder holds shares in his or her name. Shares held in “street name” means shares that are held in the name of a bank or broker on a person’s behalf.

Am I entitled to vote if my shares are held in “street name”?

Yes. If your shares are held by a bank or a brokerage firm, you are considered the “beneficial owner” of those shares held in “street name.” If your shares are held in street name, these proxy materials are being provided to you by your bank or brokerage firm, along with a voting instruction card if you received printed copies of our proxy materials. As the beneficial owner, you have the right to direct your bank or brokerage firm how to vote your shares, and the bank or brokerage firm is required to vote your shares in accordance with your instructions. If your shares are not registered in your own name and you would like to vote your shares at the Annual Meeting, you should contact your broker or other nominee to obtain your control number or otherwise vote through the broker or other nominee.

How many shares must be present to hold the Annual Meeting?

A quorum must be present at the Annual Meeting for any business to be conducted. The presence at the Annual Meeting online or by proxy, of the holders of a majority in voting power of the common stock issued and outstanding and entitled to vote on the Record Date will constitute a quorum.

Who can attend the Annual Meeting?

We have decided to hold the Annual Meeting this year via live webcast. You may attend and participate in the Annual Meeting by visiting the following website: www.proxydocs.com/BRDG. To attend and participate in the Annual Meeting, you will need the control number included in your Internet Notice, on your proxy card or on the instructions that accompanied your proxy materials. If your shares are held in “street name,” you should contact your bank or broker to obtain your control number or otherwise vote through the bank or broker. The meeting webcast will begin promptly at 9:00 a.m. Eastern time (7:00 a.m. Mountain time). We encourage you to access the Annual Meeting prior to the start time. Stockholders may begin to log in to the Annual Meeting 15 minutes prior to the start time, and you should allow ample time for the check-in procedures.

What if a quorum is not present at the Annual Meeting?

If a quorum is not present at the scheduled time of the Annual Meeting, the Chairperson of the Annual Meeting is authorized by our Amended and Restated Bylaws to adjourn the Annual Meeting, without the vote of stockholders.

3

What does it mean if I receive more than one Internet Notice or more than one set of proxy materials?

It means that your shares are held in more than one account at the transfer agent and/or with banks or brokers. Please vote all of your shares. To ensure that all of your shares are voted, for each Internet Notice or set of proxy materials, please submit your proxy by phone, via the Internet, or, if you received printed copies of the proxy materials, by signing, dating and returning the enclosed proxy card in the enclosed envelope.

How do I vote?

You may hold your shares in multiple accounts and therefore receive more than one set of the proxy materials. To ensure that all of your shares are voted, please submit your proxy or voting instructions for each account for which you have received a set of the proxy materials.

Shares Held of Record. If you hold your shares in your own name as a holder of record with our transfer agent, American Stock Transfer & Trust Company, LLC, you may authorize that your shares be voted at the Annual Meeting in one of the following ways:

|

|

|

By Internet |

|

If you received the Notice or a printed copy of the proxy materials, follow the instructions in the Notice or on the proxy card. www.proxypush.com/BRDG |

By Telephone |

|

If you received a printed copy of the proxy materials, follow the instructions on the proxy card. |

By Mail |

|

If you received a printed copy of the proxy materials, complete, sign, date, and mail your proxy card in the enclosed, postage-prepaid envelope. |

In Person (Virtual) |

|

You may also vote in person virtually by attending the meeting through www.proxydocs.com/BRDG. To attend the Annual Meeting and vote your shares, you must register for the Annual Meeting and provide the control number located on your Internet Notice or proxy card. |

Shares Held in Street Name. If you hold your shares through a broker, bank or other nominee (that is, in street name), you will receive instructions from your broker, bank or nominee that you must follow in order to submit your voting instructions and have your shares voted at the Annual Meeting. If you want to vote in person virtually at the Annual Meeting, you must register in advance at www.proxydocs.com/BRDG. You may be instructed to obtain a legal proxy from your broker, bank or other nominee and to submit a copy in advance of the meeting. Further instructions will be provided to you as part of your registration process.

Even if you plan to attend the Annual Meeting, we recommend that you submit your proxy or voting instructions in advance of the Annual Meeting as described above so that your vote will be counted if you later decide not to attend or are unable to attend the Annual Meeting.

Can I change my vote after I submit my proxy?

Yes.

If you are a holder of record, you may revoke your proxy at any time before it is voted at the Annual Meeting by delivering written notice of revocation to the Company’s secretary by submitting a subsequently dated proxy by mail, telephone or the Internet in the manner described above under “How to Vote,” or by attending the Annual Meeting and voting in person virtually. Attendance at the Annual Meeting will not itself revoke an earlier submitted proxy. If you hold your shares in street name, you must follow the instructions provided by your broker, bank or nominee to revoke your voting instructions, or, if you have obtained a legal proxy from your broker, bank or other nominee giving you the right to vote your shares at the Annual Meeting, by attending the Annual Meeting and voting in person virtually.

4

What is a proxy card?

The proxy card enables you to appoint Jonathan Slager and Matthew Grant as your representatives at the Annual Meeting. By completing and returning the proxy card, you are authorizing such persons to vote your shares at the Annual Meeting in accordance with your instructions on the proxy card. This way, your shares will be voted whether or not you attend the Annual Meeting. Even if you plan to attend the Annual Meeting, it is strongly recommended that you complete and return your proxy card before the date of the Annual Meeting in case your plans change. If a proposal comes up for vote at the Annual Meeting that is not on the proxy card, the proxies will vote your shares, under your proxy, according to their best judgment.

Who will count the votes?

A representative of Mediant Communications, Inc. is expected to tabulate the votes, and the Company’s secretary is expected to be our inspector of election and will certify the votes.

What if I do not specify how my shares are to be voted?

If you submit a proxy but do not indicate any voting instructions, the persons named as proxies will vote in accordance with the recommendations of the board of directors. The board of directors’ recommendations are indicated in the section titled “Proposals to be Voted on” this proxy statement, together with the description of each proposal in this proxy statement.

Will any other business be conducted at the Annual Meeting?

We know of no other business that will be presented at the Annual Meeting. If any other matter properly comes before the stockholders for a vote at the Annual Meeting, however, the proxy holders named on the Company’s proxy card will vote your shares in accordance with their best judgment.

Why hold a virtual meeting?

In light of the ongoing the COVID-19 pandemic, and in an effort to maintain a safe and healthy environment all of our stockholders, we believe that hosting a virtual meeting this year is in the best interests of the Company and its stockholders. Additionally, a virtual meeting enables increased stockholder attendance and participation because stockholders can participate from any location around the world. You will be able to attend the Annual Meeting online and submit your questions by visiting www.proxydocs.com/BRDG. You also will be able to vote your shares electronically at the Annual Meeting by following the instructions above.

What if during the check-in time or during the Annual Meeting I have technical difficulties or trouble accessing the virtual meeting website?

We will have technicians ready to assist you with any technical difficulties you may have in accessing the Annual Meeting. If you encounter any difficulties accessing the virtual-only Annual Meeting platform, including any difficulties voting or submitting questions, you may access the link to the FAQ’s Guide in the Registration Confirmation email, and on the meeting portal, with tips to finding a quick solution to a technical problem and a technical assistance phone number.

Will there be a question and answer session during the Annual Meeting?

Our virtual Annual Meeting will allow stockholders to submit questions before and during the Annual Meeting. During a designated question and answer period at the Annual Meeting, we will respond to appropriate questions submitted by stockholders.

We will answer as many stockholder-submitted questions as time permits, and any questions that we are unable to address during the Annual Meeting will be answered following the meeting, with the exception of any questions that are:

5

If we receive substantially similar questions, we will group such questions together and provide a single response to avoid repetition.

Additional information regarding the Q&A session will be available in the “Rules of Conduct” available on the Annual Meeting webpage for stockholders that have accessed the Annual Meeting as a stockholder by following the procedures outlined above in “Who can attend the Annual Meeting?”

How many votes are required for the approval of the proposals to be voted upon and how will abstentions and broker non-votes be treated?

Proposal |

Votes required |

Effect of Votes Withheld / Abstentions and Broker |

Proposal 1: Election of Directors |

The plurality of the votes cast. This means that the two nominees receiving the highest number of affirmative “FOR” votes will be elected as Class I Directors. |

Votes withheld and broker non-votes will have no effect. |

Proposal 2: Ratification of Appointment of Independent Registered Public Accounting Firm |

The affirmative vote of the holders of a majority of the votes cast. |

Abstentions will have no effect. We do not expect any broker non-votes on this proposal. |

What is a “vote withheld” and an “abstention” and how will votes withheld and abstentions be treated?

A “vote withheld,” in the case of the proposal regarding the election of directors, or an “abstention,” in the case of the proposal regarding the ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm, represents a stockholder’s affirmative choice to decline to vote on a proposal. Votes withheld and abstentions are counted as present and entitled to vote for purposes of determining a quorum. Votes withheld have no effect on the election of directors. Abstentions have no effect on the ratification of the appointment of Deloitte & Touche LLP.

What are broker non-votes and do they count for determining a quorum?

Generally, broker non-votes occur when shares held by a broker in “street name” for a beneficial owner are not voted with respect to a particular proposal because the broker (1) has not received voting instructions from the beneficial owner and (2) lacks discretionary voting power to vote those shares. A broker is entitled to vote shares held for a beneficial owner on routine matters, such as the ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm, without instructions from the beneficial owner of those shares.

6

On the other hand, absent instructions from the beneficial owner of such shares, a broker is not entitled to vote shares held for a beneficial owner on non-routine matters, such as the election of directors. Broker non-votes count for purposes of determining whether a quorum is present.

Where can I find the voting results of the Annual Meeting?

We plan to announce preliminary voting results at the Annual Meeting and we will report the final results in a Current Report on Form 8-K, which we intend to file with the SEC within four business days after the Annual Meeting. If final voting results are not available to us in time to file a Form 8-K within four business days after the Annual Meeting, we intend to file a Form 8-K to publish preliminary results and, within four business days after the final results are known to us, file an additional Form 8-K to publish the final results.

7

Proposals To Be Voted On

Proposal 1: Election of Directors

We currently have seven (7) directors on our board. At the Annual Meeting, two (2) Class I Directors, Robert Morse and Debra Martin Chase are to be elected to hold office until the Annual Meeting of Stockholders to be held in 2025 and until each such director’s respective successor is elected and qualified or until each such director’s earlier death, resignation or removal.

The proposal regarding the election of directors requires the approval of a plurality of the votes cast. This means that the nominees receiving the highest number of affirmative “FOR” votes will be elected as Class I Directors. Votes withheld and broker non-votes are not considered to be votes cast and, accordingly, will have no effect on the outcome of the vote on this proposal.

As set forth in our Amended and Restated Certificate of Incorporation, the board of directors is currently divided into three classes with staggered, three-year terms. At each annual meeting of stockholders, the successors to directors whose terms then expire will be elected to serve from the time of election and qualification until the third annual meeting following election. The current class structure is as follows: Class I, whose term currently expires at the Annual Meeting and whose subsequent term will expire at the 2025 Annual Meeting of Stockholders; Class II, whose term will expire at the 2023 Annual Meeting of Stockholders and whose subsequent term will expire at the 2026 Annual Meeting of Stockholders; and Class III, whose term will expire at the 2024 Annual Meeting of Stockholders and whose subsequent term will expire at the 2027 Annual Meeting of Stockholders. The current Class I Directors are Robert Morse and Debra Martin Chase; the current Class II Directors are Jonathan Slager and Deborah Hopkins; and the current Class III Directors are Adam O’Farrell, Dean Allara and Chad Leat.

Our Amended and Restated Certificate of Incorporation and Amended and Restated Bylaws provide that the authorized number of directors may be changed from time to time by the board of directors. Any additional directorships resulting from an increase in the number of directors will be distributed among the three classes so that, as nearly as possible, each class will consist of one-third of the directors. The division of our board of directors into three classes with staggered three-year terms may delay or prevent a change of our management or a change in control of our Company. Our directors may be removed only for cause by the affirmative vote of the holders of at least two-thirds of our outstanding voting stock entitled to vote in the election of directors.

In connection with the IPO of our Class A common stock in July 2021, we entered into a Stockholders Agreement between the Company and certain stockholders of the Company, including the Continuing Equity Owners. Robert Morse and Debra Martin Chase were designated as Class I Directors; Jonathan Slager and Deborah Hopkins were designated as Class II Directors; and Adam O’Farrell, Dean Allara and Chad Leat were designated as Class III Directors. As a result of the Stockholders Agreement and the aggregate voting power of the parties to the agreement, we expect that the parties to the agreement acting in conjunction will control the election of directors of the Company. For more information, see “Corporate Governance—Stockholders Agreement.”

If you submit a proxy but do not indicate any voting instructions, the persons named as proxies will vote the shares of common stock represented thereby for the election as a Class I Director of the person whose name and biography appears below. In the event that either of Mr. Morse or Ms. Chase should become unable to serve, or for good cause will not serve, as a director, it is intended that votes will be cast for a substitute nominee designated by the board of directors or the board may elect to reduce its size. The board of directors has no reason to believe that either of Mr. Morse or Ms. Chase will be unable to serve if elected. Mr. Morse and Ms. Chase have consented to being named in this proxy statement and to serve if elected.

Vote required

The proposal regarding the election of directors requires the approval of a plurality of the votes cast. This means that the nominees receiving the highest number of affirmative “FOR” votes will be elected as Class I Directors.

Votes withheld and broker non-votes are not considered to be votes cast and, accordingly, will have no effect on the outcome of the vote on this proposal.

8

Recommendation of the Board of Directors

The board of directors unanimously recommends a vote FOR the election of each of the below Class I Director nominees.

Nominees For Class I Director (terms to expire at the 2025 Annual Meeting)

The current members of the board of directors who are also nominees for election to the board of directors as Class I Directors are as follows:

Name |

Age |

Position with Bridge Investment Group |

Robert Morse |

66 |

Executive Chairman, Director |

Debra Martin Chase |

65 |

Director |

The principal occupations and business experience, for at least the past five years, of each Class I Director nominee for election at the Annual Meeting are as follows:

Robert Morse has served as Bridge Investment Group Holdings Inc.’s Executive Chairman since its formation and has served as the Executive Chairman of the Operating Company since 2012. He has over 30 years of experience in finance, banking, and private equity fund management. Mr. Morse serves on the investment committees for all of Bridge’s investment vehicles in addition to his responsibilities as Executive Chairman in helping to develop strategy and growth opportunities for Bridge. Mr. Morse served as Chairman and Co-Chief Executive Officer of PMN Capital, a private equity firm based in Hong Kong, from January 2009 to January 2012 and as Chief Executive Officer of Citigroup’s Asia Institutional Clients Group from April 2004 to October 2008, where, among other duties, he provided direct management oversight of Citigroup’s $5 billion of proprietary capital. Mr. Morse made investments on behalf of Citigroup clients across multiple asset classes, including equities (public and private), corporate acquisitions, distressed and mezzanine debt and real estate. At the time, Citigroup’s Asian institutional businesses included corporate banking, investment banking, markets and transaction services in 17 countries employing over 14,000 employees. From 1999 to 2004, Mr. Morse served as the Co-Head and then Head of Global Investment Banking for Citigroup. He previously held a variety of senior positions since joining Salomon Brothers in 1985. Additionally, Mr. Morse was a co-founder of SSB Capital Partners, a $400 million private equity fund formed in 2000. Since February 2013, Mr. Morse has served on the board of directors of Amkor Technology, Inc. (NYSE: AMKR). Mr. Morse also serves on a variety of charitable organization boards, including the Yale President’s Council on International Activities as Chairman, the Yale School of Management Board of Advisors, the Whitney Museum Directors Council and the Grand Teton National Park Foundation Resource Council. Mr. Morse received his Bachelor of Arts from Yale College, Phi Beta Kappa and magna cum laude, his Master of Business Administration from Harvard Business School and his Juris Doctor from Harvard Law School. We believe that Mr. Morse is qualified to serve as a member of our board of directors and Chairman due to his extensive experience in financial markets and investments and the perspective he brings as our Executive Chairman.

Debra Martin Chase has served on our board of directors since July 2021. Ms. Chase is an Emmy-nominated and Peabody Award-winning television and motion picture producer, an entertainment industry icon and trailblazer as the first Black female producer to have a deal at any major studio, and the first Black woman to produce a film that grossed over $100 million. To date, her films have grossed over $500 million. With over 30 years’ experience in motion picture and television production combined with a corporate legal background, she understands the interplay between the artistic and the business aspects of her industry. In creating highly profitable and critically acclaimed content, she has demonstrated that stories elevating people of color and women and defying stereotypes can inspire all audiences. Ms. Chase’s work has garnered Academy, Emmy, Golden Globe, SAG, Critics Choice, BET, NAACP Image and Peabody Award nominations. She serves as chief executive officer of her production company, Martin Chase Productions, which has an overall deal with Universal Television, a division of the NBCUniversal Television Group and previously had one with The Walt Disney Company from 2001 to 2016. Prior to that, Ms. Chase ran Whitney Houston’s BrownHouse Productions from 1995 to 2000 and Mundy Lane Entertainment, Denzel Washington’s production company, from 1992 to 1995. Ms. Chase currently serves on the board of B&G Foods (NYSE: BGS), where she chairs the Corporate Social Responsibility committee, as well as on the board of the New York City Ballet, where she chairs the Diversity and Inclusion Committee, and for the Second Stage Theater in

9

Manhattan where she chairs the board’s Artistic Committee. She is a frequent keynote speaker at colleges and universities across the country and is an advocate for community service. Ms. Chase serves on the Advisory Board of the African American Film Critics’ Association and is also a member of the Ambassador’s Circle of Amsale Aspire – an initiative to preserve the legacy of Amsale Aberra by creating and funding pathways for Black students in the fashion industry in partnership with the Fashion Institute of Technology. Her numerous awards and honors include Ebony magazine’s 150 Most Influential African Americans, Black Enterprise magazine’s Ten Most Bankable African American Movie Producers in Hollywood (with Chase as the only woman on the list), The Trumpet Award’s Entertainment Award, the African American Film Critics Association’s Ashley Boone Award and the Shot Caller Award at Black Girls Rock!, the nationally televised award show honoring women of color. She was also awarded a prestigious Ford Foundation Grant to develop several projects focused upon social justice, diversity and inclusion. In 2021, Ms. Chase was included in the VARIETY 500, an index of the 500 most influential business leaders shaping the global media industry. She holds degrees from Mount Holyoke College, where she majored in Political Science and graduated Phi Beta Kappa and magna cum laude, and Harvard Law School. Prior to entering the entertainment industry, Ms. Chase practiced law at Houston’s Mayor, Day, and Caldwell law firm from 1981 to 1983. After serving as a lawyer for Tenneco from 1983 to 1985, Ms. Chase moved to New York City where she worked for Stroock, Stroock & Lavan law firm, and eventually became in-house counsel for Avon Products. Ms. Chase is a member of The Academy of Motion Picture Arts and Sciences and The Academy of Television Arts and Sciences. We believe that Ms. Chase’s strong business experience and philanthropic interests enable her to provide us with fresh ideas and valuable perspectives and qualify her to serve on our board of directors.

Continuing members of the board of directors:

Class II Directors (terms to expire at the 2023 Annual Meeting)

The current members of the board of directors who are Class II Directors are as follows:

Name |

Age |

Position with Bridge Investment Group |

Jonathan Slager |

61 |

Chief Executive Officer, Director |

Deborah Hopkins |

67 |

Director |

The principal occupations and business experience, for at least the past five years, of each Class II Director are as follows:

Jonathan Slager has served as Bridge Investment Group Holdings Inc.’s Chief Executive Officer and one of its directors since its formation and is the Chief Executive Officer of the Operating Company. Mr. Slager has been with Bridge since 2011 in roles including Chief Investment Officer and Co-Chief Executive Officer prior to his current role as Chief Executive Officer, and currently serves on the investment committees for the general partners of Bridge Multifamily Funds III, IV (for which he also serves as the Chief Investment Officer) and V, Bridge Workforce Funds I and II, Bridge Seniors Housing Funds I, II and III, Bridge Office Funds I and II, Bridge Opportunity Zone Funds I, II, III and IV, and Bridge Agency MBS Fund. He has over 35 years of experience in the real estate, finance, and software industries. Mr. Slager has been involved in underwriting, acquiring, and managing over $15 billion in assets including all assets of the prior Bridge-managed funds, and has been a key driver of asset executions and returns. From 2005 to 2009, Mr. Slager worked with The Pacific Group USA, Inc., and from 2006 to 2017 was a principal and managing partner at Bridge Loan Capital Fund LP. He has been responsible for major acquisitions, development, and entitlements and financing of major real estate projects. Mr. Slager worked for several years at The Koll Company and then Wells Fargo Bank where he was responsible for the acquisition, development, asset management, and disposition of commercial real estate assets. Mr. Slager played the leading role on large institutional commercial real estate projects ranging from resort, residential, office, industrial and retail projects. Mr. Slager earned his Bachelor of Arts in English, Phi Beta Kappa and cum laude, from the University of Utah in 1981, and his Master of Business Administration in Finance and Marketing from New York University in 1985. We believe that Mr. Slager is qualified to serve as a member of our board of directors due to his extensive experience in investments and asset management and the perspective he brings as our Chief Executive Officer.

Deborah Hopkins has served on our board of directors and as chair of the audit committee since July 2021. Ms. Hopkins brings executive-level experiences in finance, technology and innovation across multiple industries that

10

allow her to bring a unique view to support management teams in pursuit of growth. She is a member of the board of directors at Union Pacific (NYSE: UNP), Marsh & McLennan (NYSE: MMC), Compass Digital Acquisition Corp. (Nasdaq: CDAQ), and privately held Deep Instinct. She is Vice-Chair of St. John’s Health of Wyoming. In 2008 Ms. Hopkins was appointed as Citigroup’s first Chief Innovation Officer, moving to Silicon Valley in 2010 to found Citi Ventures and was its CEO until her retirement from Citigroup in 2016. Previously at Citigroup she was Chief Operations and Technology officer of the company and Senior Advisor to the Corporate and Investment Bank. Prior to joining Citigroup in 2003 as Head of Corporate Strategy and M&A, she was Chief Financial Officer at Lucent Technologies and The Boeing Company and held senior-level positions at General Motors in the United States and Zurich and at Unisys Corporation, after starting her career at Ford. Ms. Hopkins was twice named to Fortune’s ten most powerful women in business. Ms. Hopkins holds a B.S. in Accounting from Walsh College and honorary doctorate degrees from Westminster College and Walsh College. We believe that Ms. Hopkins’s strong finance, business, and technology background and extensive experience in senior leadership positions qualify her to serve on our board of directors.

Class III Directors (terms to expire at the 2024 Annual Meeting)

The current members of the board of directors who are Class III Directors are as follows:

Name |

Age |

Position with Bridge Investment Group |

Adam O’Farrell |

48 |

Chief Operating Officer, Director |

Dean Allara |

59 |

Vice Chairman, Head of Client Solutions Group, Director |

Chad Leat |

66 |

Director |

The principal occupations and business experience, for at least the past five years, of each Class III Director are as follows:

Adam O’Farrell has served as Bridge Investment Group Holdings Inc.’s Chief Operating Officer and one of its directors since its formation and is the Chief Operating Officer of the Operating Company. Mr. O’Farrell is also a member of the investment committees of various Bridge-managed funds, including Bridge Debt Strategies Funds, Bridge Opportunity Zone Funds and Bridge Logistics Value Funds. Mr. O’Farrell has more than 20 years of experience as a real estate investment management attorney with significant private equity, real estate and tax experience and a broad transactional legal background. Mr. O’Farrell joined Bridge as General Counsel in January 2012 and was responsible for all legal affairs of Bridge, its affiliates and managed funds through 2020. In January 2020, Mr. O’Farrell was promoted to Chief Operating Officer and in that role has direct supervision and responsibility for all Bridge infrastructure departments and is a member of the firm’s Senior Management and Strategy Committees. Prior to joining Bridge, Mr. O’Farrell worked at several international law firms, including Foley & Lardner LLP, Morrison & Foerster LLP and Latham & Watkins LLP. He began his legal career as a tax attorney and focused his practice on advising private equity and real estate clients. Mr. O’Farrell received his Bachelor of Science degree and Master of Accountancy with an emphasis in Taxation from the Marriott School of Management at Brigham Young University and his Juris Doctor from the J. Reuben Clark Law School, Brigham Young University. We believe that Mr. O’Farrell is qualified to serve as a member of our board of directors due to his extensive experience in private investments and his deep understanding of our business and operations.

Dean Allara has served as one of Bridge Investment Group Holdings Inc.’s directors since its formation and is Vice Chairman and Head of the Client Solutions Group of the Operating Company. Mr. Allara has been a principal of BFG since 1996. Mr. Allara currently serves on the investment committees for the general partners of Bridge Multifamily Funds III, IV and V, Bridge Workforce Funds I and II, Bridge Seniors Housing Funds I, II and III, Bridge Office Funds I and II, and Bridge Opportunity Zone Funds I, II, III and IV. He has over 30 years of experience in the real estate investment process including analyzing, capital raising, acquiring, financing, developing, managing, improving and selling properties. Mr. Allara has been directly responsible for capital raising and investment of over $10 billion in multifamily, seniors housing, single family residential, commercial office, resort, golf, hotel, and retail properties. Mr. Allara has experience in real property development including permits and zoning, master planning, debt financing, insurance, construction management, homeowners’ association management, marketing, and residential sales. Mr. Allara received his Bachelor of Science degree in Business

11

Administration from St. Mary’s College with a year spent at Loyola University of Rome and his Master of Business Administration from Santa Clara University including studies at the University of Tokyo. We believe that Mr. Allara is qualified to serve as a member of our board of directors due to his extensive experience in private investments and capital markets and his deep understanding of our business and operations.

Chad Leat has served on our board of directors since August 2021. Mr. Leat, a retired Vice Chairman of Global Banking at Citigroup, has nearly thirty years of markets and banking experience on Wall Street. He is an acknowledged leader and innovator in corporate credit and M&A finance having led some of the largest acquisition financings completed. Over the years he has built and led numerous successful and profitable businesses at Citigroup, JPMorgan Chase and their predecessor companies. From 1998 to 2005 he served as the Global Head of Loans and Leveraged Finance at Citigroup. Mr. Leat began his career on Wall Street at The Chase Manhattan Corporation in their Capital Markets Group in 1985 where he ultimately became the head of their highly successful Syndications, Structured Sales and Loan Trading businesses. Mr. Leat formerly served on the board of directors of Norwegian Cruise Lines (NYSE: NCLH), where he servesd as chairman of the audit committee and a member of the compensation committee. He currently serves as chairman of the board of directors of MidCap Financial, PLC, a middle market direct commercial lending business affiliated with Apollo Global Management, chairman of the supervisory board of MyMoneyBank, a retail and commercial bank headquartered in Paris, France, and is on the supervisory board of Hamburg Commercial Bank, headquartered in Hamburg, Germany. Furthermore, Mr. Leat sits on the board of directors of TPG Pace Beneficial Financial Corp. (NYSE: TPGY), TPG Pace II Beneficial Corp. (NYSE: YTPG) and TPG Pace Tech Opportunities Corp. (NYSE: PACE) where he acts as audit committee chair for each. Previously Mr. Leat served on the board of directors of TPG Pace Holdings, Paceline Holdings and TPG Pace Energy Holding Corp., each affiliated with TPG Capital, an alternative asset fund based in San Francisco, California. Previously Mr. Leat was chairman of the board of directors of J.Crew Operating Corp, on the board of directors of Global Indemnity PLC, and on the board of directors of BAWAG P.S.K., Austria’s third largest bank. Mr. Leat is dedicated to many civic and philanthropic organizations. He is a member of Economic Club of New York and has served on the board of several charitable organizations. He was formerly also a Trustee of the Parrish Museum of Art. Mr. Leat is a graduate of the University of Kansas, where he received his B.S. degree. We believe that Mr. Leat’s strong business and finance background and extensive public company directorship experience qualify him to serve on our board of directors.

Proposal 2: Ratification of Appointment of Independent Registered Public Accounting Firm

Our Audit Committee has appointed Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2022. Our board has directed that this appointment be submitted to our stockholders for ratification at the Annual Meeting. Although ratification of our appointment of Deloitte & Touche LLP is not required, we value the opinions of our stockholders and believe that stockholder ratification of our appointment is a good corporate governance practice.

Deloitte & Touche LLP also served as our independent registered public accounting firm for the fiscal year ended December 31, 2021. Neither the accounting firm nor any of its members has any direct or indirect financial interest in or any connection with us in any capacity other than as our auditors, providing audit and non-audit related services. A representative of Deloitte & Touche LLP is expected to attend the 2022 Annual Meeting and to have an opportunity to make a statement and be available to respond to appropriate questions from stockholders.

In the event that the appointment of Deloitte & Touche LLP is not ratified by the stockholders, the Audit Committee will consider this fact when it appoints the independent registered public accounting firm for the fiscal year ending December 31, 2023. Even if the appointment of Deloitte & Touche LLP is ratified, the Audit Committee retains the discretion to appoint a different independent registered public accounting firm at any time if it determines that such a change is in the interest of the Company.

Vote Required

This proposal requires the affirmative vote of the holders of a majority in voting power of the votes cast. Abstentions are not considered to be votes cast and, accordingly, will have no effect on the outcome of the vote on this proposal. Because brokers have discretionary authority to vote on the ratification of the appointment of Deloitte & Touche LLP, we do not expect any broker non-votes in connection with this proposal.

12

Recommendation of the Board of Directors

The board of directors unanimously recommends a vote FOR the Ratification of the Appointment of Deloitte & Touche LLP as our Independent Registered Public Accounting Firm for the fiscal year ending December 31, 2022.

13

Report of the Audit Committee of the board of directors

The Audit Committee has reviewed the audited consolidated financial statements of the Company for the fiscal year ended December 31, 2021 and has discussed these consolidated financial statements with management and the Company’s independent registered public accounting firm. The Audit Committee has also received from, and discussed with, the Company’s independent registered public accounting firm various communications that such independent registered public accounting firm is required to provide to the Audit Committee, including the matters required to be discussed by statement on Auditing Standards No. 1301, as adopted by the Public Company Accounting Oversight Board (“PCAOB”).

The Company’s independent registered public accounting firm also provided the Audit Committee with a formal written statement required by PCAOB Rule 3526 (Communications with Audit Committees Concerning Independence) describing all relationships between the independent registered public accounting firm and the Company, including the disclosures required by the applicable requirements of the PCAOB regarding the independent registered public accounting firm’s communications with the Audit Committee concerning independence. In addition, the Audit Committee discussed with the independent registered public accounting firm its independence from the Company.

Based on its discussions with management and the independent registered public accounting firm, and its review of the representations and information provided by management and the independent registered public accounting firm, the Audit Committee recommended to the board of directors that the audited consolidated financial statements be included in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2021.

Deborah Hopkins (Chair)

Debra Martin Chase

Chad Leat

14

Independent Registered Public Accounting Firm Fees and Other Matters

The following table summarizes the fees of Deloitte & Touche LLP, our independent registered public accounting firm, billed to us for each of the last two fiscal years for audit services and other services:

Fee Category |

2021 |

2020 |

Audit Fees |

$4,766,382 |

$3,674,574 |

Audit-Related Fees |

110,000 |

110,000 |

Tax Fees |

- |

- |

All Other Fees |

- |

- |

Total Fees |

$4,876,382 |

$3,784,574 |

Audit Fees

Audit fees consist of all professional services rendered in connection with (a) the audit of our annual consolidated financial statements, (b) the reviews of our quarterly consolidated financial statements, (c) our Registration Statement on Form S-1 related to our IPO, (d) consents and review of other documents filed with the SEC, and (e) services rendered in connection with audits and reviews of financial statements of our managed funds.

Audit-Related Fees

Audit-related fees consist of SOC 2 Type 2 Assessment Reports.

Tax Fees

None.

All Other Fees

None.

Audit Committee Pre-Approval Policy and Procedures

The Audit Committee has adopted a policy (the “Pre-Approval Policy”) that sets forth the procedures and conditions pursuant to which audit and non-audit services proposed to be performed by the independent registered public accounting firm may be pre-approved. The Pre-Approval Policy generally provides that we will not engage Deloitte & Touche LLP to render any audit, audit-related, tax or permissible non-audit service unless the service is either (i) explicitly approved by the Audit Committee (“specific pre-approval”) or (ii) entered into pursuant to the pre-approval policies and procedures described in the Pre-Approval Policy (“general pre-approval”). Unless a type of service to be provided by Deloitte & Touche LLP has received general pre-approval under the Pre-Approval Policy, it requires specific pre-approval by the Audit Committee or by a designated member of the Audit Committee to whom the committee has delegated the authority to grant pre-approvals. Any proposed services exceeding pre-approved cost levels or budgeted amounts will also require specific pre-approval. For both types of pre-approval, the Audit Committee will consider whether such services are consistent with the SEC’s rules on auditor independence. The Audit Committee will also consider whether the independent registered public accounting firm is best positioned to provide the most effective and efficient service, for reasons such as its familiarity with the Company’s business, people, culture, accounting systems, risk profile and other factors, and whether the service might enhance the Company’s ability to manage or control risk or improve audit quality. All such factors will be considered as a whole, and no one factor should necessarily be determinative. On a periodic basis, the Audit Committee reviews and generally pre-approves the services (and related fee levels or budgeted amounts) that may be provided by Deloitte & Touche LLP without first obtaining specific pre-approval from the Audit Committee. The Audit Committee may revise the list of general pre-approved services from time to time, based on subsequent determinations.

15

Executive Officers

The following table identifies our current executive officers:

Name |

Age |

Position |

Robert Morse (1) |

66 |

Executive Chairman |

Jonathan Slager (1) |

61 |

Chief Executive Officer |

Adam O’Farrell (1) |

48 |

Chief Operating Officer |

Dean Allara (1) |

59 |

Vice Chairman, Head of Client Solutions Group |

Chad Briggs (2)(3) |

65 |

Chief Financial Officer |

Katherine Elsnab (3)(4) |

42 |

Incoming Chief Financial Officer |

(1) See biography in the section titled “Proposals to be Voted on” in this proxy statement.

(2) Chad Briggs has served as Bridge Investment Group Holdings Inc.’s Chief Financial Officer since its formation and is the Chief Financial Officer of the Operating Company. Mr. Briggs is responsible for all financial and treasury functions of Bridge Investment Group Holdings Inc. and also oversees tax compliance, as well as financial reporting and fund operations. He was hired as Chief Financial Officer of Bridge Multifamily Fund I in 2010 and began serving in the same capacity for the Operating Company in 2013. From 2011 to present, Mr. Briggs has served as Chief Financial Officer for the investment manager affiliates of Bridge, where he has had similar responsibility for the assets of all Bridge-sponsored funds. From 2005 to 2010, Mr. Briggs served as Vice President and Chief Financial Officer of Digital Draw Network, Inc., a national provider of residential construction and commercial real estate inspection services. Prior to joining Digital Draw Network, Inc., Mr. Briggs was the Director of Finance and Controller of TheraTech Inc., a publicly traded biotechnology company that provided specialized pharmaceutical drug delivery products and services. Mr. Briggs has over 30 years of experience in accounting, finance, mergers and acquisitions, public offerings, SEC reporting and human resources. He also served as the Controller for the Utah Property Casualty and Insurance Guaranty Association from 1985 to 2014. Mr. Briggs received his Bachelor of Science in accounting from the University of Utah in 1985 and is a Certified Public Accountant.

(3) On February 19, 2022, Mr. Briggs provided notice of his intent to retire from the Company, effective May 31, 2022. Upon the effective date of his retirement, Mr. Briggs will be succeeded by Katherine Elsnab, who currently serves as the Company’s Chief Accounting Officer.

(4) Katherine Elsnab has served as Bridge Investment Group Holdings Inc.’s Chief Accounting Officer since August 2021. Upon the effective date of Mr. Briggs’ retirement as the Company’s Chief Financial Officer, Ms. Elsnab will succeed Mr. Briggs as the Company’s Chief Financial Officer, and Ms. Elsnab will continue to serve as the Company’s principal accounting officer. Previously, Ms. Elsnab served as Bridge’s Corporate Controller since she joined Bridge in December 2018. Prior to joining Bridge Ms. Elsnab was an auditor with Ernst & Young, LLP for 16 years, serving clients primarily in the real estate and financial services industries. Ms. Elsnab earned a Bachelor of Science with Special Attainment in Commerce with a double major in business administration and accounting and history from Washington and Lee University and is a Certified Public Accountant in the State of Utah.

16

Corporate Governance

General

Our board of directors has adopted Corporate Governance Guidelines, a Code of Business Conduct and Ethics, and a charter for our Audit Committee to assist the board in the exercise of its responsibilities and to serve as a framework for the effective governance of the Company. You can access our Audit Committee charter, our Corporate Governance Guidelines, and our Code of Business Conduct and Ethics on our investor relations website, https://ir.bridgeig.com/, in the “Governance” section under “Governance Documents,” or by writing to our Secretary at our offices at 111 East Sego Lily Drive, Suite 400, Salt Lake City, Utah 84070.

Board Composition

Our board of directors currently consists of seven members: Robert Morse, Jonathan Slager, Adam O’Farrell, Dean Allara, Debra Martin Chase, Deborah Hopkins, and Chad Leat. As set forth in our Amended and Restated Certificate of Incorporation, the board of directors is currently divided into three classes with staggered, three-year terms. At each annual meeting of stockholders, the successors to directors whose terms then expire will be elected to serve from the time of election and qualification until the third annual meeting following election. Our Amended and Restated Certificate of Incorporation and Amended and Restated Bylaws provide that the authorized number of directors may be changed only by resolution of the board of directors (provided that such number shall not be less than the aggregate number of directors that the parties to the Stockholders Agreement are entitled to designate from time to time). Any additional directorships resulting from an increase in the number of directors will be distributed among the three classes so that, as nearly as possible, each class will consist of one-third of the directors. The division of our board of directors into three classes with staggered three-year terms may delay or prevent a change of our management or a change in control of our Company. Our directors may be removed only for cause by the affirmative vote of the holders of at least two-thirds in voting power of the outstanding shares of our capital stock entitled to vote in the election of directors.

Stockholders Agreement

In connection with our IPO in July 2021, we entered into a Stockholders Agreement. Pursuant to the Stockholders Agreement, the Continuing Equity Owners party to the Stockholders Agreement beneficially owning, directly or indirectly, in the aggregate not less than two-thirds of all issued and outstanding shares of Class A common stock and/or Class B common stock held by such parties, or by which such parties possess voting power (including pursuant to the irrevocable proxy described below), have the right to designate (i) that number of individuals, which, assuming all such individuals are successfully elected as directors, when taken together with any incumbent Original Member Directors (as defined below) not standing for election in such election, would result in there being four directors, or the “Original Member Directors” and (ii) that number of individuals who satisfy the independence requirements specified in the Stockholders Agreement, which, assuming all such individuals are successfully elected as directors, when taken together with any incumbent Original Member Designated Independent Directors (as defined below) not standing for election in such election, would result in there being three directors, or the “Original Member Designated Independent Directors.”

Each of the Continuing Equity Owners that is party to the Stockholders Agreement has agreed to vote, or cause to be voted, all of their outstanding shares of our Class A common stock and/or Class B common stock held such parties, or by which such parties possess voting power, at any annual or special meeting of stockholders in which directors are elected, so as to cause the election of the Original Member Directors and the Original Member Designated Independent Directors. Additionally, pursuant to the Stockholders Agreement, we shall take all commercially reasonable actions to cause (1) our board of directors to be comprised of at least seven directors or such other number of directors as our board of directors may determine; (2) the individuals designated in accordance with the terms of the Stockholders Agreement to be included in the slate of nominees to be elected to our board of directors at the next annual or special meeting of our stockholders at which directors are to be elected and at each annual meeting of our stockholders thereafter at which a director’s term expires; and (3) the individuals designated in accordance with the terms of the Stockholders Agreement to fill the applicable vacancies on our board of directors. The Stockholders Agreement allows for our board of directors to reject the nomination, appointment or election of a particular director if such nomination, appointment or election would constitute a breach of our board of directors’

17

fiduciary duties to our stockholders or does not otherwise comply with any requirements of our Amended and Restated Certificate of Incorporation or our Amended and Restated Bylaws.

In addition, certain of the Continuing Equity Owners specified in the Stockholders Agreement, which we refer to as “Proxy Granting Members,” have granted to certain other Continuing Equity Owners specified in the Stockholders Agreement an irrevocable proxy to vote such stockholders shares of Class A common stock and/or Class B common stock held by such Proxy Granting Member with respect to the election and removal of directors. This irrevocable proxy granted by the Proxy Granting Members will terminate upon the termination of the Stockholders Agreement.

The Stockholders Agreement will terminate upon the earlier to occur of (i) the Continuing Equity Owners that are party to the Stockholders Agreement ceasing to own or control (including by proxy) a majority in voting power of our Class A common stock or Class B common stock, (ii) the fifth anniversary of the closing of our IPO, or (iii) by unanimous consent of us and each of the other parties to the Stockholder Agreement.

Controlled Company Exception

The parties to the Stockholders Agreement have more than 50% of the combined voting power of our common stock. As a result, we are a “controlled company” within the meaning of the corporate governance standards of the NYSE rules and have elected not to comply with certain corporate governance standards, including that: (1) a majority of our board of directors consists of “independent directors,” as defined under the NYSE rules; (2) we have a nominating and corporate governance committee that is composed entirely of independent directors with a written charter addressing the committee’s purpose and responsibilities; (3) we have a compensation committee that is composed entirely of independent directors with a written charter addressing the committee’s purpose and responsibilities; and (4) we perform annual performance evaluations of the nominating and corporate governance and compensation committees. We rely on the foregoing exemptions provided to controlled companies under the NYSE rules. Therefore, we do not have a majority of independent directors on our board of directors, and do not have a nominating or corporate governance committee or compensation committee (or perform annual performance evaluations of nominating and corporate governance and compensation committees) and will not unless and until such time as we are required to do so. Accordingly, you may not have the same protections afforded to stockholders of companies that are subject to all of these corporate governance requirements.

In the event that we cease to be a “controlled company” and our shares continue to be listed on the NYSE, we will be required to comply with these provisions within the applicable transition periods.

Director Independence

Our board of directors undertook a review of the independence of our directors and considered whether any director has a relationship with us that could compromise that director’s ability to exercise independent judgment in carrying out that director’s responsibilities. Our board of directors affirmatively determined that Debra Martin Chase, Deborah Hopkins, and Chad Leat are each an “independent director,” as defined under the NYSE rules.

Director Candidates

Our board of directors is responsible for searching for qualified director candidates for election to the board and filling vacancies on the board. To facilitate the search process, the board of directors may solicit current directors and executives of the Company for the names of potentially qualified candidates or ask directors and executives to pursue their own business contacts for the names of potentially qualified candidates. The board of directors may also consult with outside advisors or retain search firms to assist in the search for qualified candidates, or consider director candidates recommended by our stockholders. Once potential candidates are identified, the board of directors reviews the backgrounds of those candidates, evaluates candidates’ independence from the Company and potential conflicts of interest and determines if candidates meet the qualifications desired by the board of directors for candidates for election as a director.

Under the Stockholders Agreement, the directors initially designated for election to the applicable classes of the board are Robert Morse, Jonathan Slager, Adam O’Farrell, Dean Allara, Debra Martin Chase, Deborah Hopkins, and Chad Leat.

18

In evaluating the suitability of individual candidates (both new candidates and current board members), the board of directors, in recommending and approving (and, in the case of vacancies, appointing) candidates, may take into account many factors, including: personal and professional integrity, ethics and values; experience in corporate management, such as serving as an officer or former officer of a publicly held company; strong finance experience; relevant social policy concerns; experience relevant to the Company’s industry; experience as a board member or executive officer of another publicly held company; relevant academic expertise or other proficiency in an area of the Company’s operations; diversity of expertise and experience in substantive matters pertaining to the Company’s business relative to other board members; diversity of background and perspective, including, but not limited to, with respect to age, gender, race, place of residence and specialized experience; practical and mature business judgment, including, but not limited to, the ability to make independent analytical inquiries; and any other relevant qualifications, attributes or skills. The board evaluates each individual in the context of the board as a whole, with the objective of assembling a group that can best perpetuate the success of the business and represent stockholder interests through the exercise of sound judgment using its diversity of experience in these various areas. In determining whether to recommend a director for re-election, the board of directors may also consider the director’s past attendance at meetings and participation in and contributions to the activities of the board. In addition, the board will consider whether there are potential conflicts of interest with the candidate’s other personal and professional pursuits. Although the board does not have a formal written diversity policy with respect to the evaluation of director candidates, in its evaluation of director candidates, the board of directors will consider factors including, without limitation, issues of character, integrity, judgment, and diversity, and with respect to diversity, such factors as gender, race, ethnicity, experience, and area of expertise, as well as other individual qualities and attributes that contribute to the total diversity of viewpoints and experience represented on the board.

Stockholders may recommend individuals to the board of directors for consideration as potential director candidates by submitting the names of the recommended individuals, together with appropriate biographical information and background materials, to the board of directors, c/o Secretary, Bridge Investment Group Holdings Inc., 111 East Sego Lily Drive, Suite 400, Salt Lake City, Utah 84070. In the event there is a vacancy, and assuming that appropriate biographical and background material has been provided on a timely basis, the board of directors will evaluate stockholder-recommended candidates by following substantially the same process, and applying substantially the same criteria, as it follows for candidates submitted by others.

Communications from Stockholders

The board will give appropriate attention to written communications that are submitted by stockholders, and will respond if and as appropriate. Our Secretary is primarily responsible for monitoring communications from stockholders and for providing copies or summaries to the directors as he considers appropriate.

Communications are forwarded to all directors if they relate to important substantive matters and include suggestions or comments that our Secretary and Executive Chairman consider to be important for the directors to know. In general, communications relating to corporate governance and long-term corporate strategy are more likely to be forwarded than communications relating to ordinary business affairs, personal grievances and matters as to which we tend to receive repetitive or duplicative communications. Stockholders who wish to send communications on any topic to the board should address such communications to the board of directors in writing: c/o Secretary, Bridge Investment Group Holdings Inc., 111 East Sego Lily Drive, Suite 400, Salt Lake City, Utah 84070.

Board Leadership Structure and Role in Risk Oversight

Our Amended and Restated Bylaws and Corporate Governance Guidelines provide our board of directors with flexibility to combine or separate the positions of Chairperson of the board and Chief Executive Officer in accordance with its determination that utilizing one or the other structure would be in the best interests of our Company. Currently, the roles are not combined, with Robert Morse serving as Executive Chairman and Jonathan Slager serving as Chief Executive Officer. Our board is comprised of individuals with extensive experience in finance, the real estate and investment management industries and public company management. For these reasons and because of the strong leadership of Robert Morse and Jonathan Slager, our board has concluded that our current leadership structure is appropriate at this time. However, our board of directors will continue to periodically review our leadership structure and may make such changes in the future as it deems appropriate.

19

Risk assessment and oversight are an integral part of our governance and management processes. Our board of directors encourages management to promote a culture that incorporates risk management into our corporate strategy and day-to-day business operations. Management discusses strategic and operational risks at regular management meetings and conducts specific strategic planning and review sessions during the year that include a focused discussion and analysis of the risks facing us. Throughout the year, senior management reviews these risks with the board of directors at regular board meetings as part of management presentations that focus on particular business functions, operations or strategies, and presents the steps taken by management to mitigate or eliminate such risks. Our board of directors does not have a standing risk management committee, but rather administers this oversight function directly through the board of directors as a whole, as well as through the Audit Committee, which oversees our policies with respect to risk assessment and risk management. In particular, our Audit Committee is responsible for overseeing our major risk exposures and the steps our management has taken to monitor and control these exposures. The Audit Committee also monitors compliance with legal and regulatory requirements and considers and approves or disapproves any related person transactions. Our board of directors monitors the effectiveness of the Corporate Governance Guidelines. The board does not believe that its role in the oversight of our risks affects the board’s leadership structure.

Code of Business Conduct and Ethics

We have a written Code of Business Conduct and Ethics that applies to our directors, officers and employees, including our principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions. We have posted a current copy of the Code of Business Conduct and Ethics on our investor relations website, https://ir.bridgeig.com/, in the “Governance” section under “Governance Documents.” In addition, we intend to post on our website all disclosures that are required by law or the NYSE rules concerning any amendments to, or waivers from, any provision of the Code of Business Conduct and Ethics.

Anti-Hedging Policy